7 Important Reasons to Consider Home Insurance While Purchasing a Home.

7 Important Reasons to Consider Home Insurance While Purchasing a Home.

As you venture into homeownership, securing your investment with home insurance while purchasing a home is critical. In this comprehensive guide, we’ll explore the Importance of home insurance and pivotal reasons emphasizing the necessity of securing your property with adequate home insurance.

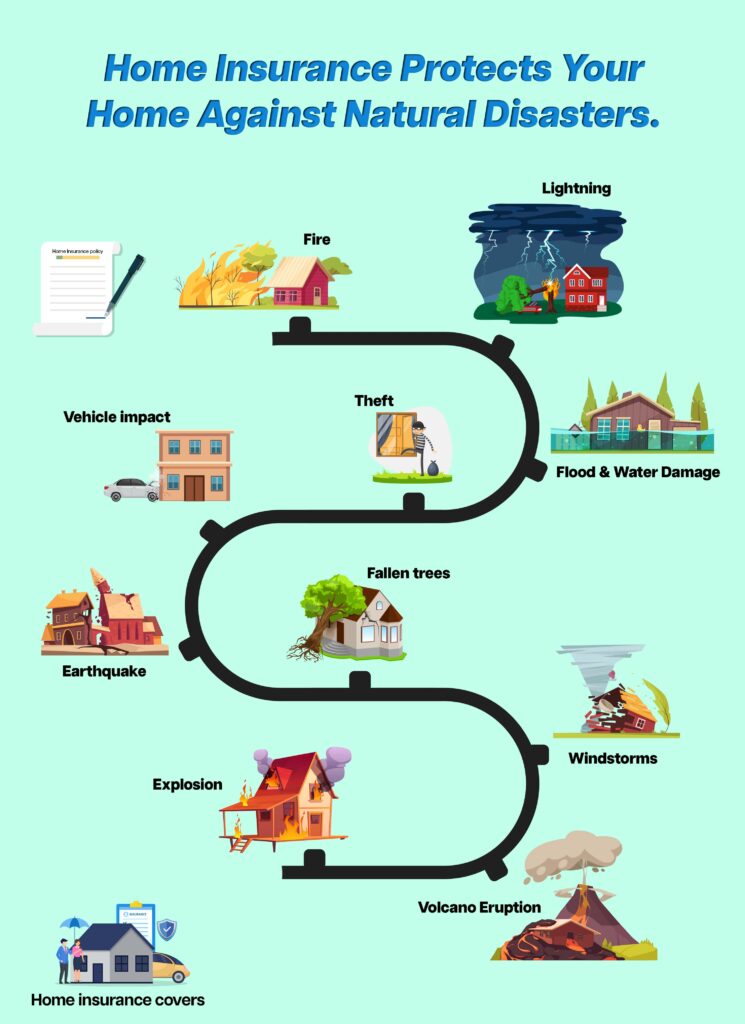

Home Insurance Protects Your Home Against Natural Disasters

Home Insurance While Purchasing a Home serves as a shield for your precious investment, safeguarding it against a plethora of natural disasters. Your property is covered against unforeseen calamities, including earthquakes, floods, tornadoes, hurricanes, wildfires, and more. In Chennai, prone to cyclones and floods, having comprehensive Home insurance benefits becomes indispensable to shield your home.

Home Insurance Covers:

-

Earthquakes:

Home insurance ensures financial support in rebuilding or repairing damages caused by earthquakes.

-

Floods:

Chennai's location makes it susceptible to floods; home insurance covers damages to the property due to flooding.

-

Tornadoes:

Protects against structural damage caused by tornadoes, ensuring a financial Safety nets for homeowners.

-

Hurricanes:

Offers coverage for structural damage and losses caused by hurricanes.

-

Wildfires:

Safeguards your property against the destruction caused by wildfires.

-

Cyclones:

Given Chennai's vulnerability, home insurance offers crucial protection against cyclone damages.

-

Landslides:

Provides financial aid in restoring property affected by landslides.

-

Tsunamis:

Ensures coverage against the devastation caused by tsunamis.

-

Heavy Rains:

Protects against water damage from excessive rainfall.

