Understanding Home Loan Eligibility Criteria in Vellore

Understanding the Home Loan Eligibility Criteria in Vellore is crucial for anyone looking to purchase property in this vibrant city. Whether you are eyeing apartments for sale in Vellore or planning to build your dream home, knowing what lenders look for can significantly enhance your chances of securing a loan. This blog outlines the key factors that determine eligibility, along with helpful tips and guidelines.

Are You Planning to Buy a Home in Vellore? Here Are the Home Loan Eligibility Criteria in Vellore

Before applying for a home loan, it’s essential to understand the home loan eligibility criteria in Vellore. Lenders assess various factors to determine if you qualify for a loan. These include your income, credit score, employment status, and the value of the property you wish to purchase. For instance, if you are looking at residential apartments in Vellore, lenders will evaluate your financial stability and repayment capacity based on these criteria.

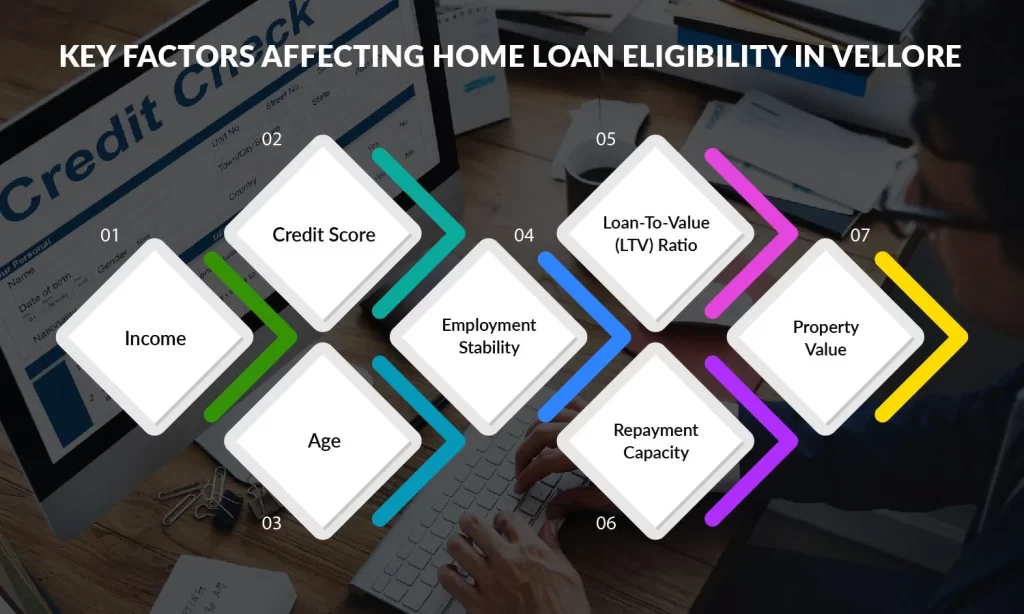

Key Factors Affecting Home Loan Eligibility in Vellore

Several key factors influence your home loan eligibility in Vellore:

- Income

Lenders typically require a minimum salary for home loan applicants. For example, many banks set this threshold at around ₹25,000 per month.

- Credit Score

A credit score of 750 or above is generally favorable. A higher score can lead to better interest rates.

- Age

Most lenders prefer applicants between 21 and 60 years old. Your age impacts how long you can repay the loan.

- Employment Stability

A steady job history can enhance your eligibility. Lenders prefer candidates with at least two years of stable employment.

- Loan-To-Value (LTV) Ratio

This ratio compares the loan amount to the property value. A lower LTV indicates less risk for lenders.

- Repayment Capacity

Your ability to repay the loan is assessed through your debt-to-income ratio.

- Property Value

The market value of the property you wish to buy will also affect your eligibility.

Understanding these factors is vital when navigating the home loan process in Vellore.

Tips for Improving Home Loan Eligibility

Improving your home loan qualifications can significantly increase your chances of approval:

- Enhance Your Credit Score

Pay off outstanding debts and ensure timely payments on existing loans.

- Increase Your Income

Consider additional income sources or promotions that could boost your monthly earnings.

- Save for a Larger Down Payment

A higher down payment reduces the loan amount needed and improves your LTV ratio.

- Maintain Job Stability

Staying with one employer for an extended period can positively impact your application.

- Consider a Co-applicant

Adding a co-applicant can improve your chances if their income and credit score are strong.

These strategies will help you meet the Vellore home loan requirements more effectively.

If you are curious about learning more about Home Loans, please take a moment to read this blog – ‘’5+ Tips to Manage Home Loan Emis During a Financial Crisis’’.

