How to Become a Real Estate Investor?

Becoming a real estate investor can be a lucrative and rewarding path, offering the potential for substantial profits, diversification, and property improvements. However, it’s a journey that requires careful planning, research, and execution. In this comprehensive guide, we’ll walk you through the key steps to become a real estate investor in India, equipping you with the knowledge and tools to navigate the real estate landscape and achieve your investment goals.

When you are looking to save money with eligible investors for a housing loan, make sure to choose a proper real estate in India to identify it with the right location which is based on the needs of the budget and consider the factors with capital maintenance and costs, to score high.

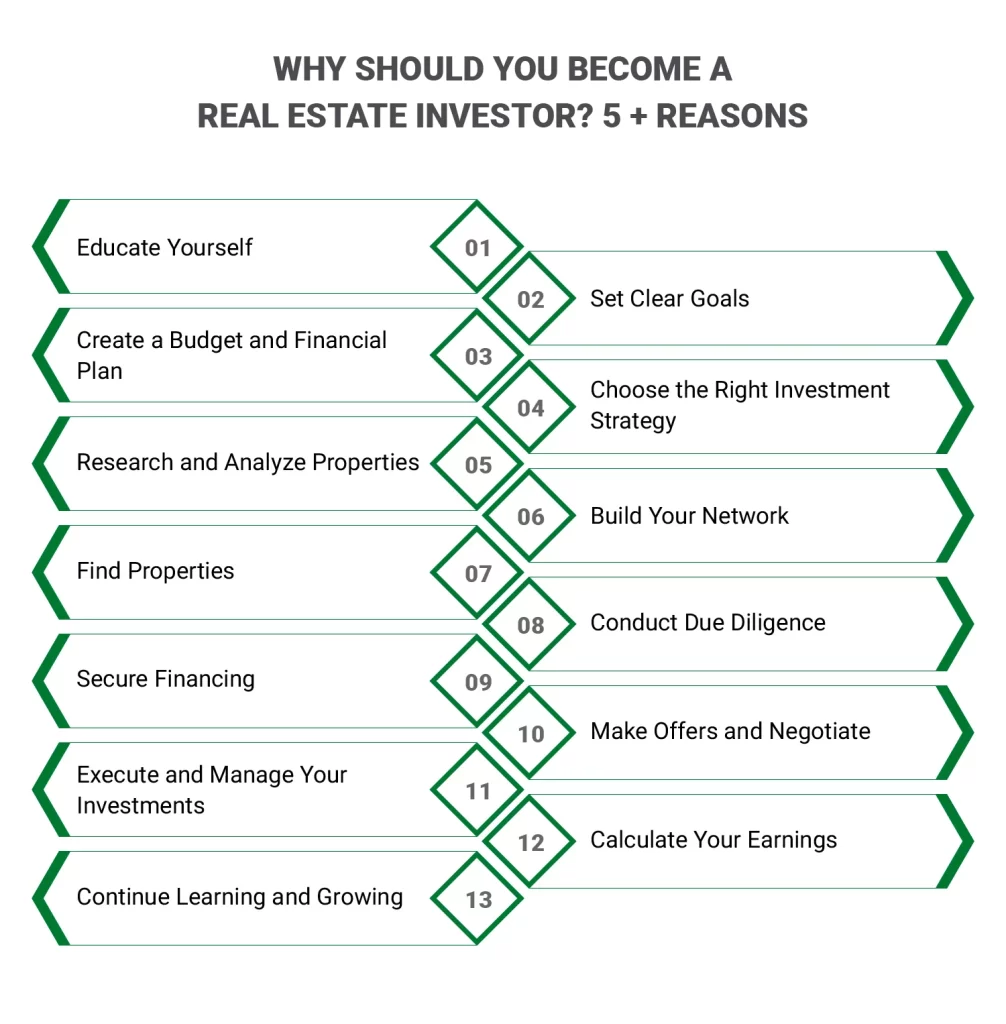

How to Become a Real Estate Investor in India?

- Educate Yourself

To become a real estate investor, check with the rates of rental properties, and vacant properties in the area where you invest through housing investors, and also examine local law market trends.

- Set Clear Goals

Create a targeting strategy to invest in Indian real estate for well-defined goals, it provides you best mutual funds or REITs which keep you away from dissatisfaction and reduce risk.

- Create a Budget and Financial Plan

Calculate and plan the budget with land investors who get connected with rental income, property appreciation and financing costs.

