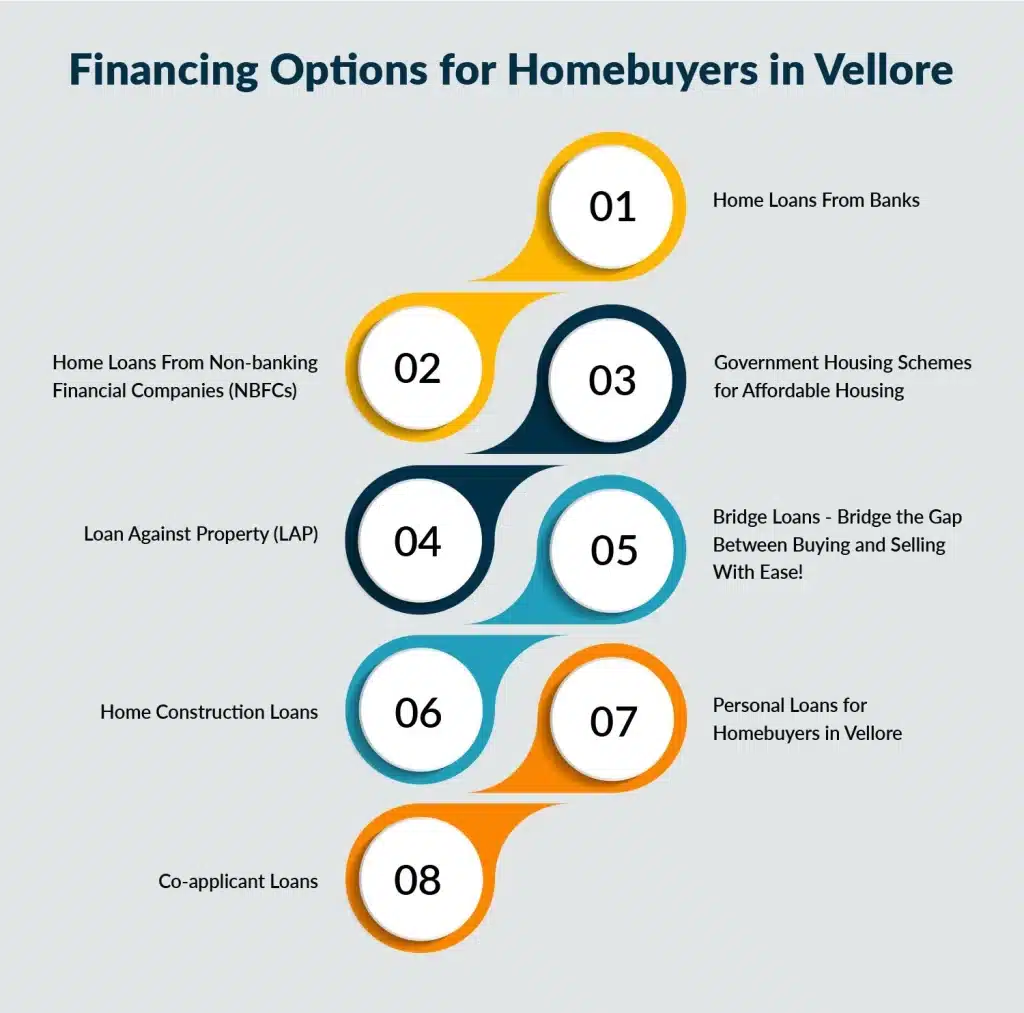

8 Financing Options for Homebuyers in Vellore

Owning a home is a significant milestone for many, especially in a vibrant city like Vellore. However, navigating the financing options for homebuyers can be challenging. With various choices available, understanding these options can help you make better decisions. This blog outlines eight financing options customized for homebuyers in Vellore, ensuring you find the best solution for your needs.

Home Loans From Banks

Banks offer a variety of home loan options that cater to different needs. These loans typically feature competitive mortgage rates and flexible repayment terms. For instance, State Bank of India (SBI) provides loans with interest rates starting as low as 8.5% per annum. If you are a first-time buyer, you may qualify for special schemes that reduce your loan processing fees.

