Minimize Risks and Maximize Returns in Real Estate Investing

Real Estate Investing can be a lucrative way to build wealth, but it also comes with its fair share of risks. By understanding the market, conducting thorough research, and having a solid plan in place, you can minimize risks and maximize your returns. In this blog post, we’ll share expert insights and practical tips to help you succeed in your real estate investing journey.

1. Understand the Real Estate Market

Before diving into real estate investing, it’s crucial to understand the market trends, demographics, and economic factors that can impact property values and rental demand. Look at historical data, analyze market reports, and stay updated on the latest developments in your target areas. For example, if you’re considering investing in a prime residential project in Chennai, understanding the growth potential of the city and the preferences of the target audience is key to making informed decisions.

2. Conduct Thorough Property Research

Once you’ve identified a potential investment property, it’s time to conduct a comprehensive analysis. Assess the property’s condition, evaluate the neighborhood, and compare prices with similar properties in the area. Consider factors such as accessibility, amenities, and potential for appreciation. For instance, if you’re looking at a 2 BHK apartment in a prime location like OMR, Chennai, priced at ₹1.2 crore, research the average rental yield and occupancy rates in the area to understand its potential returns.

3. Choose the Right Financing Options

Securing the right financing is important for real estate investing. Explore various options such as mortgages, private loans, or partnerships to find the one that best suits your needs and budget. Consider factors like interest rates, loan terms, and down payment requirements. Working with experienced real estate builders can provide valuable insights and connections to help you navigate the financing landscape.

4. Start With a Clear Investment Plan

Before making any purchases, create a clear investment plan that outlines your goals, risk tolerance, and expected returns. Determine your target property type (residential or commercial), location, and budget. Set realistic timelines and exit strategies. Having a well-defined plan will help you stay focused and make better decisions throughout your real estate investing journey.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”Minimize Risks and Maximize Returns in Real Estate Investing – 9 Strategies”.

