10+ Important Things to Know in Real Estate Investment

The world of real estate signals with the promise of stable returns and long-term growth. For aspiring real estate investors, navigating this exciting yet complicated landscape requires a strong foundation of knowledge. Here, we will explore 10+ Things to Know in Real Estate Investment.

Here Are the 10+ Important Things to Know in Real Estate Investment

1. Investment Strategy

Before diving in, establish a clear investment strategy. Are you aiming for short-term gains through property flipping or seeking steady income via rental property? Each approach demands a distinct set of skills and resources. Define your goals, risk tolerance, and investment horizon to develop a personalized roadmap.

2. Property Type Analysis: Knowing Your Niche

Not all properties are created equal. Things to Know in Real Estate Investment include understanding the different types of real estate investments. Explore residential property (single-family homes, apartments), commercial spaces (office buildings, retail stores), or even land development. Research the pros and cons of each type to identify one that aligns with your strategy and risk appetite.

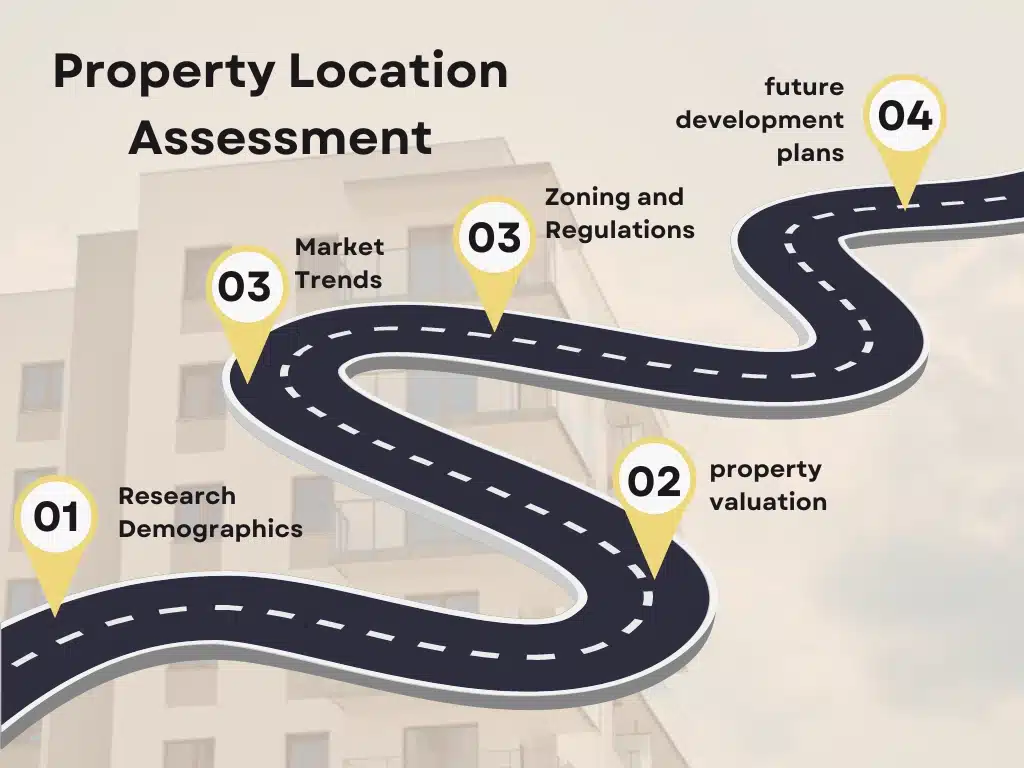

3. Property Location Assessment: Picking the Perfect Spot

The mantra in real estate remains true: Location is paramount. When considering property valuation, research demographics, job markets, and future development plans in your target area. A property in a high-demand neighborhood with excellent schools is likely to appreciate in value and attract reliable tenants.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”What Are the Current Trends in Real Estate Investment in India for 2024?”.

4. Rental Income Evaluation

Rental income is the lifeblood of most investments in real estate. Carefully research fair market rents for similar properties in your chosen location. Factor in vacancy rates, maintenance costs, and property management fees to ensure positive cash flows.

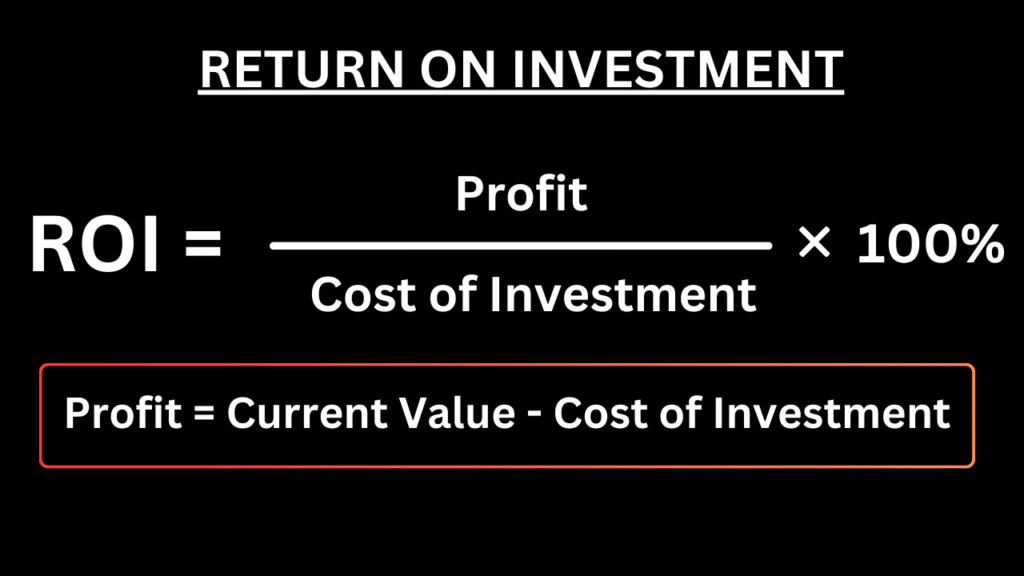

5. Return on Investment

Return on Investment (ROI) is an important metric for measuring the success of your investment. This calculation considers both rental income and property value appreciation over time. This is one of the things to know in real estate investment, Understanding ROI helps you compare potential investments and make informed choices.