When considering financing options for homebuyers, it is essential to check the home loan eligibility criteria set by banks, which often include a minimum credit score of 750 and proof of stable income. Many people looking for apartments for sale in Vellore often start their journey with bank loans.

Also Read: Top 5 Home Loan Tips for Apartment Buying In 2024

Home Loans From Non-banking Financial Companies (NBFCs)

NBFCs like HDFC and Bajaj Finserv are gaining popularity for their home financing solutions. They often provide faster processing times and more lenient eligibility criteria compared to traditional banks. For example, Bajaj Finserv offers home loans with interest rates starting at 8.6% and allows borrowers to access up to 90% of the property value.

Choosing NBFCs as part of your financing options for homebuyers can be beneficial if you have a lower credit score or need quick access to funds. Many buyers of residential apartments in Vellore find NBFCs to be a convenient option.

Loan Against Property (LAP)

If you already own property, a Loan Against Property (LAP) can be an effective way to finance your new home purchase. This secured loan allows you to borrow against the value of your existing property, often at lower interest rates compared to personal loans.

For instance, if your property is valued at ₹50 lakhs, you could potentially secure a loan up to ₹40 lakhs at an interest rate of around 9%. This makes LAP one of the viable financing options for homebuyers looking to leverage their existing assets.

If you are curious about learning more about Home Loan, please take a moment to read this blog – ‘’5+ Tips to Manage Home Loan Emis During a Financial Crisis’’.

Bridge Loans - Bridge the Gap Between Buying and Selling With Ease!

Bridge loans are short-term financing solutions designed to help buyers purchase a new home before selling their current one. They are particularly useful in competitive markets where timing is crucial. For example, if you find an ideal apartment but haven’t sold your existing one yet, a bridge loan can provide the necessary funds quickly.

These loans typically come with higher interest rates but can be an effective strategy among the available financing options for homebuyers in Vellore.

Home Construction Loans

For those looking to build their dream homes from scratch, home construction loans are tailored specifically for this purpose. These loans disburse funds in stages based on construction milestones, ensuring that you only pay interest on the amount utilized.

In Vellore, many banks offer construction loans with competitive rates starting at around 8.5%. This option allows buyers to customize their homes while managing costs effectively, making it one of the popular financing options for homebuyers.

Personal Loans for Homebuyers in Vellore

Personal loans can also serve as a financing option if you’re short on funds or need additional capital beyond what your home loan covers. These unsecured loans typically have higher interest rates but offer quick access to cash without collateral requirements.

For instance, if you need ₹5 lakhs urgently for renovations or down payments, personal loans from banks like ICICI could be processed within days with minimal documentation. This flexibility makes them attractive among the various financing options for homebuyers looking at various properties including apartments in Vellore.

Also Read: How to improve your credit score before applying for a home loan?

Co-applicant Loans

Co-applicant loans allow multiple borrowers to combine their incomes when applying for a mortgage. This approach can enhance your chances of approval and increase your borrowing capacity. For example, if both partners earn ₹30,000 each per month, they may qualify for a larger loan than if applying individually.

Utilizing co-applicant loans is an effective strategy among the various financing options for homebuyers, especially for young couples starting their journey toward homeownership.

