Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market awareness. Whether you’re a beginner or have some experience, understanding the fundamentals can significantly enhance your investment journey. Here are some essential tips to guide you on your path to success.

1. Understanding Market Trends

To be successful in real estate investing, it’s vital to understand current market trends. Research local and national real estate markets to identify areas with growth potential. For instance, if you notice that the demand for Luxury Apartments is rising in Chennai, it may be a good time to invest in that sector. Tracking market trends can give you a clear idea on deciding when and where to invest.

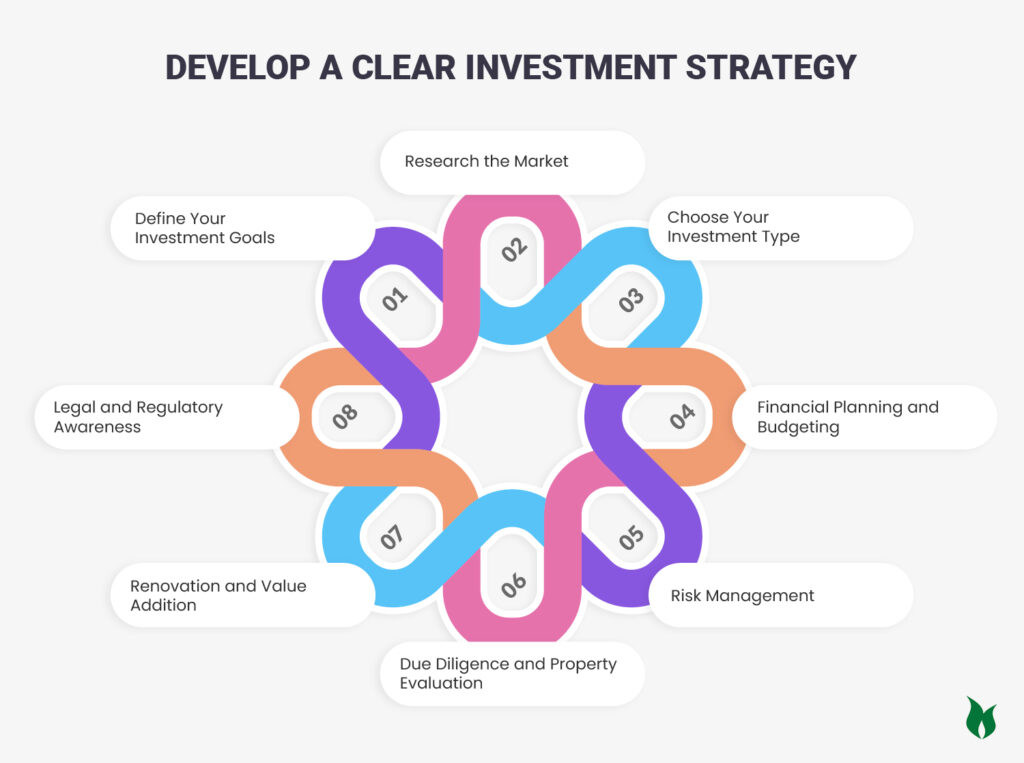

2. Develop a Clear Investment Strategy

A clear investment strategy is crucial for being successful in real estate investing. Define your goals, whether they involve generating passive income, flipping properties, or long-term appreciation. For example, if your goal is to invest in residential real estate investment, outline the types of properties you want to target, such as single-family homes or multi-unit buildings.

If you are curious about learning more about Buying a Flat, please take a moment to read this blog – ”11 Tips to Become Successful in Real Estate Investing (2024)”.

3. Location Analysis

Location is one of the most important factors in successful real estate investing. Properties in prime locations tend to appreciate faster and attract higher rental demand. Conduct a thorough analysis of potential neighborhoods. For instance, investing in an area close to schools, shopping centers, and public transport can lead to better returns. If a property in a sought-after location costs ₹1 crore, but similar properties are appreciating at 10% annually, the investment could yield significant returns over time.

4. Financial Planning and Budgeting

Effective financial planning and budgeting are essential for being successful in real estate investing. Determine how much you can afford to invest and consider all associated costs, such as property taxes, maintenance, and insurance. For example, if you’re investing in a property worth ₹50 lakh, ensure you account for additional expenses that could amount to 20% of the property value, bringing your total investment to ₹60 lakh.

5. Building a Strong Network

Networking is vital for successful real estate investing. Connect with other investors, real estate agents, and professionals in the industry. Attend local real estate investment groups or seminars to meet potential partners and mentors. A strong network can provide valuable insights and opportunities that you might not find on your own.

6. Stay Informed About Legal and Regulatory Changes

To be successful in real estate investing, it’s essential to stay updated on legal and regulatory changes that may affect your investments. Familiarize yourself with local zoning laws, rental regulations, and tax implications. For instance, understanding the recent changes in property tax laws in Chennai can help you budget more accurately and avoid unexpected expenses.

