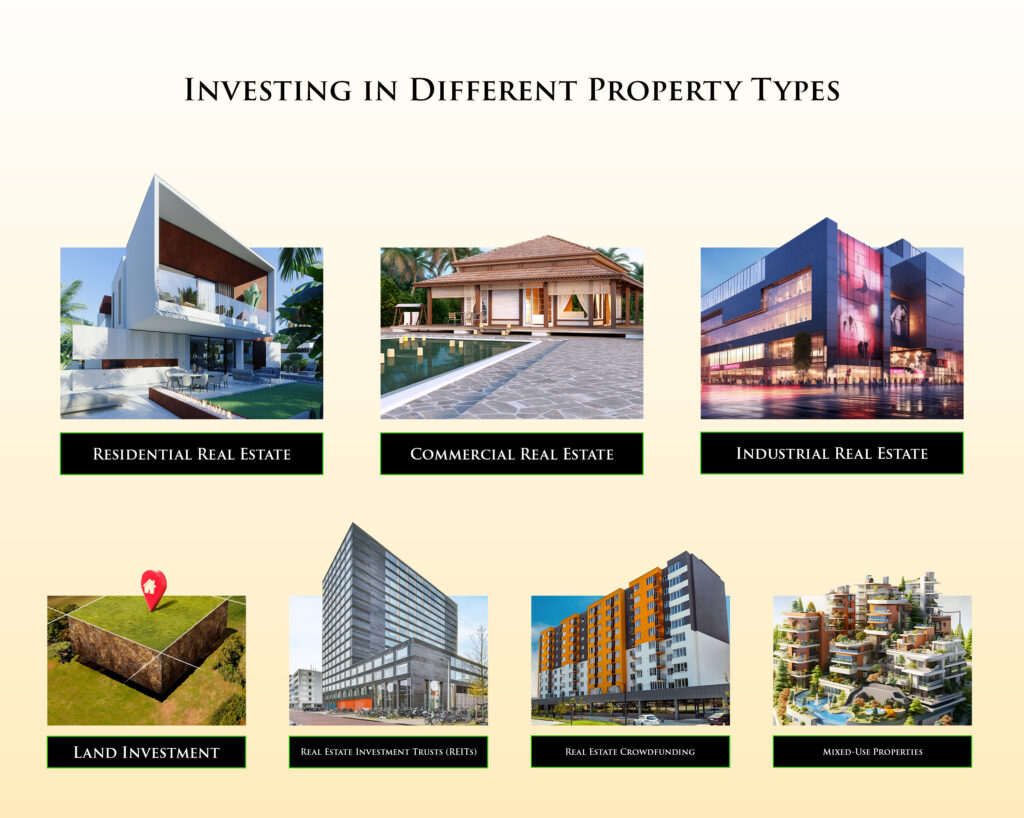

Types of Real Estate Investments and Which Is Best

When it comes to the different types of Real Estate Investments, you can find there are plenty of Real estate investment options on which you can learn how to invest in Real Estate. These options help you build your wealth, have potential cash flows and give you long-term financial stability. However, when you are choosing the right type of investment for yourself keep in mind your financial goals and your risk appetite. Let’s look into the different types of real estate investments one by one.

Residential Real Estate

Residential real estate investments are one of the types of real estate investments that involve properties such as apartments, houses, or vacation homes. The main strategy is to generate rental income or profit from appreciation over time.

Whether you’re considering this as an option within the broader Indian scenario or internationally, the demand for quality housing makes residential real estate a fairly stable investment.

Commercial Real Estate

Examples of Commercial real estate investments are office buildings, shopping centers, and large apartment complexes. Compared to residential properties, commercial real estate gives higher returns on investments and longer lease terms.

This also helps you have a more continuous flow of cash. One of the Types of Real Estate Investments in the commercial aspect includes shops and restaurants. When you choose to have a shop in the right location with knowledge about customer trends, you will have a successful business.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”Which Is Better REIT or Real Estate Investment?”

Industrial Real Estate

With the boom in the e-commerce market, there has been an increase in Industrial Real Estate Investments like warehouses and other distribution centers. Industrial Real Estate is usually leased out to businesses that are in sectors such as production, logistics, and distribution.

Land Investment

Raw land investments are one of the types of real estate investments that involve acquiring undeveloped land with the expectation that its value will increase as it becomes developed or more desirable. This type of investment can offer significant returns.

Real Estate Investment Trusts (Reits)

REITs are one of the types of real estate investments that allow investors to invest in real estate without owning physical properties. By combining funds from multiple investors, REITs invest in a variety of real estate assets, offering diversification and liquidity. They are required to distribute most of their taxable income to shareholders, providing an attractive income stream.

Real Estate Crowdfunding

Real estate crowdfunding platforms have democratized access to the best real estate investments in India, allowing investors to contribute smaller amounts of capital towards specific projects or portfolios. It is one of the types of real estate investments. This method can offer access to higher-value projects that were previously inaccessible to individual investors, though it comes with its own set of risks and rewards.

Mixed-Use Properties

Mixed-use properties are one of the types of real estate investments that combine residential, commercial, and sometimes industrial elements in one complex. These Real estate development investments can offer a blend of stable rental incomes from residential tenants and higher rental incomes from commercial leases, making them an attractive prospect for diversification.

Understanding the Risks and Rewards in Real Estate Investment

Investing in real estate in India can provide substantial rewards including regular income, appreciation, and tax benefits. However, potential investors should also be mindful of the risks such as market variability, high initial capital requirements, and management responsibilities. Conducting due diligence and adopting a well-thought-out investment strategy can mitigate these risks.

How to Invest in Real Estate in 2024

The pathway to real estate investment involves thorough market research, financial planning, and considering various investment strategies to align with your goals. For beginners, they have a lot of questions that How to Invest in Real Estate in 2024? Starting with less capital-intensive options like REITs or crowdfunding can be a prudent approach before venturing into direct property ownership.

Choosing the Right Investment for You

Selecting the right type of real estate investment depends on your financial objectives, risk tolerance, and the amount of time and effort you’re willing to commit. Whether you’re leaning towards the hands-off approach of REITs or the direct involvement of owning a rental property, aligning your choice with your personal goals is paramount.

Also Read: Real Estate: Definition, Types, How to Invest in It

Getting Started on Your Investment Journey

Embarking on your real estate investment journey requires planning, education, and strategic action. Leveraging the insights from this guide and engaging with professionals for advice can set you on the path to making informed decisions that align with your long-term financial objectives.

Real estate investing for beginners offers diverse paths to potential success; choosing the right type for you is the first step towards building your wealth.

Vijay Shanthi Builders, a top real estate developers in India, offers various real estate properties in Chennai. Whether you’re considering a luxurious apartment like their “Patio” project or a spacious villa, their portfolio caters to different investment preferences within the residential real estate sector.

FAQs About Types of Real Estate Investments

Raw land investments carry higher risks and require patience, making them less suited for beginners seeking immediate returns.

Commercial benefits of real estate investments offer the benefits of longer lease terms, higher rental incomes, and potential for significant capital appreciation.

The main difference lies in the use and lease terms, with residential properties being used for living purposes and commercial properties for business activities.

Profitability can vary greatly depending on trends of the real estate market in India, location, and management. Historically, commercial and industrial real estate have offered high returns, but diversification is key to managing risk.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market