The Ultimate Guide to Property Taxes in Vellore

Understanding property taxes in Vellore is crucial for homeowners and potential buyers. This guide will provide you with essential information about property tax rates, payment methods, exemptions, and strategies for managing your tax obligations. Here’s everything you need to know about property taxes in Vellore.

Complete Breakdown of Property Taxes in Vellore

Property taxes in Vellore are levied by the Vellore Municipal Corporation and are calculated based on the Annual Rental Value (ARV) of the property. The formula used is:

Annual Rental Value=(Area×Zone Rate×Factor Indicator×Building Usage Rate)×12

For example, if you own a residential property with an area of 1,000 sq. ft. located in a zone with a rate of ₹10 per sq. ft., the calculation would be:

ARV=(1000 sq ft ×10)×12=₹120,000

This amount is then subject to local tax rates which can vary based on property type and location. As of 2024, Vellore property tax rates typically range from 0.1% to 2% of the property’s registered value.

How to Pay Property Taxes in Vellore

Paying your property taxes in Vellore can be done conveniently online or offline. To pay online:

- Visit the official Vellore Corporation website.

- Click on the ‘Epay’ link.

- Select ‘Property Tax’ and enter your assessment number.

- Follow the prompts to complete your payment.

For offline payments, you can visit the municipal corporation office with your property tax invoice and identity proof.

The last date to pay without penalties is April 30, so it’s important to stay aware of property tax due dates in Vellore to avoid late fees.

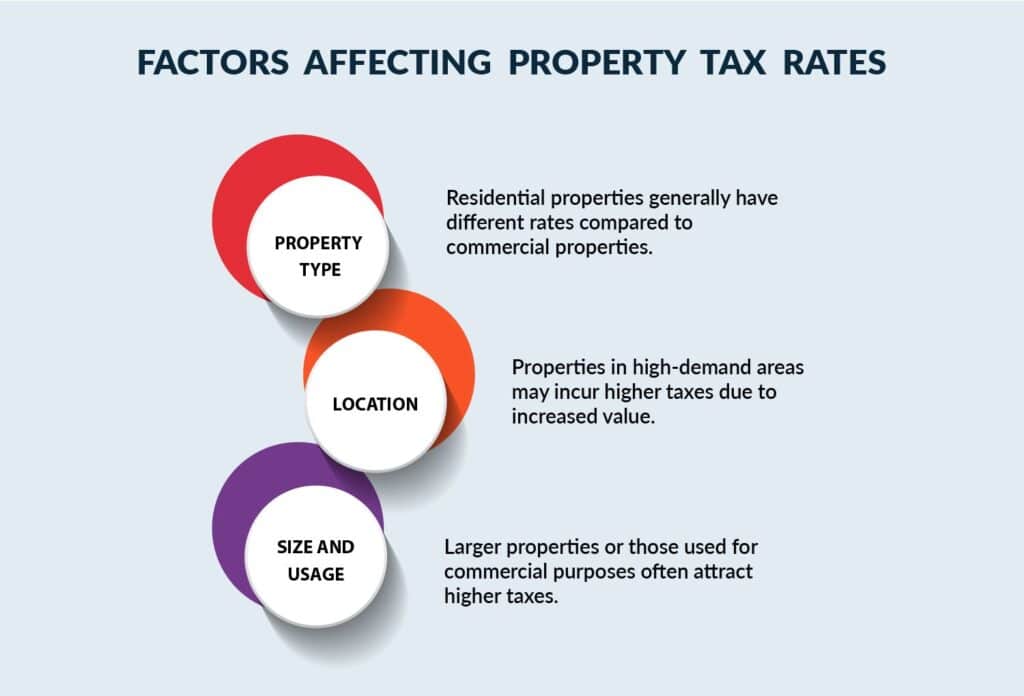

Factors Affecting Property Tax Rates

Several factors influence Vellore property tax rates, including:

- Property Type

Residential properties generally have different rates compared to commercial properties.

- Location

Properties in high-demand areas may incur higher taxes due to increased value.

- Size and Usage

Larger properties or those used for commercial purposes often attract higher taxes.

For instance, a newly built flat in a prime area like Anna Nagar might face higher tax rates compared to older properties in less sought-after locations.

Also Read: What Are the Tax Implications in Real Estate Investing?

Property Tax Benefits

Homeowners can benefit from various deductions and rebates on their property taxes. For example, paying your property tax before the due date can earn you a 5% rebate on the total amount payable. Additionally, certain categories of properties may qualify for exemptions based on usage or ownership status.

Understanding these benefits can significantly reduce your overall tax burden as a homeowner.

