Is It Smart to Buying a Property as an Investment in 2024?

Investing in property in 2024 offers numerous benefits, from potential capital appreciation to rental income. In this blog, we explore buying a property as an investment by analyzing the current real estate market, financial considerations, tax implications, and essential factors for choosing the right location and property. Discover how to make a smart investment decision in today’s dynamic real estate landscape.

Benefits of Buying a Property as an Investment in 2024

When considering Buying a Property as an Investment in 2024, exploring the investment property market trends and real estate investment opportunities is important. The benefits include potential high returns on investment, especially when aligning with investment property ROI in 2024 projections. Additionally, owning real estate can give you tax benefits like deductions on mortgage interest, property tax, and depreciation.

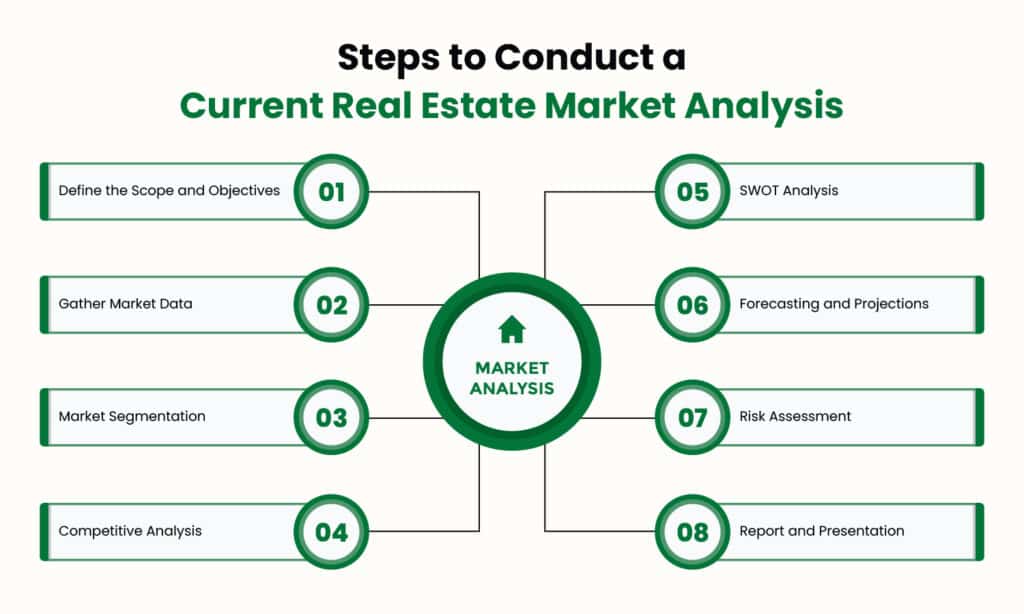

Current Real Estate Market Analysis

After analyzing the current market, real estate market analysis and buying rental property in 2024 factors highlight a strong demand in cities. The trends in the rental property market analysis and insights on Economic factors affecting property investment provide a deep understanding of the potential growth zones that make Buying a Property as an Investment a wise decision this year.

Financial Considerations and Tax Implications

The financial aspect of Buying a Property as an Investment covers several areas including investment property financing options and tax implications of investment property ownership. It’s important to consider that while the initial costs might be high, the long-term tax benefits can offset these expenses. Specific tax benefits include the ability to write off operational expenses and the potential for a 1031 exchange, which can defer capital gains tax.

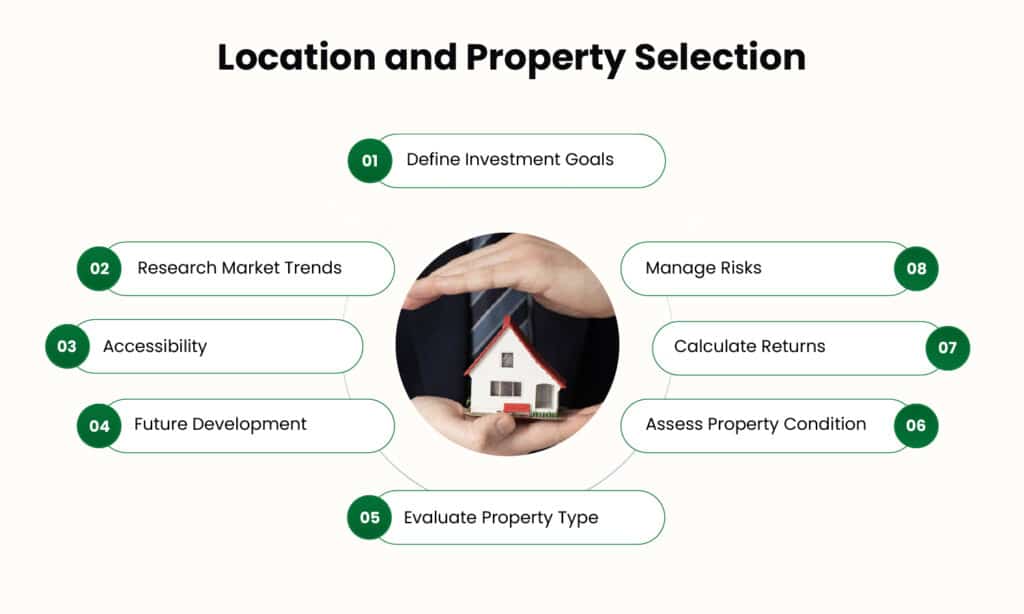

Location and Property Selection

Location analysis for investment properties plays a pivotal role when you consider Buying a Property as an Investment. Markets like the Real Estate in India, especially regions highlighted by real estate builders and residential builders in Chennai, offer promising returns due to extensive development and increased demand for housing.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”Factors to Keep in Mind While a Buying a Property in Chennai”.

