What Is the 1% Rule in Real Estate Investing and How Does It Work?

In the dynamic world of Real Estate in India, investors are constantly seeking reliable strategies to identify the best real estate investments in India. One such rule that has gained significant attention is the 1% Rule in Real Estate Investing. This comprehensive guide delves into the intricacies of this rule, its benefits, and its applicability in the Real Estate Market in India.

What Is the 1% Rule in Real Estate Investing?

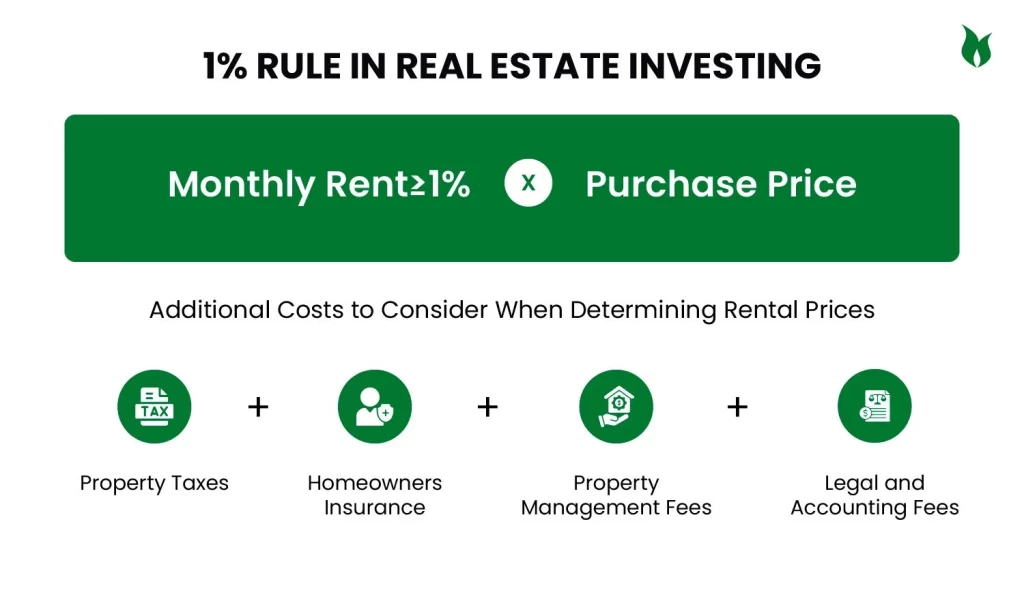

The 1% Rule in Real Estate Investing can be useful for locating the ideal property to invest in monthly rent and helps to purchase the price for an investment property. The rule is intended to guarantee a higher mortgage payment.

How Does the 1% Rule Work in India?

This is a simple calculation with multiple purchase prices of property that has necessary repairs. The 1% Rule in Real Estate Investing in India gives the owner a better understanding of monthly cash flow.

Why Is the 1% Rule Important in India?

Ensuring the 1% Rule in Real Estate Investing with positive cash flow and covering mortgage payments is crucial in the changing Indian real estate market. This helps all the investors make wise decisions about why the 1% Rule in Real Estate Investing is important in India. All the investors evaluate the rental property with the 1% Rule in Real Estate Investing, where they guarantee the rent with higher purchasing.

Benefits of the 1% Rule in India

- Allows investors to quickly analyze and filter through many potential properties to narrow down to the most promising ones for further due diligence.

- Works for different types of properties, including single-family homes and multifamily properties.

- Helps investors avoid psychological biases, like favoring properties in their local market over potentially better investments elsewhere.

- Provides a quick way to estimate if a property will generate positive cash flow, as the monthly rent should be at least 1% of the purchase price.

- Gives investors a general sense of the risk level of an investment property – a higher percentage means less risk, while a lower percentage means more risk Can be used as a financial safety net in case of vacancies or major repairs.

Example of the 1% Rule

99% of internet users merely consume the material that is typically posted for every person who does commercial real estate with 1% of estate properties calculating rental property income for the subject intensely.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”What Is Passive Real Estate Investing?|Types, Benefits, Pros & Cons”.

What Is the 2% Rule in Real Estate Investing, How it Works and Example

The metrics that elevate the rental property investment with a high potential of the 2% Rule in Real Estate Investing, which used the property with capitalization rate and helped the investors purchase the price with rental income. It works into various significant drawbacks up to the 2% Rule in Real Estate Investing which has no cash flow, that is greatly impacted by running costs like taxes, insurance, and utilities and also ignores factors that affect vacancy rates and market conditions.

When to Use the 1% Rule and 2% Rule

When you are looking for a property, but the 1% Rule in Real Estate Investing does not come to make adjustments for your property investment, you can try the 2% Rule in Real Estate Investing for monthly rent on a property through purchase price with the help of rapid assessments in operating costs and market conditions.

Choosing the Right Rule: 1% Rule or 2% Rule

As per the source, the rent of the monthly purchase of the property and rental income exceeds the running costs by 1% for positive cash flow determination. The 1% Rule in Real Estate Investing is the right choice.

Some Additional Tips for Using the 1% Rule in India

This will assist the profit target with additional tips for using the 1% Rule in Real Estate Investing in India, which values your account from property loss and continues to do overall calculating rental property income.

Also Read: Breaking Down The 1% Rule In Real Estate: What You Should Know Before Investing

Other Investment Rules in Real Estate

The 50% rule is an expense for rental property, will mortgage payment through rough gross income. The 70% rule is to fix and flip properties through minus costs repairs, the 80% rule is a variation of the 1% Rule in Real Estate Investing and it states with 0.8% purchase price. Still, achieving the 1% Rule in Real Estate Investing in some markets is difficult.

If you have any queries related to the 1% rule in real estate investing or would like to explore investment opportunities with Vijay Shanthi Builders, you can get in touch with them. Their experienced team will be happy to assist you in understanding the nuances of real estate investing and guide you toward making better decisions.

FAQS:

This works in the 1% rule, the calculation is simple to multiply the purchase price of the property and the repairs by 1% with the best real estate investments in India and the result is based on monthly level through estimated quick cash flow, the 1% rule provides a good general with a flexible key.

It is a baseline level for all rental commercial properties, the owners can apply in all types of tenants or both residential and commercial real estate investments, and it assesses rental property potential.

The limitation of the 1% rule is that they won’t consider all the costs, only certain property management fees, repairs and maintenance, property taxes and insurance. These are the limits of the 1 % rule.

For best real estate investment in India is based on locations to check the market demand and 1% is reflective of market condition, additionally the 1% Rule in real estate investing is not applicable in certain areas where the average rent has a lower ratio with alternative investments.

In multifamily investing, the investors can assess the investment ability to cover enough income purchases with a cost of 1% rule with the help of real estate builders and developers.

Yes, the expectations of the 1% rule may not hold true multifamily property investment with perfect profit potential by Using the 1% rule for property analysis.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market