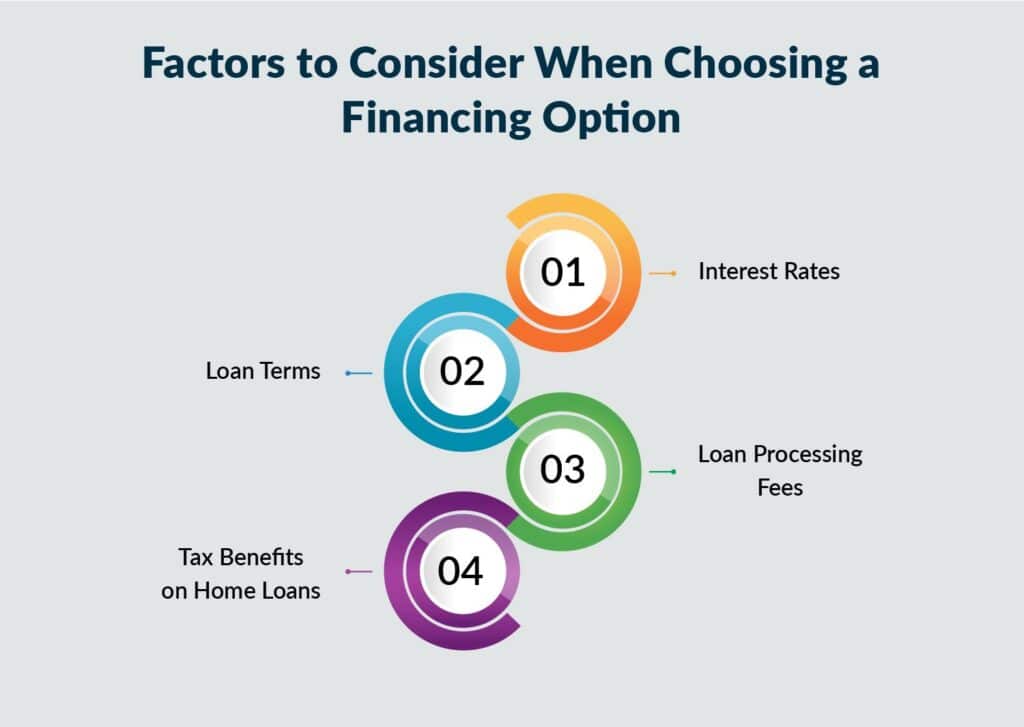

Factors to Consider When Choosing a Financing Option

When selecting from the numerous financing options for homebuyers, consider factors such as:

- Interest Rates

Compare current mortgage rates from different lenders.

- Loan Terms

Look at repayment periods and whether they fit your financial plans.

- Eligibility Requirements

Understand what credit scores and income levels are needed.

- Loan Processing Fees

Be aware of any hidden costs associated with securing your loan.

- Tax Benefits on Home Loans

Explore potential tax deductions available under Section 80C and Section 24(b) of the Income Tax Act.

Choosing the Right Financing Option

Ultimately, choosing the right financing option depends on your unique circumstances—your financial situation, property type, and long-term goals all play crucial roles. By evaluating all available choices within the context of your needs and preferences, you can effectively navigate through the myriad financing options for homebuyers in Vellore.

Key Takeaways

Navigating through various financing options can be overwhelming but essential in achieving your dream of owning a home in Vellore. Whether exploring traditional bank loans or innovative solutions like co-applicant loans or government schemes such as PMAY, understanding each option’s benefits will empower you in making informed decisions.

In conclusion, when considering residential properties such as apartments in Vellore, it’s crucial to partner with reputable builders like Vijay Shanthi Builders. Their commitment to quality ensures that your investment aligns with both your financial goals and lifestyle aspirations while providing exceptional value in the real estate market.

FAQS:

Banks are regulated financial institutions offering various financial products including savings accounts and loans; NBFCs focus primarily on lending without accepting deposits.

Yes, NBFCs often provide quicker processing times and more flexible eligibility criteria compared to traditional banks.

The best loan depends on individual circumstances; however, government-backed schemes like PMAY offer substantial benefits for first-time buyers.

Yes, schemes like PMAY provide subsidies on interest rates specifically designed to assist first-time buyers.

Funds are disbursed in stages based on construction milestones; borrowers pay interest only on utilized amounts until completion.

FHA or government-backed loans often have more lenient requirements making them easier to qualify for than conventional mortgages.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Evaluating Resale Value and Property Appreciation in Vellore

Understanding the Resale Value and Property Appreciation of real estate is vital for anyone

Pros & Cons of Buying Ready-To-Move vs.Under-Construction Properties in Vellore

When considering a property investment in Vellore, potential buyers often face the dilemma of

Understanding Home Loan Eligibility Criteria in Vellore

Understanding the Home Loan Eligibility Criteria in Vellore is crucial for anyone looking to