Understanding the Basics of Real Estate Investment

Investing in real estate is one of the major ways, how people build wealth all over the world. Getting into the basics of real estate investment is not just about purchasing properties but also understanding all the opportunities and risks that come along with it. In your real estate journey, you can find yourself having very attractive returns and at times some unexpected challenges. In this blog, we shall look into the different aspects of the basics of real estate investment.

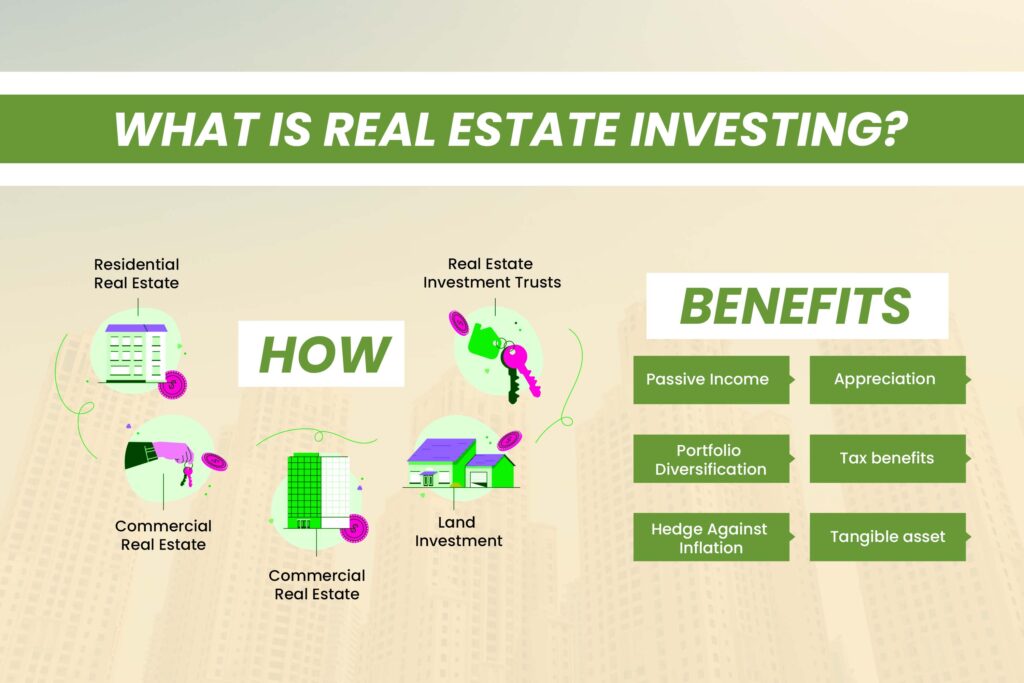

What Is Real Estate Investing?

By definition “Real estate investment involves the purchase, ownership, management, rental, and/or sale of real estate property for profit.” Real estate can be of different property types like residential and commercial. When it comes to the basics of real estate investment it’s all about investing in a property that will appreciate over time, this also provides a steady income at a later stage.

Why Invest in Real Estate?

Investing in real estate, especially when it comes to the right property can give you a sense of stability and measurable returns Unlike Stock markets, real estate always appreciates in value.

Investing in real estate carries a quintessential allure:

The promise of stability and tangible returns. Unlike volatile stock markets, real estate investment offers a tangible asset, often appreciating in value. Property investment becomes particularly attractive in developing markets like India where the rapid urbanization and economic growth forecast healthy real estate opportunities.

What Are the Different Types of Investment Properties?

The types of investment properties in real estate can vary significantly, from commercial spaces in the big cities to peaceful residential villas. When basics of real estate investment, elaborate types of investment in properties are:

Residential Real Estate Investing

This involves properties like houses, apartments, and townhouses where individuals or families live.

Commercial Property Investment

A focus on properties used for business purposes, including offices, malls, and hotels.

Vacation Rentals

These are properties rented out on a short-term basis to tourists or travelers. They can be houses, condos, or even rooms within a property. Vacation rentals can generate high rental income during peak seasons but may also come with higher maintenance and management costs.

Mixed-Use Properties

These properties combine residential and commercial spaces within the same building or complex. For example, a building might have retail shops on the ground floor and residential units above.

Real estate investment trusts REITs

REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investors can buy shares in publicly traded REITs, providing exposure to real estate without directly owning properties.

Raw Land

Investing in undeveloped land involves purchasing land with the expectation of appreciation over time or future development potential. Raw land investments can be speculative and require patience as they may take time to generate real estate investment returns.

Real Estate Crowdfunding

Investors pool their money together to invest in real estate projects through online platforms. Crowdfunding offers access to real estate investments with lower capital requirements and allows investors to diversify across different properties and locations.

Real Estate Syndications

Syndications involve pooling funds from multiple investors to purchase larger properties or projects. One or more sponsors manage the investment and typically take a share of the profits.

Triple Net Lease Properties

In these arrangements, tenants are responsible for property expenses such as taxes, insurance, and maintenance, in addition to rent. Triple net leases can provide a steady income stream with minimal landlord responsibilities.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”What Are the Benefits of Investing in Real Estate?”.

Basics of Real Estate Investment in Location Analysis

The mantra ‘location, location, location’ holds paramount importance in real estate investing. A prime location not only ensures appreciation but also attracts high rental demand. Areas like Chennai, with their robust infrastructure and economic growth, stand out as prime locations for real estate investments in India.

