7 Tips for 1st Time Homebuyers in Manapakkam

When delving into the world of real estate in Manapakkam, prospective homebuyers often embark on an exciting yet daunting journey rather examining tips for 1st time home buyers. For homebuyers, navigating this landscape can be both exhilarating and challenging. To ensure a smooth and informed home buying process in Manapakkam, it’s crucial to consider various factors and tips for 1st time home buyers. One of the primary aspects is comprehending your budgetary constraints, a fundamental step in this endeavor.

Understanding Your Budget | tips for 1st time home buyers

When venturing on your home buying journey, the 1st tip for 1st time home buyers is to comprehend your budget is the initial step. Assess your finances thoroughly to determine a realistic budget. This understanding will help you narrow down your choices among the diverse options of 1 BHK apartments in Manapakkam, Chennai. It is a basic aspect of the home buying process in Manapakkam

Researching the Manapakkam Neighborhoods

Tips for 1st time home buyers in Manapakkam, scrutinizing the neighborhoods is pivotal. Research thoroughly to find the one that aligns with your lifestyle and preferences. Here are key aspects:

- Availability of healthcare facilities.

- Accessibility to supermarkets and local markets.

- Connectivity to major roads and public transport.

- Safety and security measures in the locality.

- Reputation of schools or educational institutions in the area.

As you explore 1 BHK apartments in Manapakkam or other housing options, these considerations play a vital role in making an informed decision about your future residence

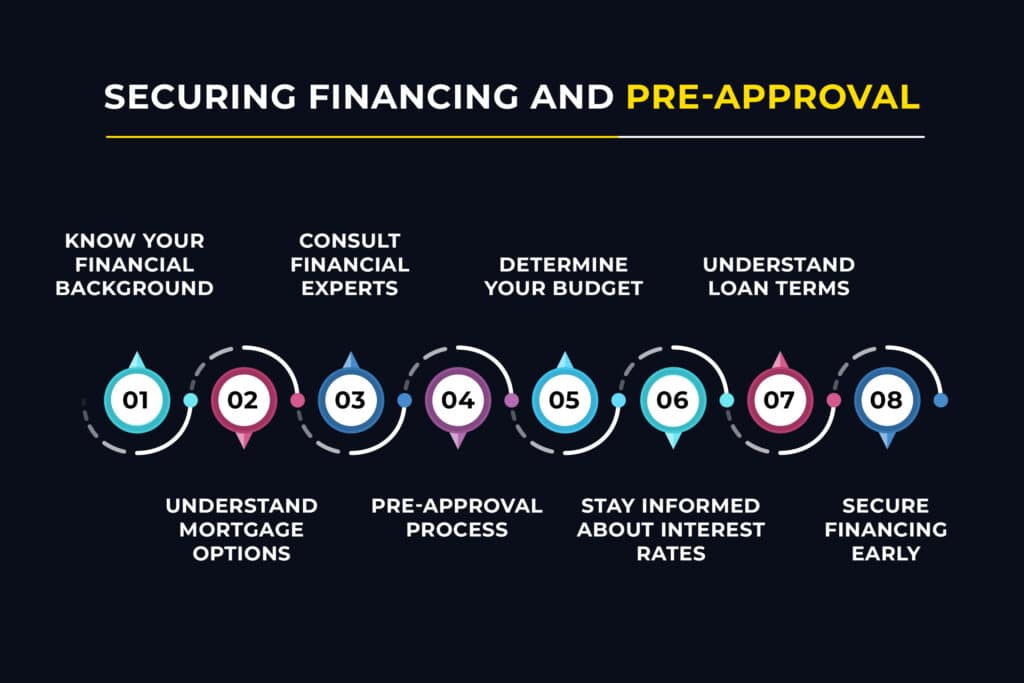

Securing Financing and Pre-approval | Tips for 1st Time Home Buyers

To turn your homeownership dream into reality, secure financing and obtain pre-approval. This step or tip for 1st time home buyers is crucial in determining your budget and streamlining the buying process. Explore Mortgage options in Manapakkam if you are ready to move flats in Manapakkam and consult experts for advice on the best route to take.

Know Your Financial Background:

Assess your credit score and financial stability.

Understand your debt-to-income ratio for a realistic overview.

Understand Mortgage Options:

Research various mortgage types available in Manapakkam.

Consider fixed-rate and adjustable-rate mortgages based on your preferences.

Consult Financial Experts:

Seek advice for first time home buyers from financial advisors or mortgage brokers.

Gain insights into the best financing options tailored to your situation.

Pre-Approval Process:

Initiate the pre-approval process with chosen lenders.

Provide necessary documentation, including income and credit history.

Determine Your Budget:

Use pre-approval to determine a realistic budget for your home purchase.

Factor in potential interest rates and monthly mortgage payments.

Stay Informed About Interest Rates:

Keep abreast of current interest rates in Manapakkam.

Lock in favorable rates when they align with your financial goals.

Understand Loan Terms:

Thoroughly comprehend the terms and conditions of the loan.

Clarify any doubts regarding repayment schedules and penalties.

Secure Financing Early:

Start the financing process early in your home buying journey.

Ensure a smooth and timely transaction when you find your ideal home.

If you are curious about learning more about Real Estate, please take a moment to read this blog. – ‘’How to Invest in Real Estate in Manapakkam: A Beginner’s Guide’’.

Inspecting Homes Thoroughly

Don’t overlook the significance of home inspections. Prioritizing a meticulous examination of potential homes is one of the tips for 1st time home buyers. Consider aspects like structural integrity, necessary repairs, and overall condition. This diligence ensures you make a sound investment.

