7 Important Reasons to Consider Home Insurance While Purchasing a Home.

As you venture into homeownership, securing your investment with home insurance while purchasing a home is critical. In this comprehensive guide, we’ll explore the Importance of home insurance and pivotal reasons emphasizing the necessity of securing your property with adequate home insurance.

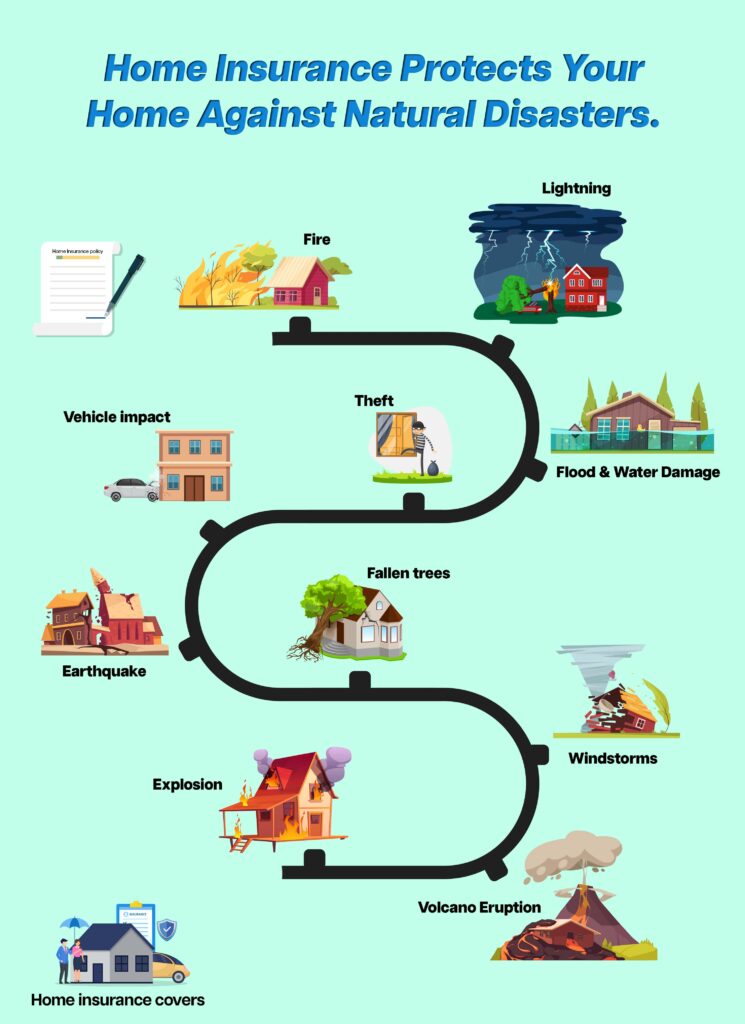

Home Insurance Protects Your Home Against Natural Disasters

Home Insurance While Purchasing a Home serves as a shield for your precious investment, safeguarding it against a plethora of natural disasters. Your property is covered against unforeseen calamities, including earthquakes, floods, tornadoes, hurricanes, wildfires, and more. In Chennai, prone to cyclones and floods, having comprehensive Home insurance benefits becomes indispensable to shield your home.

Home Insurance Covers:

Provides Coverage for Personal Belongings

Home Insurance While Purchasing a Home extends beyond Protecting your investment and the structure; it offers coverage for your personal belongings. Whether it’s jewelry, electronics, furniture, or other valuables, insurance helps recover losses due to theft, damage, or destruction.

Top 7 Coverages for Personal Belongings:

Mitigates Financial Risks Associated With Accidents on Your Property

Home Insurance While Purchasing a Home significantly mitigates financial risks tied to accidents on your property. Statistics reveal that nearly 60% of homeowners face unexpected liabilities. With adequate insurance coverage:

- Medical expense coverage for injuries sustained by guests on your property.

- Liability coverage for accidents that result in property damage or bodily harm.

Having Home Insurance While Purchasing a Home ensures that if someone gets injured on your property, the liability coverage assists in medical payments and legal expenses.

Getting a Home Insurance While Purchasing a Home Is Crucial for Mortgage Approval and Lender Requirements

When considering top residential builders in chennai, remember that securing house purchase insurance aids in mortgage approval.

If you are curious about learning more about RERA Act, please take a moment to read this blog. – ‘’What is RERA Carpet Area and How is it calculated?’’.

What Risks Does Home Insurance Shield You Against During the Purchasing Process?

Home Insurance While Purchasing a Home shields you against potential risks, process such as:

How Does Home Insurance Safeguard Against Theft and Vandalism?

Protection of your property from theft and vandalism is facilitated by Home Insurance While Purchasing a Home. Losses arising from burglary, theft, or malicious acts are covered, thereby securing your investment against unforeseen events.

Ways Home Insurance While Purchasing a Home Safety Coverage Against Theft and Vandalism:

Are There Extra Benefits or Special Coverages in Home Insurance Policies You Should Know About?

Beyond the standard coverage, some home insurance policies offer additional benefits or special coverages that homeowners should be aware of:

Ensuring Your Peace of Mind and Investment Protection for your luxury apartments in Chennai

Vijay Shanthi Builders, acclaimed among the Best Builders in Chennai, redefine luxury living with their upscale offerings in the Chennai real estate market. Renowned for their commitment, they craft impeccable apartments for sale in Chennai, including lavish 2 bhk apartments in chennai. As esteemed real estate builders and developers in Chennai, they set a benchmark for quality residences.

FAQs:

When considering Home Insurance While Purchasing a Home, prioritize coverage tailored to your needs. Evaluate insurance companies based on their property safeguard tips and coverage for natural disasters to make an informed choice.

Yes, having comprehensive Home Insurance While Purchasing a Home can potentially increase the resale value and overall appeal of your property to potential buyers.

Often, people overlook insuring their investment due to misconceptions about its necessity or the belief that their property might not be at risk. Lack of awareness regarding financial security for homeowners also plays a role in this decision.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

What Is The RERA Registration Process And How To Start?

What Is The RERA Registration Process And How To Start? A Foundation Built on TrustIn

7 Benefits Of Installing Glass Windows For Home

Introduction – A View That Speaks of You In a well-crafted home, even the simplest

5 Vastu Tips for a Peaceful Home Environment

Introduction Your home is more than just walls and furniture — it’s a space that