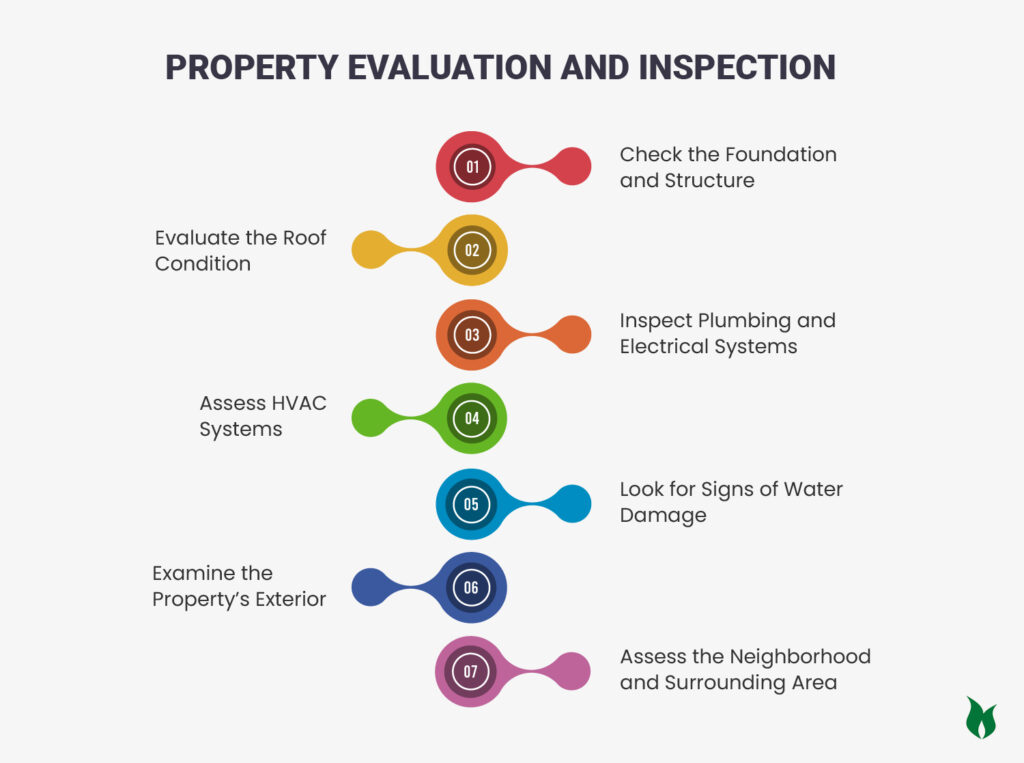

7. Property Evaluation and Inspection

Conducting thorough property evaluations and inspections is essential for being successful in real estate investing. Before purchasing a property, assess its condition and potential repair costs. For example, if a property requires ₹5 lakh in renovations, factor that into your overall investment analysis. This diligence can prevent costly surprises down the line.

8. Renovation and Value Addition

Investing in properties that require renovations can lead to significant returns. By making strategic improvements, you can increase a property’s value and rental income. For instance, updating a kitchen or adding an extra bathroom can yield a higher return on investment. If a renovation costs ₹3 lakh but increases the property’s value by ₹10 lakh, the investment is worthwhile.

9. Diversification of Investments

Diversifying your investment portfolio is key to being successful in real estate investing. Consider investing in different types of properties, such as residential, commercial, or land. This strategy spreads risk and can lead to more stable returns. For example, if you invest in both Luxury Apartments and commercial spaces, you can balance the risks associated with fluctuations in either market.

10. Effective Property Management

Proper property management is crucial for successful real estate investing. Whether you manage properties yourself or hire a property management company, ensure that tenants are satisfied and maintenance issues are addressed promptly. Happy tenants are more likely to renew leases, reducing vacancy rates and maintaining consistent cash flow.

11. Utilizing Technology

In today’s digital age, leveraging technology can enhance your real estate investing efforts. Use online platforms for property research, financial analysis, and market trends. Tools like property management software can streamline operations, making it easier to track expenses and income. For instance, using a property management app can help you monitor rent payments and maintenance requests efficiently.

Key Takeaways

- Understand market trends to identify growth opportunities.

- Develop a clear investment strategy aligned with your goals.

- Analyze locations for potential appreciation and rental demand.

- Plan your finances and budget for all associated costs.

- Build a strong network for insights and opportunities.

- Stay informed about legal and regulatory changes.

- Conduct thorough property evaluations and inspections.

- Consider renovations to add value to your investments.

- Diversify your portfolio to spread risks.

- Implement effective property management practices.

- Utilize technology to enhance your investing efforts.

Becoming successful in real estate investing in 2024 requires a combination of knowledge, strategy, and proactive management. By understanding market trends, developing a clear investment strategy, and leveraging technology, you can enhance your investment journey. Partnering with reputable builders like Vijay Shanthi Builders can also provide valuable insights and support as you navigate the real estate landscape.

FAQS:

Focus on properties with high rental yields and consider value-added renovations.

Knowledge of the market, a clear strategy, and effective management are key.

Analyze cash flow, rental yields, and potential appreciation to assess profitability.

Kitchen and bathroom upgrades typically yield the highest returns.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Minimize Risks and Maximize Returns in Real Estate Investing

Real Estate Investing can be a lucrative way to build wealth, but it also