What was the value of real estate in Chennai before the year 2000?

When discussing the value of real estate in Chennai before the year 2000, it is important to consider the tax rates on real estate commissions during that time. However, it is worth noting that the tax rate on real estate commissions in India during that period varied between states and was influenced by national tax policies.

Real estate commissions are typically paid to brokers or agents involved in property transactions. These commissions are usually a percentage of the property’s sale price, and the tax on these commissions would be determined based on prevailing tax laws and regulations. Prior to the year 2000, it is likely that Chennai had its own tax structure for real estate commissions, which could have been influenced by various factors such as market conditions and government policies.

What would the price of real estate in Chennai be in 2000?

Determining the exact price of real estate in Chennai before the year 2000 is a challenging task, as the data available from that time is limited. However, we can make an approximation based on market trends and available information

In the late 1980s and early 2000s, Chennai experienced significant growth in its real estate market. Rapid industrialization, expansion of IT and manufacturing sectors, and the overall economic development of the city played a crucial role in boosting property prices.

During this period, Chennai witnessed an increase in demand for both residential and commercial properties. The prices of houses, apartments, and plots of land witnessed a substantial increase. For instance,

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”Minimize Risks and Maximize Returns in Real Estate Investing”.

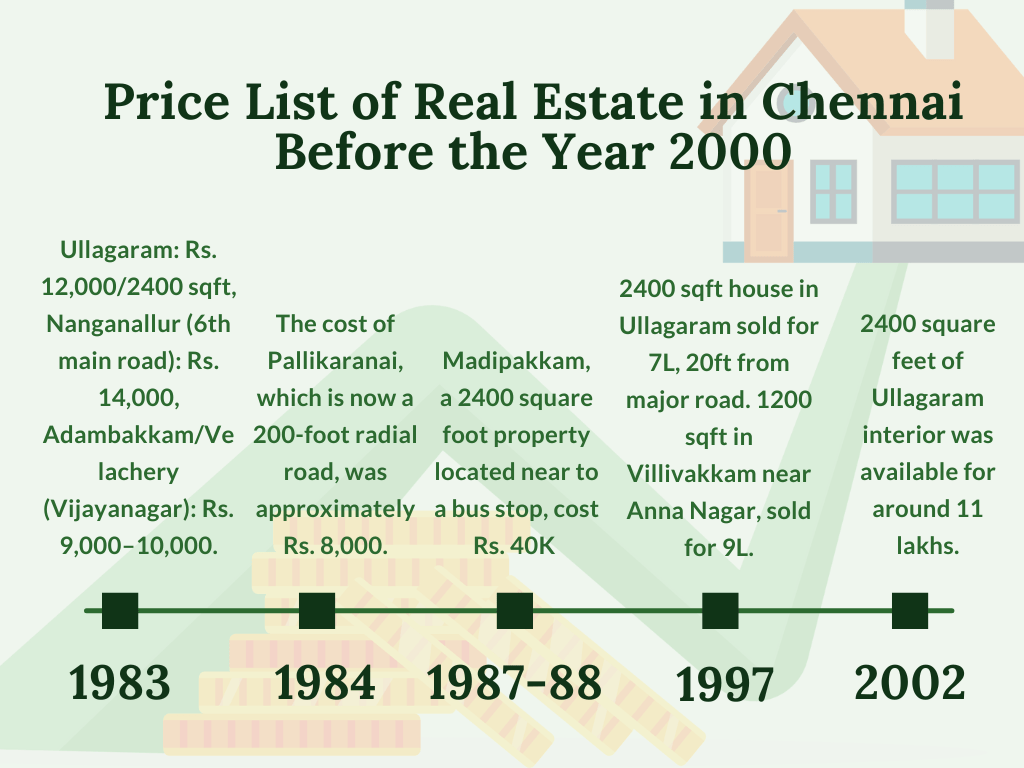

1983

Ullagaram’s 2400 square feet of land cost roughly Rs. 12,000

Nanganallur (6th main road) cost roughly Rs. 14,000. Comparable costs in Adambakkam.

Velachery (Vijayanagar) cost roughly Rs. 9,000–10,000.

800 square feet in Chepauk, close to the Star theater, cost about Rs. 14,000

1984

The cost of Pallikaranai, which is now a 200-foot radial road, was approximately Rs. 8,000.

1987–88

Madipakkam, a 2400 square foot property located near to a bus stop, cost Rs. 40K

1997

A 2400 square foot house in Ullagaram was sold for 7 lacs. The major road would have been only around 20 feet away.

1200 square feet in Villivakkam, which is nearer Anna Nagar than ICF, for roughly 9 lacs

2002

2400 square feet of Ullagaram interior was available for around 11 lakhs.

It is important to note that various factors such as location, amenities, and infrastructure development also influenced property prices in Chennai. Premium builders in Chennai sought to capitalize on the rising demand by offering high-quality properties in prime locations at premium rates.