Also Read: 5+ Most Profitable Types of Real Estate Investments

6. Tax Implications

Real estate investments come with specific tax advantages. Depreciation allows you to deduct a portion of the property’s value from your taxable income each year. Rental income is also subject to taxation, so consult a tax advisor to understand your obligations and potential benefits.

7. Finance Options

Securing financing is an important step as it is one of the things to know in real estate investment. Explore different finance options like traditional mortgages, hard money loans, and private lenders. Consider factors like interest rates, loan terms, and down payment requirements to select the option that best suits your investment strategy and financial situation.

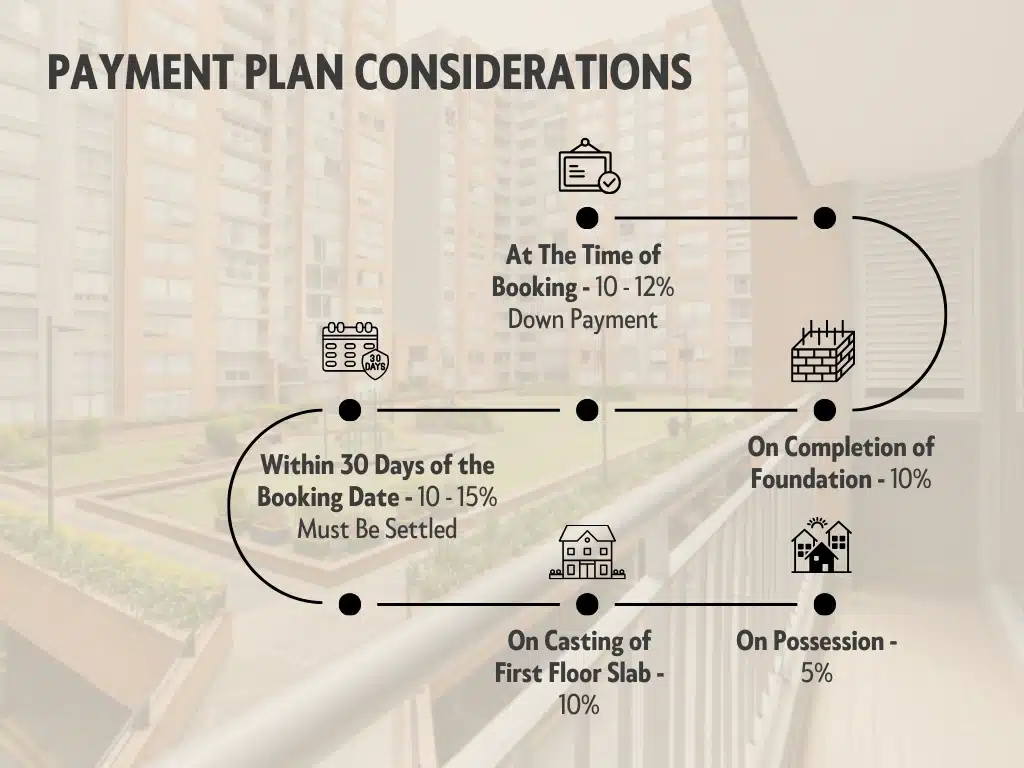

8. Payment Plan Considerations

Don’t underestimate the ongoing costs of real estate ownership. Factor in property taxes, insurance premiums, maintenance expenses, and potential vacancies when creating your payment plan. A realistic budget ensures your investment remains profitable over the long term.

9. Property Condition Inspection

A thorough property condition inspection is essential before finalizing any purchase. This uncovers potential repairs, code violations, and hidden problems that could significantly impact your investment’s profitability.

10. Real Estate Law Compliance

Familiarize yourself with real estate laws in your area. Real estate law compliance is also one of the things to know in real estate investment. This includes landlord-tenant regulations, eviction procedures, and fair housing practices. Ensuring compliance protects you from legal challenges and fosters a positive relationship with your tenants.

Also Read: 10 Things You Should Keep In Mind When Investing In Real Estate

11. Real Estate Marketing Costs Analysis

If you plan to rent out a property, real estate marketing costs need to be factored in. This could include listing fees, advertising costs, and tenant screening services. As it is one of the things to know in real estate investment, understanding these expenses helps you determine your break-even point and set a competitive rental price.

Investing in Real Estate in India can be a lucrative option, and Vijay Shanthi Builders might be a good starting point to explore the best real estate investments in India. They offer a variety of residential properties that could be suitable for those considering entering the real estate market in India.

FAQs:

You can invest directly in residential or commercial properties, or indirectly through Real Estate Investment Trusts (REITs) or real estate crowdfunding platforms.

Rental income is taxable, but depreciation allows you to deduct a portion of the property’s value from your taxable income each year. Consulting a tax advisor is recommended.

Returns vary depending on factors like property type, location, and market trends and conditions. Rental income provides regular cash flow, while property value appreciation offers long-term gains.

Conduct thorough due diligence, your portfolio diversification across different property types and locations, and maintain a healthy financial buffer to weather market fluctuations.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market