How to Improve Your Credit Score Before Applying for a Home Loan?

How to Improve Your Credit Score Before Applying for a Home Loan?

Are you looking to apply for a home loan? Not sure how to improve your credit score?

Look no further, you have landed on the right page. Here we have carefully listed the aspects to help you increase your credit score so that you can apply for a home loan with ease for either buying an apartment for sale in Chennai or a luxury townhouse in the outskirts of the city. Let’s look into how we can refine your financial stability for a promising future.

Check Your Credit Reports and Scores

First Start by understanding the overall view of your credit value. A Credit report helps you understand the pros and cons of your credit score. A prompt review can show you any errors or information that has been outdated, and if that has been rectified, than there will be a positive impact on your credit score.

- Obtain reports from major credit bureaus.

- Scrutinize for inaccuracies or fraudulent activities.

- Correct any discrepancies promptly.

Pay Your Bills on Time

Timeliness in settling your bills cannot be overstated. Payment history is a significant contributor to your credit score. Consistently paying your credit card bills and loan EMIs on time demonstrates your reliability to lenders, thereby improving your credit score.

- Set up reminders or auto-debit to ensure timely payments.

- Prioritize bills and due dates.

- Even small bills can impact your payment history, so don’t overlook them.

Reduce Your Credit Card Balances

High credit card utilization can adversely affect your good credit score. It’s advisable to keep your credit card balances low compared to your credit limits. This not only helps improve your credit score but signals to lenders your prudent financial management.

- Aim to maintain a balance of less than 30% of your credit limit.

- Pay down existing balances to free up credit.

Avoid Opening New Accounts

Opening new credit accounts can temporarily lower your credit score. Ir can also decrease your score. If you’re eyeing a home loan, it’s wise to not make any new credit applications.

- Avoid unnecessary credit checks before applying for a home loan.

- Consolidate credit inquiries as much as possible.

Increase Credit Limits

If manageable, request an increase in your credit limits without increasing your spending. This improves your credit utilization ratio, a key component in how to improve your credit score. Higher credit limits with unchanged spending equate to lower utilization ratios.

- Contact your credit card issuers to discuss credit limit increases.

- Showcase your history of timely payments to support your request.

Address Negative Items

Your credit report might contain a bad reputation from past financial hiccups. While some of these items naturally fall off over time, you can proactively seek to address them, possibly to improve your credit score faster.

- Negotiate with creditors to remove negative items.

- Engage in goodwill letters or payment for delete arrangements where applicable.

Keep Old Accounts Open

The age of your credit history matters. Older accounts contribute positively to your credit score. Unless there’s a strong reason (such as high fees), keeping your old accounts open can strengthen how to improve your credit score.

- Resist closing old credit cards.

- Utilize older accounts occasionally to keep them active.

Seek Professional Help if Needed

Navigating credit improvement can be daunting. If the task seems overwhelming, consider consulting with a credit counselor or financial advisor. These professionals can offer personalized strategies tailored to your financial situation.

- Research reputable credit counseling services.

- Ensure advisors understand your home purchasing goals.