Also Read: ”Average housing prices up 38 per cent in last decade”

What is the future of Chennai's real estate value?

Chennai has consistently held a prominent position in the Indian real estate market, and its value is expected to continue growing in the future. The city’s strategic location, robust infrastructure, and strong economic growth make it an attractive destination for real estate investments.

In recent years, Chennai has witnessed significant development in areas such as IT and manufacturing, leading to an increased demand for residential and commercial properties. With major corporate giants setting up their operations in the city, the demand for housing and office spaces is expected to rise further.

Moreover, the implementation of infrastructure projects such as the Chennai Metro Rail and the development of expressways and highways have enhanced connectivity and accessibility within the city. These improvements have positively impacted the real estate market, attracting more investors and homebuyers.

Given these factors, it is safe to say that the future of Chennai’s real estate value looks promising. As the city continues to thrive and attract investments, property prices are likely to appreciate, making it a favorable market for both homebuyers and investors.

Which type of flat should you buy in Chennai in the year 2000?

In the year 2000, Chennai was experiencing a rapid growth in its real estate market, with various options available for homebuyers looking to invest in flats. The decision regarding the type of flat to buy would depend on an individual’s preferences, budget, and long-term goals.

- Budget-friendly flats

For those with limited financial resources, affordable and compact flats in upcoming areas, such as developing areas in Chennai, would have been a viable option. These flats would offer basic amenities and cater to the needs of the middle-income segment.

- Premium Flats

Chennai Also Had Premium Builders Offering Luxurious Flats With State-Of-The-Art Facilities and Amenities. These Flats Were Typically Located in Upscale Neighborhoods and Targeted High-Income Individuals Looking for a Luxurious Lifestyle.

- Gated Community Flats

Gated communities with flats were gaining popularity in Chennai during that time. These complexes offered a range of amenities such as swimming pools, gymnasiums, and landscaped gardens, along with better security measures.

It is crucial to evaluate factors such as location, proximity to essential services, reputation of the builder, and potential for future appreciation while choosing the type of flat to buy in Chennai in the year 2000.

Which area of Chennai had the highest property rates in 2000?

In the year 2000, several areas in Chennai experienced significant growth and witnessed a surge in property prices. However, the area with the highest property rates during that time was undoubtedly the central business district (CBD) and its surrounding neighborhoods

The CBD, which includes areas like Mount Road, Nungambakkam, and T. Nagar, had emerged as the prime commercial and residential hub of Chennai. The demand for properties in these areas was driven by their proximity to major business centers, commercial establishments, educational institutions, and entertainment facilities.

Additionally, traditional residential neighborhoods like Anna Nagar, Adyar, and Mylapore also commanded high property prices due to their established reputation, excellent connectivity, and presence of premium amenities.

It is important to note that property prices varied across different localities within Chennai, with certain areas having higher rates compared to others. However, the CBD and its surrounding neighborhoods, along with well-established residential areas, were generally associated with premium prices in the year 2000.

Why do real estate prices in India continue to rise?

Real estate prices in India, including Chennai, have shown a consistent upward trend. Several factors contribute to the continuous rise in real estate prices:

- Population Growth and Urbanization

India has one of the fastest-growing populations in the world, leading to increased demand for housing and infrastructure. As more people migrate to cities like Chennai in search of better opportunities, the demand for real estate continues to rise.

- Economic Growth and Investment

India’s rapid economic growth has attracted significant domestic and foreign investments in various sectors, including real estate. This influx of capital has driven up property prices, especially in prime locations.

- Limited Supply of Land

The availability of land for development in major cities is limited, leading to a scarcity factor that drives up prices. Land acquisition and development costs are also high, contributing to the overall increase in real estate prices.

- Inflation and Currency Devaluation

Inflation erodes the purchasing power of money over time, leading to an increase in the cost of goods and services, including real estate. Currency devaluation also impacts real estate prices, as imported construction materials become more expensive.

- Government policies and regulations

Government policies related to land use, zoning, and development regulations also influence real estate prices. Changes in regulations or the introduction of new policies can have a significant impact on the market dynamics and property prices.

It is essential to note that real estate prices in India can be subject to fluctuations based on market conditions and various external factors. However, the overall trend indicates a general increase in prices over time. Vijay Shanthi Builders, with a reputation as the best builders in Chennai, are here to guide and assist you through the home-buying process.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Top Residential Apartments in Chennai: Best Locations & Buying Guide

Why Choose Residential Apartments in Chennai? If you're planning to invest in a home, residential

What is UDS in Apartments and How It Is Calculated?

If you’re planning to invest in a flat, understanding UDS in apartments is non-negotiable.

6 Neighborhood Spotlight in Kadambadi Boosting Property Values

Kadambadi, located on Chennai’s scenic East Coast Road, is becoming a popular spot for