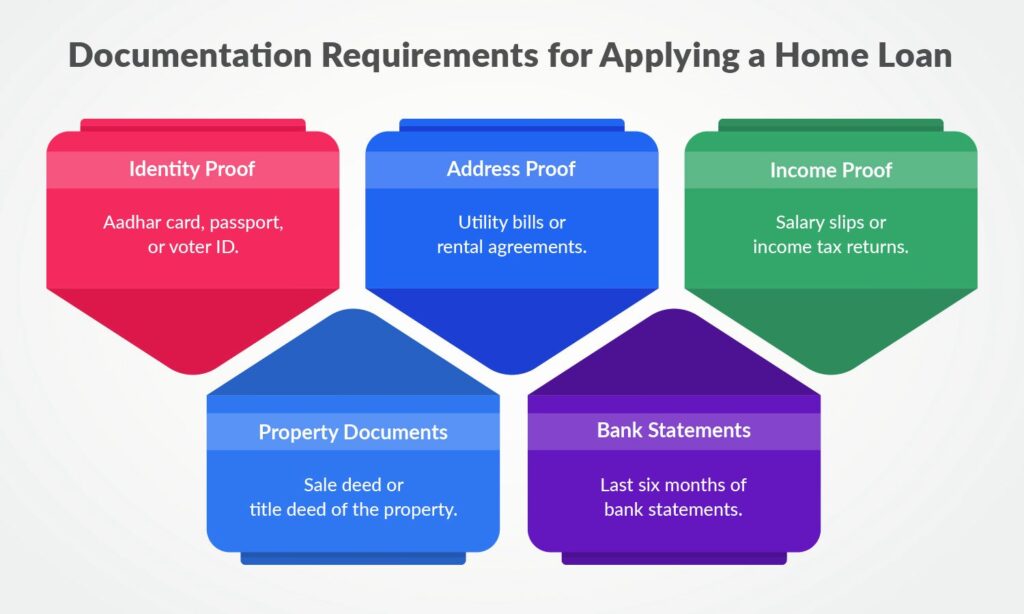

Documentation Requirements

When applying for a home loan, specific documentation is necessary:

- Identity Proof: Aadhar card, passport, or voter ID.

- Address Proof: Utility bills or rental agreements.

- Income Proof: Salary slips or income tax returns.

- Property Documents: Sale deed or title deed of the property.

- Bank Statements: Last six months of bank statements.

Having all required documents ready streamlines the home loan application process and enhances your eligibility.

Interest Rates and Loan Tenure

Interest rates play a significant role in determining your monthly EMI payments. In Vellore, typical home loan interest rates range from 8% to 10%. The tenure of the loan also affects these rates; longer tenures may have lower EMIs but higher total interest paid over time.

Understanding how interest rates work will help you make informed decisions throughout the home loan process in Vellore.

Prepayment and Foreclosure Charges

Many lenders impose charges on prepayment or foreclosure of loans before their tenure ends. It’s essential to understand these fees as they can impact your overall financial planning. For instance, some banks may charge up to 2% on outstanding principal if you decide to pay off your loan early.

Being aware of these charges is vital when considering different lending options as part of the overall home loan eligibility criteria in Vellore.

Choosing the Right Lender

Selecting the right lender can significantly impact your home buying experience. Look for lenders offering competitive interest rates and favorable terms. Compare various options by checking their customer reviews and service quality. Some of the best builders in Vellore often have tie-ups with banks that provide attractive financing options for their properties.

Researching thoroughly will ensure that you choose a lender aligned with your financial goals while meeting all necessary home loan criteria.

Key Takeaways

Understanding the home loan eligibility criteria in Vellore is crucial for prospective homeowners. By focusing on key factors such as income stability, credit scores, and documentation requirements, you can improve your chances of securing a favorable home loan.

In conclusion, when looking at options like apartments for sale in Vellore, partnering with reputable developers like Vijay Shanthi Builders ensures that you’re not only investing wisely but also aligning with builders who understand financing options well and can guide you through every step of acquiring your dream home effectively within all stipulated criteria.

FAQS:

Generally, a minimum monthly income of ₹25,000 is required by most banks.

A higher credit score increases chances of approval and secures better interest rates.

This varies by lender but typically allows financing up to 80% of the property value.

Yes, self-employed individuals can qualify; however, they may need additional documentation like profit-loss statements.

Most lenders prefer applicants aged between 21 and 60 years at application time.

Various schemes like PMAY offer subsidies on interest rates for eligible first-time buyers.

Yes, adding a co-applicant can enhance overall eligibility based on combined income and credit scores.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Evaluating Resale Value and Property Appreciation in Vellore

Understanding the Resale Value and Property Appreciation of real estate is vital for anyone

Pros & Cons of Buying Ready-To-Move vs.Under-Construction Properties in Vellore

When considering a property investment in Vellore, potential buyers often face the dilemma of

8 Financing Options for Homebuyers in Vellore

Owning a home is a significant milestone for many, especially in a vibrant city