What Is Passive Real Estate Investing? | Types, Benefits, Pros & Cons

Passive real estate investment, an increasingly popular strategy in the dynamic world of investment, offers a compelling alternative to traditional ventures in the real estate sector, especially in countries like India. The real estate market in India is one of the very few real estate markets to be unagitated by the hikes in interest rates between the year 2022-2023.

Passive real estate investing minimizes the need for active involvement, providing avenues for income generation with reduced time and effort. Exploring its nuances, benefits, and potential pitfalls can help investors navigate this promising avenue more effectively.

What Is Passive Investing?

Passive Real Estate Investing in real estate passively is putting money into properties in order to earn profits without actively managing them on a daily basis. Real estate investment trusts (REITs), real estate crowdfunding, and real estate syndication are just a few of the channels that are covered by this approach.

Types of Passive Real Estate Investment

- REITs (Real Estate Investment Trusts)

REITs allow investors to own shares in professionally managed portfolios of real estate properties. They offer regular income streams and potential capital appreciation without the complexities of direct property ownership, making it the best real estate investment in India.

- Real Estate Crowdfunding

This method entails pooling the money of multiple investors to finance real estate projects. Through certain websites, there are opportunities to invest in a range of properties with relatively low financial requirements.

- Real Estate Syndication

When investors band together, they can buy larger properties or projects that would be beyond of reach for each of them alone. Property management is supervised by a syndicator, and investors split the earnings.

If you are curious about learning more about Real Estate Investment, please take a moment to read this blog – ”10+ Important Things to Know in Real Estate Investment”.

Distinction Between Passive and Active Real Estate Investment

The primary difference between passive real estate investing and active real estate investment is the degree of commitment. Passive investors take a hands-off stance and delegate management duties to experts, while active investors handle property administration, tenant relations, and maintenance. In general, real estate investments in India have the potential for higher returns than other investment options. Capital appreciation on properties in major cities can be up to 10-15% per year.

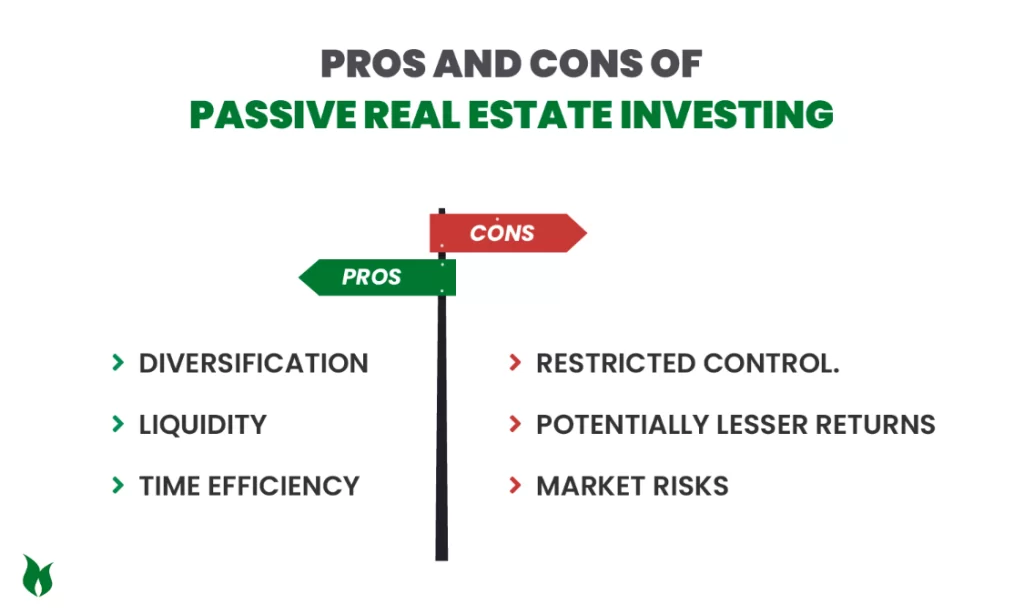

Pros and Cons of Passive Real Estate Investing

Pros:

- Diversification

Investing in passive real estate gives you access to a variety of property portfolios.

- Liquidity

Compared to direct property ownership, real estate investment trusts (REITs) and real estate crowdfunding offer liquidity.

- Time Efficiency

Real estate benefits are available to passive investors without requiring the time investment of active management.

Cons:

- Restricted Control

The decisions made by property management companies are mostly unaffected by passive investors.

- Potentially lesser Returns

When compared to active tactics, passive investments may provide lesser returns.

- Market Risks

The value of investments might be affected by the volatility of real estate markets.

Risks and Challenges of Passive Real Estate Investing

Passive real estate investing has inherent dangers, just like any other type of investment. Investment success can be impacted by interest rate changes, market volatility, and economic downturns. To reduce the danger of fraud or poor management, platforms and syndicators must undergo extensive due diligence.

Factors to Consider in Passive Real Estate Investing

Think about things like your investment horizon, risk tolerance, and financial goals before you start investing in real estate passively. To properly control risks, consider fees, diversify your portfolio, and evaluate the track record of the platform or syndicator.

How to start Investing in Passive Real Estate

Learn about the benefits and hazards of various passive investment alternatives.

- Establish Investment Objectives

Establish your risk tolerance and financial goals before choosing an appropriate investing strategy.

- Select a Platform

Choose reliable syndicators or platforms based on your research and objectives. Spread your investments over a variety of properties or asset types to reduce risk by diversifying.

- Observe and Modify

To maximize your portfolio, check your investments on a regular basis and make any required adjustments.

Tax Advantages of Passive Real Estate Investing

Tax advantages associated with investing in passive real estate include depreciation deductions, capital gains tax deferrals, and the ability to offset passive losses against passive income. To optimize tax efficiency and guarantee adherence to tax regulations, confer with tax consultants.

Passive real estate investing offers a strong chance to diversify your portfolio and generate income. For those seeking, for top real estate developers in India, there are various options as the passive investment in India offers diverse propositions. Vijay Shanthi Builders, being one of the best residential builders in Chennai, helps in exploring real estate options for those who are interested in active or passive real estate investments.

Despite market fluctuations, real estate in India has historically shown resilience, making it an enthralling option for passive investors looking to expand their portfolios and secure dependable returns over time.

FAQS:

Depending on the investment instrument and strategy, different capital requirements apply. Certain platforms provide opportunities that require little initial outlay of funds, while others could demand higher sums.

Investors collect their passive income in the form of returns or dividends from funds. This investing is considered passive because there is no daily management needed and it’s considered indirect because it doesn’t deal with a certain specific piece of real estate.

Investing with Vijay Shanthi Builders can be an ideal choice for beginners looking for passive income without the hassle of active management obligations.

The decision is based on personal preferences, objectives, and available resources. Active investors need time and experience, but they also benefit from control and maybe larger returns. While ease and convenience are advantageous to passive investors, they may forfeit some control and reward.

Passive real estate investing can complement retirement planning by providing passive income and portfolio diversification. Consider risk tolerance and investment horizons when integrating real estate into retirement strategies.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Understanding Vellore’s Real Estate Market

Vellore, a city known for its rich history and cultural heritage, has also emerged

How Do I Educate Myself to Invest in Real Estate?

Investing in real estate can be a lucrative path to financial freedom, but it

Tips to Become Successful in Real Estate Investing (2024)

Becoming successful in real estate investing requires a blend of knowledge, strategy, and market