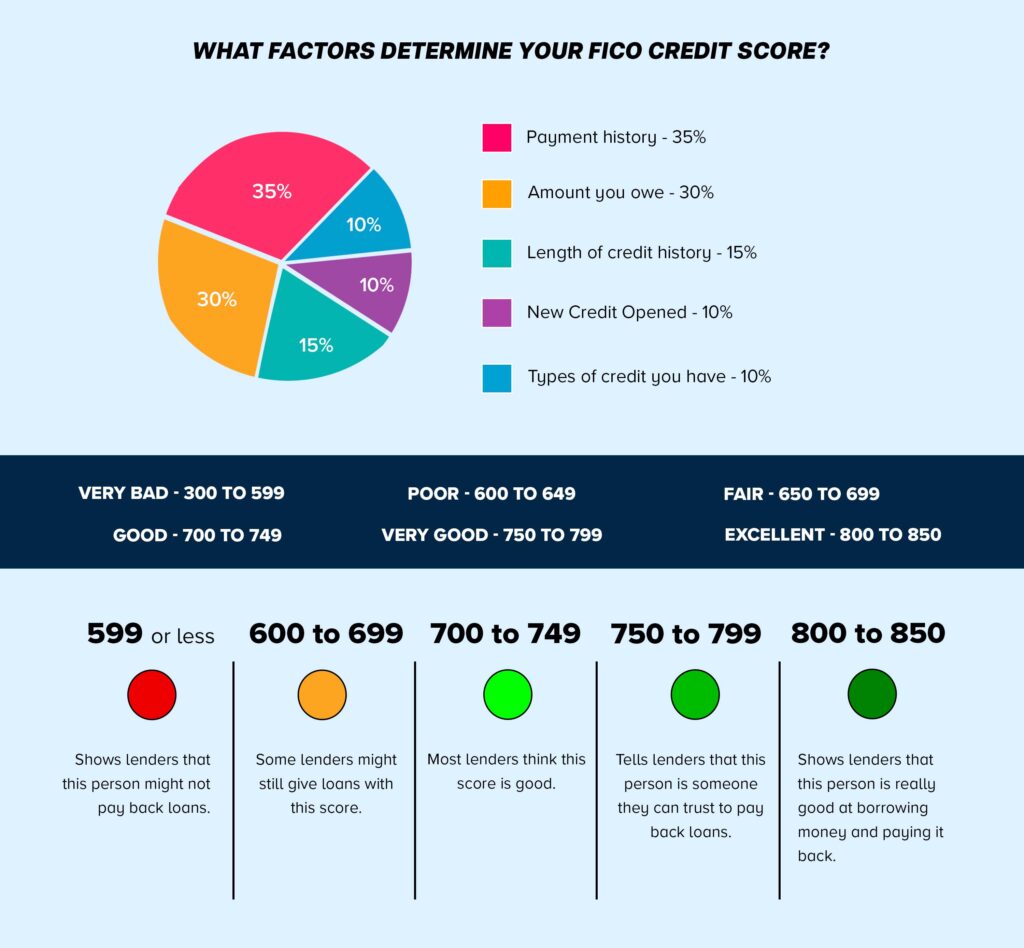

What Factors Determine Your FICO Credit Score?

Understanding the components of your FICO score is highly important. FiCO is an acronym for Fair Isaac Corporation. Factors include payment history, credit utilization, length of credit history, new credit, and credit mix. Each plays a role in calculating your score, guiding your credit improvement efforts.

How Fast Can You Raise Your Credit Score?

Improvement timelines vary, but with consistent effort, it’s possible to see changes within a few months. However, addressing significant issues like high balances or negative information can take longer.

Vijay Shanthi Builders recognized among the top real estate builders in Chennai, presents premier residential options for purchasing flats in Chennai. Renowned for their best apartments in Chennai, they offer an excellent choice for potential homebuyers aiming to improve your credit score ahead of applying for a home loan.

Improving your credit score is a journey, not a sprint. It demands patience, discipline, and a strategic approach. By implementing these practices, you position yourself for approval for a home loan, bringing you closer to securing your dream property, from a 2 bhk apartment in Chennai to a new flat for sale in Chennai. Remember, your financial health impacts every facet of your life, so take the necessary steps today to ensure a bright and stable tomorrow.

FAQS:

Access your score through credit bureaus or free credit score services online.

Scores above 670 are typically considered good, but the higher, the better for loan terms.

Minor improvements can be seen in a few months, but more substantial changes might require a year or more.

The lowest acceptable credit score to buy flats in Chennai may vary by lender, but scores in the mid-600s are often the minimum for traditional loans.

Yes, through disputes, goodwill letters, or as negative items age off your report.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Beware of the Red Flags for home buyers – Top 10 Insights

When embarking on the journey to purchase a home, armed with excitement and dreams,

Must Read – About Encumbrance Certificate in Property Buying

In the network of property transactions, one document stands tall as a beacon of

5+ Tips to Manage Home Loan Emis During a Financial Crisis

Handling home loan EMIs during financial difficulties can be overwhelming, but with careful planning