Important Details About TDS on Property Buying

The process of buying a property involves several key steps that require in-depth understanding. One such major aspect is knowing about Tax Deducted at Source or TDS on property buying. With the best builders in Chennai offering luxury apartments, understanding the TDS can be quite beneficial for both buyers and sellers in the Chennai real estate market.

Tds on Property Buying -Explained

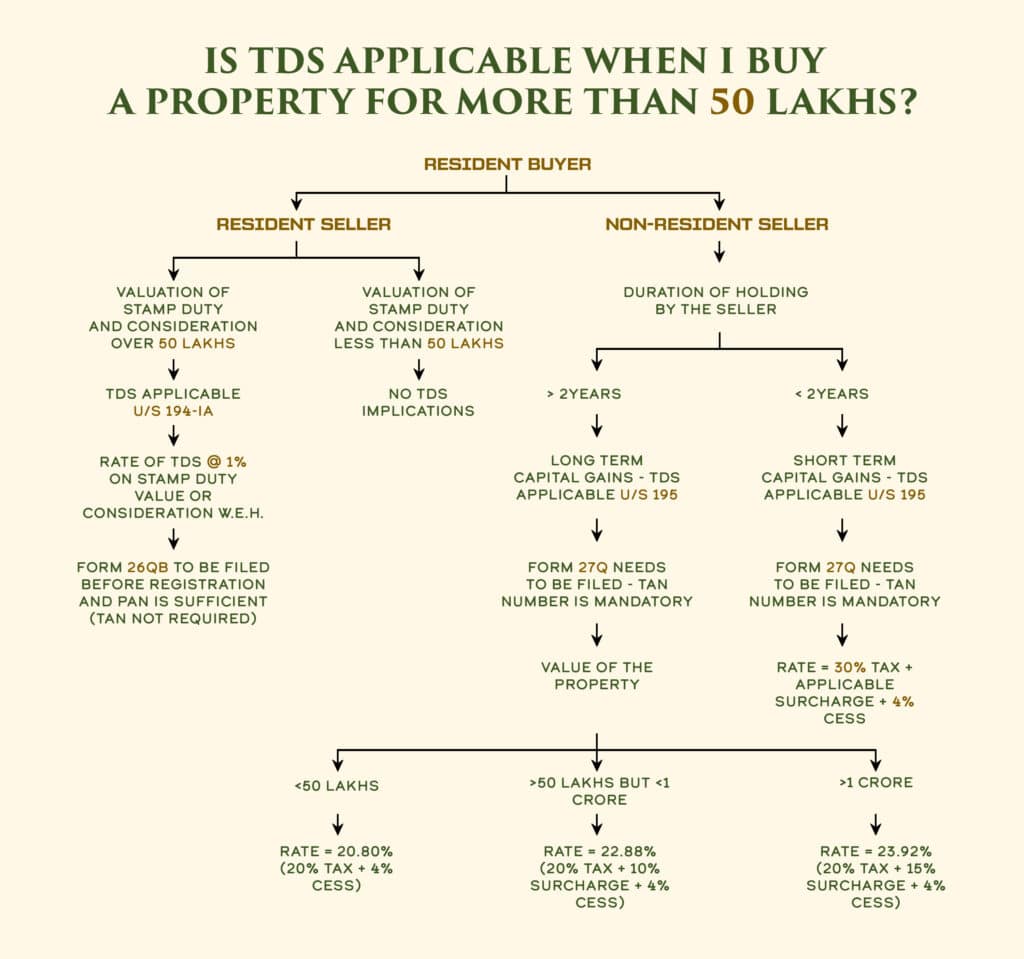

Any Property transaction income tax involving an amount exceeding INR 50 Lakh requires deduction of TDS on Property Buying, per the country’s Income Tax Act, 1961(This rule is applicable across India, but since the blog emphasizes Chennai, we’re using the best builders in Chennai as the backdrop). When you buy 2 bhk apartments in Chennai from any of the top residential builders, a portion of your payment is deducted towards TDS. The buyer must then deposit this amount with the government.

Is Tds Applicable When I Buy a Property for More Than 50 Lakhs?

Definitely, yes. Whether you’re buying from builders and developers in Chennai or a standalone owner, if the property cost exceeds 50 Lakhs, TDS on Property Buying is applicable. This rule applies to residential, commercial, and other forms of real estate transactions, thereby affecting a vast majority of real estate builders in Chennai.

How Much Should I Pay as Tds On Property Buying?