-

Storms:

Offers coverage for property damage resulting from severe storms.

Provides Coverage for Personal Belongings

Home Insurance While Purchasing a Home extends beyond Protecting your investment and the structure; it offers coverage for your personal belongings. Whether it’s jewelry, electronics, furniture, or other valuables, insurance helps recover losses due to theft, damage, or destruction.

Top 7 Coverages for Personal Belongings:

-

Jewelry and Valuables:

Offers protection against theft or loss of high-value items.

-

Electronics:

Covers damage or theft of gadgets like laptops, televisions, and smartphones.

-

Furniture:

Provides coverage for damage or loss of household furniture.

-

Clothing and Accessories:

Insures against loss or damage to clothing and accessories.

-

Appliances:

Coverage for kitchen and other home appliances.

-

Artwork and Antiques:

Protects valuable art pieces and antiques.

-

Sporting Equipment:

Offers coverage for sports gear and equipment.

Mitigates Financial Risks Associated With Accidents on Your Property

Home Insurance While Purchasing a Home significantly mitigates financial risks tied to accidents on your property. Statistics reveal that nearly 60% of homeowners face unexpected liabilities. With adequate insurance coverage:

- Medical expense coverage for injuries sustained by guests on your property.

- Liability coverage for accidents that result in property damage or bodily harm.

Having Home Insurance While Purchasing a Home ensures that if someone gets injured on your property, the liability coverage assists in medical payments and legal expenses.

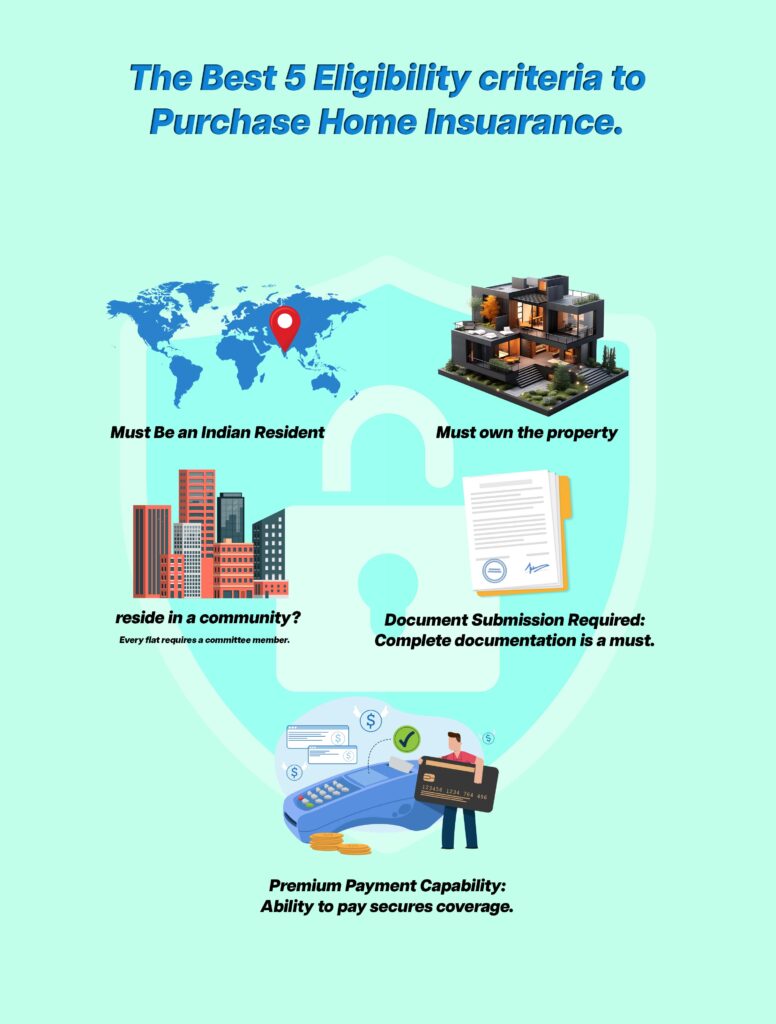

Getting a Home Insurance While Purchasing a Home Is Crucial for Mortgage Approval and Lender Requirements

When considering top residential builders in chennai, remember that securing house purchase insurance aids in mortgage approval.