If you are curious about learning more about Buying a Property, please take a moment to read this blog – ‘’Important Details About TDS on Property Buying’’

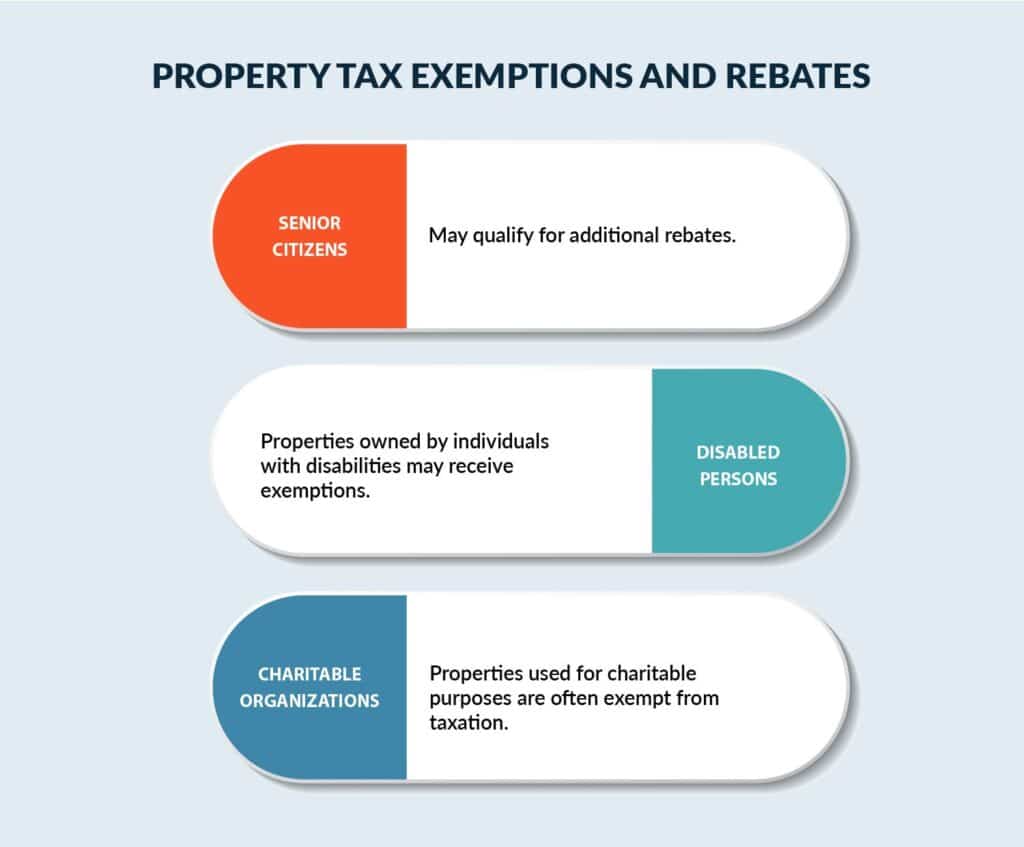

Property Tax Exemptions and Rebates

In Vellore, there are specific exemptions available for certain categories of property owners:

- Senior Citizens

May qualify for additional rebates.

- Disabled Persons

Properties owned by individuals with disabilities may receive exemptions.

- Charitable Organizations

Properties used for charitable purposes are often exempt from taxation.

It’s advisable to check with the local municipal office regarding eligibility for these exemptions and how they apply to your specific situation.

Tips for Managing Costs

Managing your property taxes in Vellore effectively can help you save money:

- Stay Informed

Regularly check for updates on tax rates and regulations.

- Plan Payments

Budget for property taxes as part of your annual expenses.

- Utilize Online Tools

Use online calculators provided by the municipal corporation to estimate your taxes accurately.

- Consult Professionals

Seeking legal advice for complex situations can save you money in the long run.

By staying proactive about your property tax obligations, you can avoid surprises and manage costs more efficiently.

Key Takeaways

- Understand how property taxes in Vellore are calculated using ARV.

- Utilize online platforms for convenient payment options.

- Be aware of factors that influence property tax rates.

- Take advantage of available exemptions and rebates.

- Plan ahead to manage costs effectively and avoid penalties.

In conclusion, understanding property taxes in Vellore is essential for homeowners and potential buyers alike. Vijay Shanthi Builders offers valuable insights into navigating these financial obligations while providing quality apartments in Vellore that meet various needs. As one of the best builders in Vellore, they ensure that homebuyers are well-informed about all aspects of real estate transactions, including important considerations like property taxes!

Whether you’re looking at new developments or established residential apartments in Vellore, Vijay Shanthi Builders is here to guide you every step of the way!

FAQS:

The rates typically range from 0.1% to 2% of the property’s registered value, depending on its type and location.

You can pay online through the official Vellore Corporation website by entering your assessment number.

Yes, paying before April 30 qualifies you for a 5% rebate on the total amount payable.

Late payments incur penalties which increase your overall bill; it’s best to pay on time to avoid these charges.

You can check your bill online by visiting the official municipal website and entering your assessment details.

Property tax assessments are typically reviewed annually based on changes in property value or local regulations.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Evaluating Resale Value and Property Appreciation in Vellore

Understanding the Resale Value and Property Appreciation of real estate is vital for anyone

Pros & Cons of Buying Ready-To-Move vs.Under-Construction Properties in Vellore

When considering a property investment in Vellore, potential buyers often face the dilemma of

Understanding Home Loan Eligibility Criteria in Vellore

Understanding the Home Loan Eligibility Criteria in Vellore is crucial for anyone looking to