- Choose the Right Investment Strategy

Verify the status with proper potential rental revenue to reduce legal errors, and prevent market response while adhering to the investment strategy.

- Research and Analyze Properties

Research different investments for purchasing a property or to become a real estate investor which doesn’t cost risk in budget.

- Build Your Network

Build up the sharing of knowledge through professional agents, brokers, and developers, which connect them through networking and online platforms.

- Final Properties

These portals provide large properties that have been narrowed down by selecting a price range and investment property through narrowed parameters by investment opportunity.

- Conduct Due Diligence

Due diligence is an essential part of all corporate transactions, which merges to require other transactions for the business’s operations, and making an investment choice. To become a real estate investor, conducting thorough due diligence is crucial to ensure informed decision-making and successful investments.

- Secure Financing

Those who are eligible for standard bank finance, for borrowing the private individuals to organize with flexible choice and secure the financing.

- Make Offers and Negotiate

The essential property values have demographics and market trends with similar ideas and fair prices by offering Real Estate Entrepreneur through making offers to negotiate.

- Execute and Manage Your Investments

Through analysis, the market investing objects seek out locations with high demands of executing and managing investment with a stable economy for potential appreciation.

- Calculate Your Earning

When you become a real estate investor the calculation is a little more complicated with variables and loan interest rates by property value, later calculators turn out to be helpful to set property value with possible return investment.

- Continue Learning and Growing

While pursuing an educational certificate to knowledge in areas where property management should learn and grow through finance, and law for rental property investors.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”11 Tips to Become Successful in Real Estate Investing (2024)”.

Eligibilities to Become a Real Estate Investor

The criteria to become a real estate investor in the industry is to create a well-out business plan, these essentials are used to recognize the foundation of real estate in financial investment for market analysis, identify the risk tolerance to understand the basic market needs by achieving lifestyle through investing as a real estate entrepreneur.

Pros and Cons of Being a Real Estate Investor

Pros:

- Large Profits

All the property investments have rental revenue and tax advantages for real estate with potential sizable profits. All the passive income streams with investors to make money through large profits.

- Diversification

Land Investors have equal bonds to offer diversification, which lowers the overall risk for portfolio investors.

- Property Improvements

To upgrade the raise and value to generate the additional terms that are known to improve the commercial real estate

cons:

- Repairs and Maintenance

Maintaining real estate properties can be expensive and time-consuming with repairs.

- Greater Transaction

When you compare other assets with original real estate transactions it will come with a larger price tag.

- Low Liquidity

All the real estate investments make it challenging to sell a property rapidly, but the investing calls have more time than commitment.

How Much Capital Is Needed to Start Investing in Real Estate?

As per the resource, from the 2007-2008 credit crisis, the idea started obtaining a mortgage without providing income up to 20% which depends on other fees to sell and lend for a fixer-upper, you have to seek loan construction and renovations to make the house more comfortable.

Ready to Become a Real Estate Investor? We Can Help You Begin!

When you buy a property with the help of real estate investors, it’s a big deal to work with an agency, the seller will discuss the commission with the party. That will remain the same regardless of your agency for invaluable advice and support.

Beginning the journey to Become a Real Estate Investor in India requires dedication, perseverance, and a willingness to learn. By following the steps outlined in this guide, you’ll be well on your way to building a successful real estate investment portfolio and achieving financial freedom. Remember, the key to success lies in continuous learning, adaptability, and a strategic approach to navigating the dynamic real estate market. Start your investment journey today and unlock the countless opportunities that the Indian real estate industry has to offer. Get in Touch with Vijay Shanthi Builders to be a pro-Real Estate Investor.

FAQS:

When looking for places to invest your money with a level of experience in stocks, bonds, and mutual funds can exchange-traded funds with real estate investors to violate the risk from money and start investing and pay for a profitable and fulfilling approach which remains for land investors.

Property Flipper has proven to track the record to appreciate the value over time when it’s done by other investments; ups and downs might value the property steadily to grow the population in urban areas without any demands for housing, to make the real estate investing more profitable by getting through Investment Property Developer.

All the investors typically operate in teams or alone, since the realtors and investors independently have no subject that has the same regulations as realtors, the additional costs have to be considered to impress with a specific investment approach with property type.

The real estate agent has several well-known investors for searching opportunities to build advanced careers for professional prospects.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market