What Are the Primary Real Estate Investment Strategies?

- Buy and Hold

A long-term strategy focused on capital appreciation.

- Fix and Flip

Involves purchasing undervalued properties, renovating them, and selling at a profit.

- Wholesaling

Acting as a middleman and selling a property contract to another investor before the deal closes.

What Are the Financing Options for Real Estate Investment

Real estate investment financing varies from traditional bank loans to more sophisticated methods like private funding and crowdfunding. Understanding the Basics of Real Estate Investment financing is crucial for both beginners and seasoned investors.

- Home Loans:

Offered by banks, these loans help investors purchase residential properties with repayment over a specified period.

- Loan Against Property (LAP):

Utilizes existing property as collateral for obtaining funds, often with lower interest rates compared to personal loans.

- Real Estate Crowdfunding Platforms:

Online platforms enabling investors to pool funds for diverse real estate projects, offering varying risk profiles and investment amounts.

- Real Estate Funds (REITs, REMFs):

Provide opportunities to invest in diversified real estate assets, with REITs trading on stock exchanges and REMFs functioning as mutual funds.

- Non-Banking Financial Companies (NBFCs):

Offer alternative financing options, including loans for property acquisition, construction, and project funding, often with flexible eligibility criteria.

- Private Lenders and Investors:

Provide financing options such as hard money loans or joint ventures, offering flexibility but typically with higher interest rates and fees.

- Government-Sponsored Schemes:

Initiatives promoting affordable housing and real estate development through subsidies, tax benefits, and low-interest loans.

- Self-Funding and Equity Investment:

Utilizes personal savings or equity from existing properties to finance investments, offering control but requiring sufficient capital.

- Construction Finance:

Provides funding for developers to construct or develop real estate projects, structured as term loans or project finance.

- Government Housing Finance Schemes:

Offer subsidies, interest rate concessions, or credit-linked subsidies to facilitate homeownership and affordable housing development.

What Are the Advantages and Disadvantages of Real Estate Investing?

Advantages:

- Stable Income Stream: Rental income can provide a steady cash flow.

- Appreciation: Over time, real estate value generally increases.

- Tax Benefits: Real estate investors can avail of various tax advantages.

Disadvantages:

- Liquidity: Real estate is not as easily liquidated as stocks or bonds.

- Maintenance Costs: Property upkeep can be financially and physically taxing.

- Market Volatility: Real estate market trends can fluctuate due to various external factors.

What Is Due Diligence in Real Estate Investment?

Imagine you’re considering buying a house or an apartment. Before you go through with the purchase, you’d want to make sure it’s a smart investment, right? In that way, due diligence is all about doing thorough research and constant checks to make the best decision.

You’d look at things like the financial side – how much money can you make from renting it out or selling it later? Then there’s the physical condition – you’d want to inspect the property to make sure there are no hidden problems or repairs needed.

What Are the Risk Factors of Real Estate Investment?

Risks in the basics of real estate investment range from unexpected maintenance costs and property damage to fluctuations in the real estate market trends. Investors must be prepared to navigate these challenges effectively.

Real Estate Investment Risks Mitigation

Mitigating risks involves thorough market research, diversification across different real estate opportunities, and maintaining a buffer for unplanned expenses.

What Is Market Research in Real Estate?

Market research in real estate involves studying local property trends, prices, amenities, demographics, and competition to understand the market conditions and make informed decisions.

Also Read: How To Invest in Real Estate: 5 Ways to Get Started

Future Trends in Real Estate Investment

The Indian real estate sector is evolving due to the growing middle class. Key trends include a rise in low-density housing demand, technological integration, increased preference for homeownership post-pandemic, a focus on luxury housing, Tier 2 cities emerging as strong players, and a renewed focus on affordable housing.

What Is the Difference Between Real Estate Investment and Real Estate Development?

While real estate investment focuses on acquiring and managing properties for income and appreciation, real estate development involves the actual construction or renovation of properties.

Vijay Shanthi Builders, recognized among the top real estate builders in Chennai, presents premier residential options for purchasing flats in Chennai. Renowned for their best apartments in Chennai, they offer an excellent choice for potential homebuyers aiming to improve your real estate investment into a memorable experience.

FAQs:

An investment property is purchased with the intent of generating income or profit, whereas a primary residence is where the owner personally lives.

Online real estate investing platforms allow investors to buy shares in commercial or residential properties, enabling access to real estate markets without physically owning properties.

Real estate investing offers the potential for significant financial rewards, passive income, and portfolio diversification.

Real estate investment analysis is evaluating a property’s potential to generate income, considering factors like location, market trends, and property condition.

Yes, investors can diversify their portfolio by investing in international real estate markets, though it requires understanding of the local market dynamics and regulations.

Real estate can provide a steady income stream and capital appreciation, making it an attractive investment option for retirement.

Networking in real estate involves building relationships with other industry professionals, which can open up new opportunities and provide valuable insights.

Co-investment in real estate involves partnering with other investors to pool resources and share the risks and rewards of a property investment.

Despite the challenges associated with real estate investment, the Basics of Real Estate Investment underscore the potential for significant financial rewards. By understanding the market dynamics, employing strategic planning, and staying informed about global trends, investors can navigate the complexities of real estate investment and build a robust portfolio that stands the test of time.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market