Are You a First-Time Homebuyer? You Must Read This

Thinking about buying your first home? Our easy guide for first-time home buyer covers everything – finding a house, managing money, and making your dream home a reality!

What Do I Need to Know about My Finances Before Buying My First Home?

When purchasing a first house, it’s very important to understand your financial situation. Consider the total income you’re earning and figure out how much of your income you can afford to pay towards a home loan installment.

Buying an apartment for sale in Chennai or even investing in 2 BHK apartments in Chennai involves more than just the cost of the property. Other costs like electricity, maintenance fees, and unplanned repair bills must be taken into consideration.

Renowned builders in Chennai will often ask for proof of financial stability, so ensure you have a steady income source and a good credit score for first-time home buyer when you’re planning to buy flats in Chennai.

In regards to interest rates, first-time home buyer should understand that these can greatly impact the total cost of the home. A lower interest rate means you pay less over the course of your loan.

How Do I Set a Realistic Budget for My First Home Purchase?

Setting a realistic budget is a crucial step in the home purchase journey for a first-time home buyer. In addition to the price of the residential property, bear in mind the costs of mortgage payments, homeowner’s insurance, and property taxes.

While looking for an affordable home, one of the most prominent builders in Manapakkam offers a wide range of 2 BHK apartments in Chennai that have been crafted for different budget brackets.

With a higher credit score, you can buy a house more easily by obtaining a better interest rate on your home loan, which will also reduce your monthly payments.

What Mortgage Options Are Available for First-Time Home buyers?

First-time home buyer can choose from a range of mortgage options. A range of mortgage options are available to first-time homeowners. These services help you buy a house that is within your means by providing a variety of options to meet your financial needs. You’ll find different interest rates and payment options available to you.

The real estate sector in Chennai, for example, offers attractive home loan options for first-time home buyers, even for the prime 2 BHK apartments in Chennai.

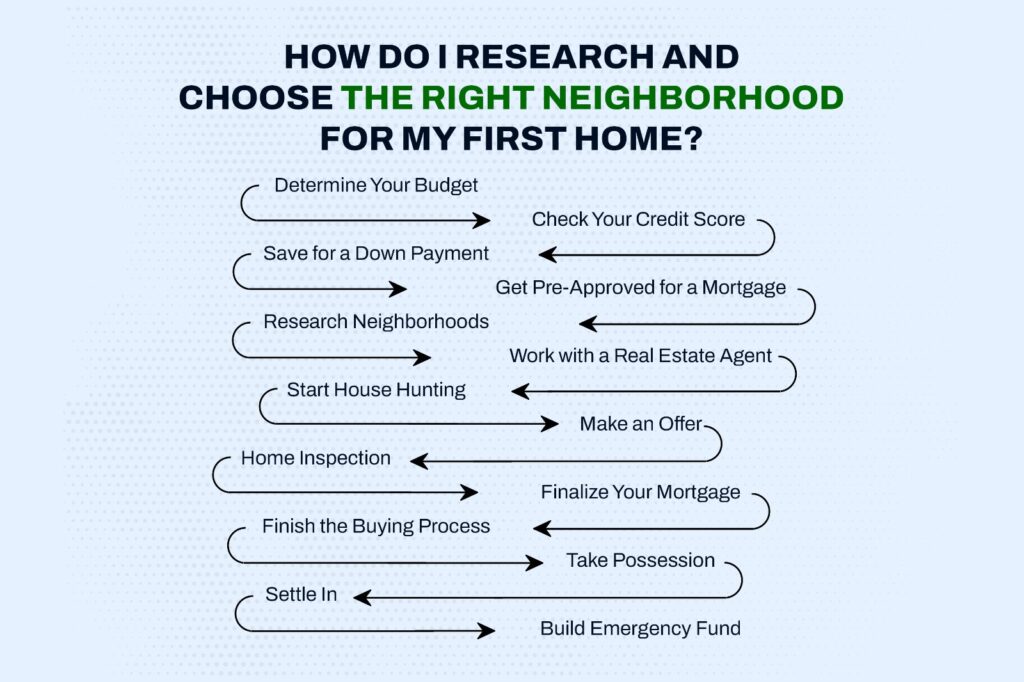

How Do I Research and Choose the Right Neighborhood for My First Home?

Choosing the right neighborhood is as essential as selecting the perfect flat for sale in Chennai. Consider factors like commute times to work, proximity to amenities like markets, hospitals, schools, and safety standards.

While looking for an apartment for sale in Chennai, you can check out the best builders in Manapakkam who offer excellent residential complexes in well-connected and thriving neighborhoods.

If you are curious about learning more about Real estate investment, please take a moment to read this blog. – ”Why buying a flat is good investment in Chennai in 2024?”

What Should I Look for During Home Inspections as a First-Time Home buyer?

For those purchasing their first home, a home inspection is essential. It protects you from possible future issues. Check the building’s electrical work, plumbing, heating and cooling systems, and other important parts.

When you buy flats in Chennai, ensure the builders in Chennai provide a comprehensive home inspection report.

What Legal Formalities Are Involved in Buying My First Home?

Many legal procedures must be followed when purchasing a property. Make sure the seller is entitled to sell the property and has legal possession of it. There should be no encumbrance or claims on the property. If searching for an apartment for sale in Chennai, you find one you love, reputable builders in Chennai will aid you through these formalities smoothly.

What Are the Common Additional Costs That First-Time Home buyer Often Overlook?

While the apartment for sale in Chennai might seem within your budget, as a 1st time home buyer, you may overlook additional costs. These include stamp duty, registration charges, GST, interior decoration, parking space charges, brokerage (if any), and charges for amenities.

Are You a 1st Time Homebuyer? We Are Here to Help

Buying your first home is a significant milestone. Making thoughtful and well-informed decisions plays an important role during this process. The reputable and best builders in Manapakkam and other areas of Chennai are always available to guide you through this exciting journey of buying homes for first-time buyer.

Ready for your first home? With helpful tips, you’re set! For the ideal apartment and expert guidance, trust Vijay Shanthi Builders in Manapakkam and Chennai. Let’s make your dream home a reality!

FAQS:

Being a first-time home buyer often comes with several tax benefits. The total cost of purchasing a property is far less than it could be because to these benefits.

Typically, first time home buyers are advised to save around 20% of the home’s price for a down payment. However, this can vary based on loan types and can be sometimes as low as 3.5%.

Getting pre-approved for a home loan displays to sellers that you are serious about buying and capable of affording their property. When multiple buyers show interest in the same home, it gives you an advantage.

One of the most important things that lenders consider when determining the terms of your mortgage is your credit score. Your interest rate can be lowered with a higher credit score, which lowers the overall cost of your mortgage.

A major advantage you gain as a first-time home buyer is potential tax benefits, depending on the country and state you reside in.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

10 Best Interior Wall Colour Combinations To Try In 2025

When you walk into a room that feels right, chances are—it’s the walls quietly

Top 12 Benefits of a Clubhouse in an Apartment

A clubhouse in modern apartments is a dynamic hub that enriches resident life with

7 Interior Lighting Tips for a Brighter Interior

Good lighting can completely transform the look and feel of any space. In this