Building Value:

Examine the foundation, walls, and roof for any signs of damage.

Look for cracks, uneven surfaces, or drooping that may indicate structural issues.

Plumbing and Electrical Systems:

Check plumbing for leaks, water pressure, and drainage issues.

Evaluate the electrical system, ensuring it meets safety standards and can handle your needs.

Appliances and Fixtures:

Test appliances to ensure they are in working order.

Inspect fixtures such as faucets and lighting for functionality and potential replacements.

Heating, Ventilation, and Air Conditioning (HVAC):

Verify the condition of the HVAC system.

Change filters and assess the efficiency of heating and cooling units.

Windows and Doors:

Inspect windows for proper sealing and functionality.

Check doors for secure locks, smooth operation, and weatherstripping.

Mold and Pest Inspection:

Look for signs of mold, especially in damp areas like basements and bathrooms.

Conduct a pest inspection to identify and address any infestations.

Roof Condition:

Assess the roof for missing or damaged shingles.

Check for signs of leaks, water stains, or rot in the attic.

Environmental Factors:

Consider environmental factors like noise levels and air quality.

Evaluate the surroundings for potential hazards or nuisances.

Future Renovation Potential:

Assess the potential for future renovations or expansions.

Consider whether the layout and structure allow for your long-term plans.

Documentation Review:

Request and review documentation related to past inspections and repairs.

Ensure all necessary permits are in place for any modifications.

Considering Future Resale Value

Considering future resale value is one of the main tips for 1st time home buyers and its crucial when buying a home in Manapakkam, Chennai. Statistical data reveals that property taxes in the area range from 0.5% to 2% of the property’s assessed value. Interest rates for mortgages vary, averaging around 7.5% to 8.5%. First-time homebuyer tips Manapakkam emphasize saving at least 20% for a down payment to secure better rates.

Don’t skip the home inspection, it’s your secret weapon for uncovering potential deal-breakers before you seal the deal. Manapakkam’s property market trends indicate a steady rise, with a 7% annual appreciation rate.

Affordable 2 bhk apartments in manapakkam hold appeal, with new flats in manapakkam chennai offering modern amenities. Grasping how to buy a home and sifting through mortgage choices can really set you up for making bank when it’s time to sell.

Navigating Legal and Documentation Processes

Tips for 1st-time home buyers in Manapakkam when navigating legal and documentation processes for apartments in Manapakkam:

- Understand the Documentation:

Begin by comprehending the necessary paperwork involved in purchasing apartments in Manapakkam, including agreements, property records, and NOC (No Objection Certificate) from authorities.

2. Seek Legal Assistance:

Engage a reputable real estate lawyer or advisor experienced in Manapakkam property market trends and laws to guide you through the legal aspects and ensure compliance with regulations.

3. Verify Property Titles:

Conduct a thorough check on property titles, confirming their authenticity and ensuring the absence of any legal disputes or encumbrances.

4. Check for Approvals:

Confirm that the property has received clearances and approvals from local authorities and complies with building regulations and environmental norms.

5. Stamp Duty and Registration:

Understand the stamp duty and registration fees applicable to apartments in Manapakkam to avoid any discrepancies during the registration process.

6. Review Contracts Carefully:

Scrutinize all contracts and agreements related to the property transaction meticulously, seeking clarification on any ambiguities before signing.

Exploring Government Housing Schemes and Incentives

Explore government housing schemes and incentives available for first-time homebuyers in Manapakkam.

Pradhan Mantri Awas Yojana (PMAY): A flagship scheme offering affordable housing for all by 2022, providing financial assistance and subsidies for home construction and purchase.

Credit Linked Subsidy Scheme (CLSS): Under PMAY, it offers interest subsidies on home loans for individuals from various income groups, making homeownership more affordable.

Rajiv Awas Yojana (RAY): Aims to provide housing to slum dwellers and the urban poor by encouraging affordable housing projects and infrastructure development.

Affordable Housing Fund (AHF): An initiative by the National Housing Bank to support housing finance companies for lending to economically weaker sections for affordable housing.

Interest Subvention Scheme for Urban Poor (ISSUP): Offers interest subsidies on housing loans for the urban poor, reducing the cost of borrowing and promoting homeownership

Are You a First-Time Homebuyer in Manapakkam? Contact Vijay Shanthi Builders

Vijay Shanthi Builders, with a reputation and best builders in manapakkam, are here to guide you through the process. Their expertise in Affordable homes in Manapakkam makes the first-time homebuyer to buy flats in manapakkam which aligns perfectly with their needs.

FAQs:

What Types of Properties Are Commonly Available in Manapakkam?

Explore a variety of properties, including 1 BHK and 2 BHK apartment for sale in manapakkam.

What Are the Current Property Values in Manapakkam?

Stay updated on the dynamic property market trends to make informed decisions about your investment.

What Types of Properties Are Popular Among First-Time Buyers in Manapakkam?

First-time buyers often find 1 BHK apartments and affordable homes appealing in Manapakkam.

Can I Negotiate the Price When Buying Property in Manapakkam?

Yes, negotiating the price is common practice. Consult with your real estate agent for effective negotiation strategies.

How Can I Estimate Property Taxes for My First Home?

Calculate property taxes accurately by considering the property’s value and local tax rates. Consult with financial experts for precise estimations.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

What Is The RERA Registration Process And How To Start?

What Is The RERA Registration Process And How To Start? A Foundation Built on TrustIn

7 Benefits Of Installing Glass Windows For Home

Introduction – A View That Speaks of You In a well-crafted home, even the simplest

5 Vastu Tips for a Peaceful Home Environment

Introduction Your home is more than just walls and furniture — it’s a space that