Should I Invest in Residential or Commercial Properties in 2024?

The decision between investing in residential vs. commercial properties in 2024 depends on your investment goals and risk tolerance. Residential properties often offer more consistent rental income streams and might be less uncertain than commercial options, making them suitable for those new to real estate investing for beginners.

Risk Assessment

Property investment risks and rewards must be assessed before getting into the investment property arena. While the rewards can be high, the risks — such as tenant turnover, unexpected maintenance costs, and fluctuations in the property market must also be considered. Properly assessing these can guide you in making an informed decision when Buying a Property as an Investment.

Long-Term Investment Strategy

For those considering Buying a Property as an Investment, developing a long-term investment strategy is essential. This involves understanding property investment tips for 2024, projected cash flows, and exit strategies. Having a clear long-term vision can significantly influence the success of your investment.

Market Timing and Predictions When Buying a Property as an Investment

Understanding investment property trends and timing the market is key. The investment property market research suggests that timing your investment in sync with economic cycles can maximize your investment returns, especially when investing in real estate in 2024.

Also Read: Real Estate Investing In 2024: What You Should Know

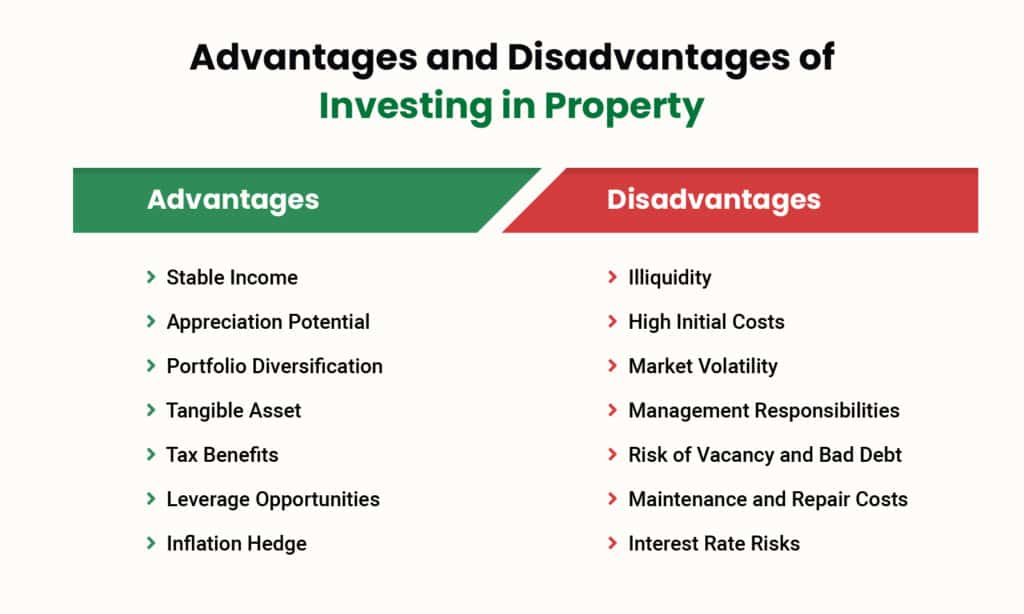

Advantages and Disadvantages of Investing in Property

Investing in property comes with its sets of advantages such as potential steady income, capital appreciation, and tax benefits. However, the disadvantages include liquidity issues, high initial capital requirements, and market risk factors. Balancing these factors is crucial when Buying a Property as an Investment.

Also Read: Is Now a Good Time To Invest In Real Estate? [2024]

What Are the Current Interest Rates for Investment Properties?

The current interest rates for financing investment properties in 2024 play a crucial role in the decision-making process for potential investors. Competitive rates can significantly affect the overall cost of purchasing an investment property and should be monitored closely.

Interest rates for investment properties are typically higher than those for primary residences. This is because lenders consider investment properties to be riskier. Here’s a breakdown:

- Rate Difference

Investment property rates can be 0.50 to 1.00 percentage points higher than conventional loan rates.

(https://www.bankrate.com/mortgages/investment-property-rates/.)

- Current Averages

It’s difficult to give a definitive number as rates can vary based on your creditworthiness and other factors. However, to get a general idea, you can add 0.50 percentage points to the average rate for a 30-year fixed-rate mortgage.

(https://www.forbes.com/advisor/mortgages/daily-rates/.)

- Finding Exact Rates

The best way to get a specific rate quote is to contact a lender directly. They can assess your situation and provide personalized interest rates for investment properties.

Vijay Shanthi Builders is a prominent real estate developer in India known for their residential projects. They have a strong presence in Chennai and are committed to delivering high-quality homes to their customers.

If you have any queries related to buying an investment property in 2024 or would like to explore investment opportunities with Vijay Shanthi Builders, you can get in touch with them. Their experienced team will be happy to assist you in understanding the nuances of real estate investing and guide you toward making better decisions.

FAQs:

Choosing the right location involves researching market trends, understanding the demographic shifts, and evaluating the local economy. A thorough location analysis for investment properties helps in maximizing ROI.

Various financing options include traditional mortgages, government-backed loans, and private lending. Each option comes with different rates, terms, and conditions geared towards Buying a Property as an Investment.

Benefits include generating passive income, property value appreciation, and significant tax benefits which reduce the overall taxable income through deductions and depreciations.

The best type of property for investment depends on your financial goals, risk profile, and market conditions. Residential properties generally offer more stability, while commercial properties might provide higher yields but with a larger initial investment and higher risk.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market