-

Required by Lenders:

Most mortgage lenders mandate Home Insurance While Purchasing a Home to protect their investment.

-

Mortgage Approval:

Securing house insurance is pivotal for mortgage approval.

-

Comprehensive Coverage:

Lenders insist on insurance covering the property's value.

-

Ensures Security:

A safeguard against unforeseen circumstances that could impact the mortgage.

-

Property Protection:

Assures lenders about the property's safety and security.

-

Risk Mitigation:

Helps lenders mitigate their financial risks associated with the property.

-

Lender Requirements:

Fulfilling lender prerequisites ensures a smooth home purchase process.

-

Peace of Mind:

Having insurance assures lenders and homeowners of financial security.

-

Financial Protection:

Offers a safety net for both homeowners and lenders.

-

Long-term Investment:

Protects the interest of both parties in the long run.

If you are curious about learning more about RERA Act, please take a moment to read this blog. – ‘’What is RERA Carpet Area and How is it calculated?’’.

What Risks Does Home Insurance Shield You Against During the Purchasing Process?

Home Insurance While Purchasing a Home shields you against potential risks, process such as:

-

Property Damage:

Covers damages that might occur before or during the purchase.

-

Legal Liabilities:

Shields against legal issues arising during the property transaction.

-

Investment Protection:

Offers security against unforeseen damages impacting the purchase.

-

Additional Expense Coverage:

Covers additional costs related to property purchase uncertainties.

How Does Home Insurance Safeguard Against Theft and Vandalism?

Protection of your property from theft and vandalism is facilitated by Home Insurance While Purchasing a Home. Losses arising from burglary, theft, or malicious acts are covered, thereby securing your investment against unforeseen events.

Ways Home Insurance While Purchasing a Home Safety Coverage Against Theft and Vandalism:

-

Financial Coverage:

Provides monetary compensation for stolen or damaged items.

-

Recovery Assistance:

Assists in recovering losses incurred due to theft or vandalism.

-

Property Restoration:

Aids in repairing damages caused by vandalism or break-ins.

-

Peace of Mind:

Offers homeowners peace of mind knowing their assets are protected.

-

Legal Protection:

Covers legal fees if there's a need to pursue legal action.

Are There Extra Benefits or Special Coverages in Home Insurance Policies You Should Know About?

Beyond the standard coverage, some home insurance policies offer additional benefits or special coverages that homeowners should be aware of:

-

Natural Calamity Endorsement:

Provides extra coverage for specific natural calamities not included in standard policies.

-

Rider for Expensive Items:

Offers additional coverage for high-value items like jewelry or artwork.

-

Loss of Use Coverage:

Helps cover living expenses if the property becomes uninhabitable due to covered damages.

-

Identity Theft Protection:

Some policies have protection against identity theft-related expenses.

Ensuring Your Peace of Mind and Investment Protection for your luxury apartments in Chennai

Vijay Shanthi Builders, acclaimed among the Best Builders in Chennai, redefine luxury living with their upscale offerings in the Chennai real estate market. Renowned for their commitment, they craft impeccable apartments for sale in Chennai, including lavish 2 bhk apartments in chennai. As esteemed real estate builders and developers in Chennai, they set a benchmark for quality residences.

FAQs:

When considering Home Insurance While Purchasing a Home, prioritize coverage tailored to your needs. Evaluate insurance companies based on their property safeguard tips and coverage for natural disasters to make an informed choice.

Yes, having comprehensive Home Insurance While Purchasing a Home can potentially increase the resale value and overall appeal of your property to potential buyers.