The amount you need to pay as (Tax Deducted at Source) TDS on Property Buying is calculated based on the transaction value and the applicable TDS rate. The TDS on property above 50 lakhs is 1%. Here’s how you can calculate it:

Calculation of TDS on Property Buying:

1. Determine Transaction Value:

Identify the total value of the property transaction.

2. Check if Exceeds 50 Lakhs:

If the property transaction value is more than 50 lakhs, TDS is applicable.

3. Calculate TDS Amount:

Multiply the transaction value by the applicable TDS rate (1%).

TDS Amount =Transaction Value * TDS Rate (1%)

Example:

If the Property transaction tax value is 60 lakhs, the TDS amount would be 60,000 (60 lakhs * 1%).

Payment Process:

Prepare TDS Challan:

Generate a TDS challan with accurate details for the payment of TDS.

Payment of TDS:

Pay the calculated TDS amount using the generated challan.

Additional Considerations:

- Ensure compliance with Section 194IA of the Income Tax Act.

- Obtain a TDS certificate (Form 16B) from the seller as proof of Tax deduction on property sale.

Note: Tax laws are subject to change, and it’s advisable to consult with a tax professional or refer to the latest guidelines to ensure compliance with the most current regulations.

If you are curious about learning more about Buying a Property, please take a moment to read this blog – ”Property Registration: The Key to Unlocking Your Home’s Potential”.

Who Is Responsible for Deducting Tds on Property Buying, the Buyer, or the Seller?

In a property transaction, the buyer is responsible for deducting the TDS on Property Buying. Let’s say you’re purchasing apartments for sale in Chennai from any of the notable builders in Chennai. Here, you, as the buyer, would need to deduct the TDS before making the payment to the seller.

Are There Any Exemptions or Conditions Regarding Tds on Property Buying?

Yes, there are specific exemptions when it comes to TDS on property buying. The rule does not apply if the property’s total value is less than 50 Lakhs. Moreover, if the seller is an NRI, different Property buying tax rules apply under Section 195 of the Income-tax Act, further affecting real estate in Chennai transactions.

What Is the Procedure for Tds Deduction and Submission in Property Transactions?

Enough to say, as a stakeholder in the Chennai real estate market, you begin by deducting the TDS from the property’s total amount. Following this, you need to deposit the deducted amount with the government through Challan 26QB, an online form available on the Income Tax department’s website. After making the payment, you should provide the seller with Form 16B, which serves as the TDS certificate.

What Happens if I Forget or Neglect Tds Compliance in My Property Purchase?

Non-compliance with TDS rules can attract penalties, including a heavy fine and interest on the pending amount. Therefore, Tax rules for property buyers should be followed whether you’re a buyer exploring 2 bhk apartments in Chennai or a seller, it’s very essential to ensure TDS compliance in all property transactions.

How Can Buyers and Sellers Navigate Tds Compliance Efficiently in Property Deals?

Is there TDS for real estate buyers? Stakeholders in the Chennai real estate market, including top residential builders in Chennai, can manage TDS on Property Buying compliance by staying informed about the rules and Home buying tax regulations, using professional help from real estate agents or chartered accountants, and lastly, by maintaining meticulous documentation.

Understood About Tds on Property Buying? Buy Your Property With Us!

Grasping the nuances of TDS on property buying is undeniably beneficial, reducing potential legal woes and financial hiccups in your real estate journey. Armed with this knowledge, you’re now ready to explore the vibrant Chennai real estate market, brimful with opportunities and offerings from the best builders in Chennai. No matter whether you’re looking to invest in luxury apartments in chennai or affordable 2 bhk apartments in Chennai, ensuring TDS compliance is the stepping stone towards a secure property buying experience.

As a prospective property buyer in the vibrant Chennai real estate landscape, understanding TDS on property buying can make your real estate journey smoother and financially sound.

At Vijay Shanthi Builders, we’re here to make your property buying journey easy and enjoyable. Our team is dedicated to guiding you at every step, ensuring a smooth and rewarding experience. Trust us to help you find your dream home hassle-free!

FAQs:

The buyer will deduct the TDS when purchasing goods.

Yes, TDS on property purchase must be deducted on advance payments pertaining to a property transaction.

TDS is applicable on any transaction where the property’s value exceeds 50 Lakhs.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

What Is The RERA Registration Process And How To Start?

What Is The RERA Registration Process And How To Start? A Foundation Built on TrustIn

7 Benefits Of Installing Glass Windows For Home

Introduction – A View That Speaks of You In a well-crafted home, even the simplest

5 Vastu Tips for a Peaceful Home Environment

Introduction Your home is more than just walls and furniture — it’s a space that