What is the Procedure to Register A Property For A Pre Owned House?

If you’re on the exciting journey of buying a pre-owned house, you may find the registration process a bit daunting. The process involves various steps, legalities, and paperwork. We shall look into the entire procedure and cover everything from the initial check to the possession on your new home.

From Paperwork to Possession: The Step-by-Step Process of Registering a Pre-Owned House

Acquiring a pre-owned house is a significant step in your real estate journey. We shall breakdown the registration process step by step

Step 1: Initial Checks and Verification

Before diving into the registration process, it’s crucial to verify the property’s ownership and legal standing. Begin by confirming the property’s status using your Aadhar card. This ensures that the property you intend to buy is free from any legal disputes or encumbrances.

Step 2: Registering the Property

Once you’ve confirmed the property’s status, the next step is to initiate the registration process. Visit your local property registration office, equipped with all the necessary documents, including property deeds and identification proofs. This step involves the legal transfer of ownership from the seller to you.

Step 3: Understanding Land Registration

Property registration often involves land registration. This is significant because it proves that you are the rightful owner of the property on which your home is located. You would have to pay for land taxes and complete the documentation.

Step 4: House Registration

Separate from land registration, house registration pertains specifically to the property structure itself. It involves the transfer of ownership of the house, ensuring it is legally yours.

Step 5: Property Ownership and PAN Card

Curious about how many properties are linked to your PAN card? It’s important to understand the implications of property ownership on your financial matters. Ensure that your PAN card accurately reflects your property ownership status.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog. – ‘’What is the Basics of Real Estate Investment? | A Detailed Explanation’’.

How do I verify the status of my property with an Aadhar card?

Your Aadhar card can be a valuable tool for property verification. By linking your Aadhar card to the property, you can check its legal status and ownership. This step is vital in ensuring a hassle-free property acquisition process.

How do I register a home and land in my name?

Registering a home and land in your name involves visiting the property registration office and completing the necessary documentation. This is the legal process that ensures the property is rightfully yours.

How can I find out how many properties are on my PAN card?

Your PAN card holds critical information about your financial matters, including property ownership. To find out how many properties are linked to your PAN card, you can approach the relevant authorities or check the official website for property-related information.

What are the new rules for property registration in India 2023?

As of 2023, India has introduced new rules and regulations for property registration.

Within four months after the registration date, the required documents must be submitted. In 2023, copies of the paperwork are available the same day because of computerization. A piece of property cannot be used as legitimate evidence in court if it is not registered. Property that is not registered is invalid legally. If the property is not registered, no compensation will be granted in the event that the government purchases it.

Technology advancements have made it feasible to obtain copies of all significant documents the same day as registration. Long wait periods are practically eliminated as a result of this.

In an income tax return, any property that the government acquires but is not registered cannot be claimed as compensation. This describes how important it is to register your property to safeguard your rights and interests

It is crucial to understand that unregistered properties have no legal value and cannot be presented as evidence in court. This shows how important it is to confirm that your property is registered and that you have all the required documents in place.

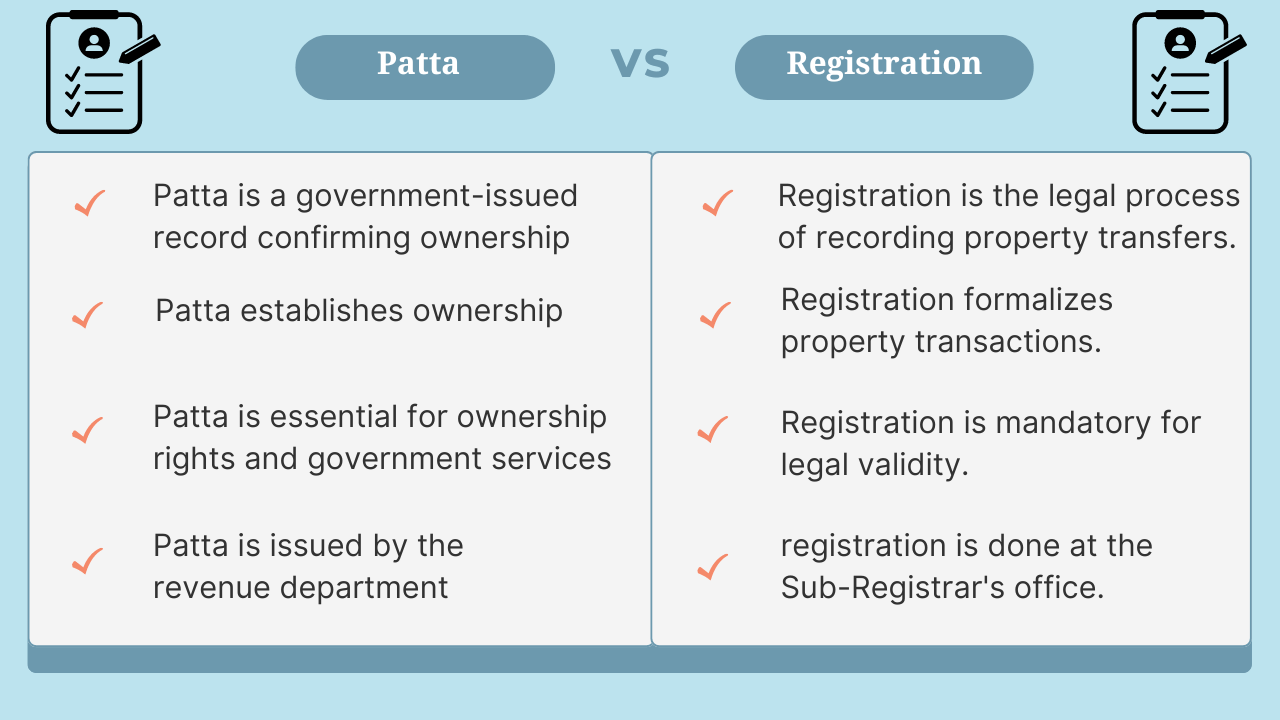

What is the difference between patta and registration?

Understanding the distinction between ”patta” and “registration” is essential. Patta refers to the revenue record of the land, which proves your ownership, while registration is the legal process of recording property transactions. Both elements are crucial in establishing your property’s legality.

In conclusion, the journey from considering a pre-owned house to taking possession involves multiple essential steps. Ensuring a smooth registration process begins with initial checks and verification and continues with legal procedures such as land and house registration. Understanding the implications of property ownership on your PAN card and staying updated with the latest rules in India are equally vital. Lastly, knowing the difference between patta and registration is crucial to comprehending the legal aspects of your property.

Also Read: What You Need to Know about Deeds and Property Transfer

When you are buying a pre-owned house, it is necessary to understand all the details in regards to your property registration so that you can have a smooth and secure transaction. Even if the process may seem quite difficult, it would be easier if you break it down to simple steps. So, whether you’re considering a pre-owned house, looking to understand your property’s status with an Aadhar card, or simply curious about the rules for property registration in 2023, this guide has you covered. Happy house hunting!

Vijay Shanthi Builders, with a reputation as the best builders in Chennai, are here to guide and assist you through the home-buying process.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Beware of the Red Flags for home buyers – Top 10 Insights

When embarking on the journey to purchase a home, armed with excitement and dreams,

Must Read – About Encumbrance Certificate in Property Buying

In the network of property transactions, one document stands tall as a beacon of

How to Improve Your Credit Score Before Applying for a Home Loan?

How to Improve Your Credit Score Before Applying for a Home Loan? Are you looking