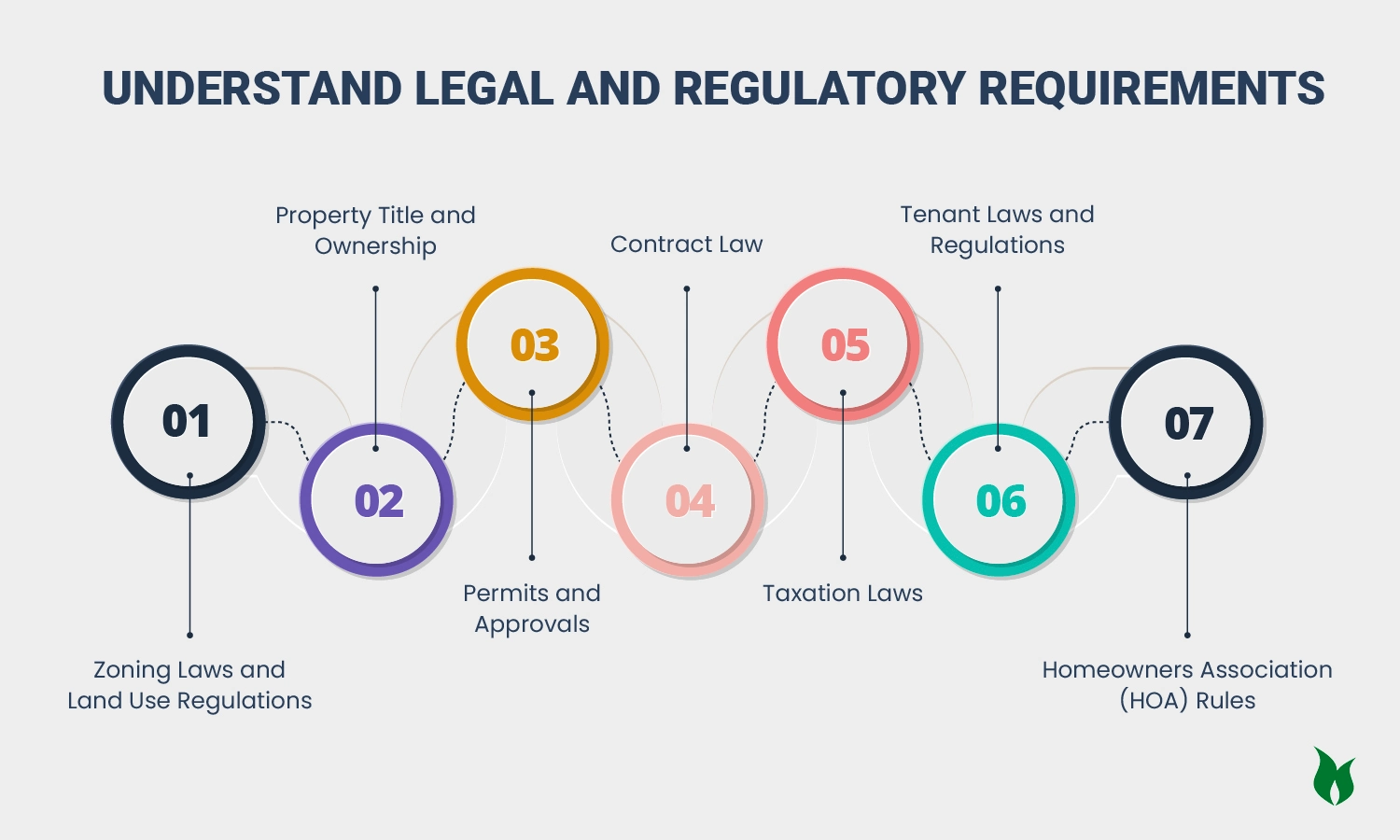

5. Understand Legal and Regulatory Requirements

Real estate investing comes with its fair share of legal and regulatory requirements. Familiarize yourself with local zoning laws, building codes, and tax regulations. Consult with experienced professionals such as lawyers, accountants, and property managers to ensure compliance and minimize legal risks. For example, if you’re investing in a property in Chennai, understanding the stamp duty and registration fees is crucial to budgeting accurately.

6. Diversify Your Investment Portfolio

Diversification is key to managing risks in real estate investing. Consider investing in different property types, locations, and price points to spread your risk and increase your chances of success. For instance, you could invest in a mix of residential properties, commercial spaces, and land parcels to create a balanced portfolio.

7. Focus on Location

Location is one of the most critical factors in real estate investing. Properties in desirable areas with good infrastructure, amenities, and growth potential tend to appreciate faster and attract higher rental demand. Research the local market thoroughly and consider factors such as accessibility, schools, and employment opportunities. For example, investing in a well-connected area like Manapakkam, Chennai, can provide stable returns due to the high demand for rental housing.

8. Assess Rental Yield and Occupancy Rates

When evaluating a potential investment property, consider its rental yield and occupancy rates. Rental yield is the annual rental income as a percentage of the property’s value, while occupancy rates reflect the property’s ability to attract and retain tenants. Look for properties with a history of stable occupancy and strong rental yields. For instance, a 3BHK apartment in a prime location like Manappakam, Chennai, with a rental yield of 3-4% and occupancy rates of 90% or higher could be a good investment.

9. Educate Yourself Continuously

Real estate investing is an ongoing learning process. Stay Updated about market trends, legal changes, and best practices by attending workshops, reading industry publications, and networking with experienced investors. Continuously educating yourself will help you make informed decisions and adapt to changing market conditions.

Key takeaways

- Understand the real estate market and stay informed about trends and developments.

- Conduct thorough property research to assess the potential risks and returns.

- Choose the right financing options based on your budget and investment goals.

- Create a clear investment plan with realistic goals and timelines.

- Understand the legal and regulatory requirements in your target market.

- Diversify your portfolio to spread risks and increase your chances of success.

- Focus on location when evaluating potential investment properties.

- Assess rental yield and occupancy rates to gauge the property’s potential returns.

- Continuously educate yourself and stay informed about best practices in real estate investing.

Real estate investing offers great potential for wealth creation, but it also requires careful planning, research, and execution. By understanding the market, conducting thorough property research, choosing the right financing options, and diversifying your portfolio, you can minimize risks and maximize your returns. Working with reputable real estate builders like Vijay Shanthi Builders can provide valuable support and guidance throughout your real estate investing journey.

FAQS:

To maximize returns from real estate investments, focus on understanding the market, conducting thorough property research, choosing the right financing options, creating a clear investment plan, and continuously educating yourself about best practices in the industry.

Diversifying your real estate investment portfolio by investing in different property types, locations, and price points can help spread risks and increase your chances of success, as not all markets and properties will perform equally well at the same time.

To assess the potential rental income of a property, research the average rental yields and occupancy rates in the area for similar properties. For example, a 3BHK apartment in a prime location like Manappakam, Chennai, with a rental yield of 3-4% and occupancy rates of 90% or higher could be a good investment.

When investing in real estate, be aware of local zoning laws, building codes, and tax regulations. Consult with experienced professionals such as lawyers and accountants to ensure compliance and minimize legal risks. For instance, understanding the stamp duty and registration fees in Chennai is crucial when budgeting for a property investment.

The choice between investing in residential or commercial real estate depends on your investment goals, risk tolerance, and expertise. Residential properties may offer more stable rental income but require more hands-on management, while commercial properties can provide higher returns but also carry more risk. Diversifying across both sectors can help balance the risks and rewards.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market