Often, people overlook insuring their investment due to misconceptions about its necessity or the belief that their property might not be at risk. Lack of awareness regarding financial security for homeowners also plays a role in this decision.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

What Is a Bhk Apartment? Full Form, Meaning, Importance & Difference

What Is a Bhk Apartment? Full Form, Meaning, Importance & Difference Have you ever come

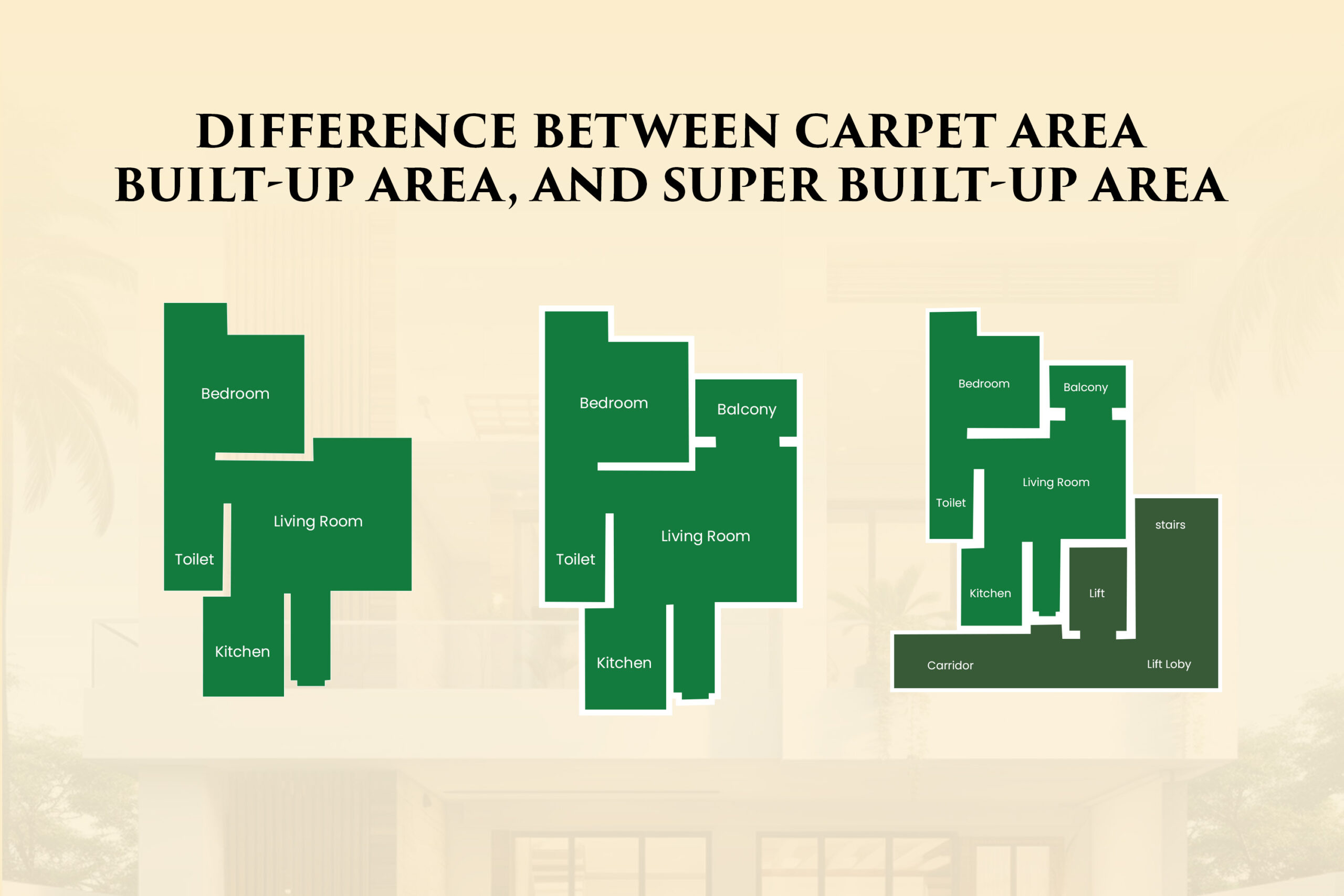

Difference Between Carpet area, Built-up Area, And Super Built-up Area

Difference Between Carpet Area, Built-up Area, and Super Built-up Area The distinctions among carpet area,

6+ Trendy Kitchen Design Ideas for Your New Home

6+ Trendy Kitchen Design Ideas for Your New Home Don't you feel, that food has