Must Read – About Encumbrance Certificate in Property Buying

In the network of property transactions, one document stands tall as a beacon of assurance – the Encumbrance Certificate EC. For those navigating the area of real estate in Chennai, particularly when considering an apartment for sale in chennai or a flat for sale in Chennai, understanding the nuances of an Encumbrance Certificate is paramount. In this blog Let’s look deeper into this essential legal document of Encumbrance Certificate in property buying.

What Is an Encumbrance Certificate in Property Buying (EC)?

An Encumbrance certificate meaning serves as a legal document when purchasing a plot, providing information regarding any financial or legal alterations made to the property.

An Encumbrance Certificate (EC) is a vital legal document that validates property ownership. It essentially serves as proof that the property is free from any monetary and legal liabilities, such as mortgages, loans, or litigation.

This certificate ensures that the property can be safely transacted without any legal hindrances.

Types of Encumbrance Certificates

There are primarily two types of Encumbrance Certificates in property buying – the Form 15 and the Form 16. The Form 15 EC is a general certificate that provides details of transactions related to the property, including mortgages, leases, and other charges. On the other hand, Form 16 EC is a specific certificate that is issued for a particular period, typically requested when you need information for a specific time frame.

Importance of Encumbrance Certificate in Property Buying.

The Encumbrance Certificate in property buying holds paramount importance due to several reasons:

- The buyer is assured of the property’s clear title, mitigating risks of legal disputes.

- Smooth processing of loans and mortgages is facilitated by the Encumbrance Certificate.

- Essential for property registration and mutation.

- In legal proceedings, it is acted upon as documentary evidence.

- Peace of mind is provided to the buyer, ensuring a secure investment.

What Is Included in the Encumbrance Certificate?

An Encumbrance Certificate in property buying typically includes details such as

- Property Description: Address and survey number of the property.

- Transaction History: Record of all financial and legal transactions.

- Owner Details: Names of previous and current owners.

- Mortgage Information: Details of any mortgages or loans taken against the property.

When Is an Encumbrance Certificate Required?

An Encumbrance Certificate in property buying is typically required during property transactions, mutation processes, and updating land tax records. It ensures the property’s legal status, verifying ownership and any monetary or legal liabilities.

Additionally, it’s necessary when applying for loans against the property or registering property transfers.

Documents Required to Get an Encumbrance Certificate

When applying for an Encumbrance Certificate, ensure you have the following documents handy:

- Proof of property ownership.

- Identity proof (such as Aadhar card, passport, or voter ID).

- Application form for encumbrance certificate application.

- Challan or receipt for the application fee.

If you are curious about learning more about Buying a house, please take a moment to read this blog. – ‘’What is the procedure to register a property for a pre-owned house?’’.

What Is the Fee for Getting an Encumbrance Certificate?

To acquire an Encumbrance Certificate in property buying, applicants are required to pay nominal fees as follows:

- Application Fees: ₹5

- First Year Certificate: ₹30

- Subsequent Year Certificate: ₹10

How to Update an Encumbrance Certificate(EC)?

Updating an Encumbrance Certificate in property buying is a straightforward process:

- Visit the concerned Sub-Registrar’s office.

- Apply along with the requisite documents.

- Pay the prescribed fees.

- Await the updated certificate, typically issued within a few days.

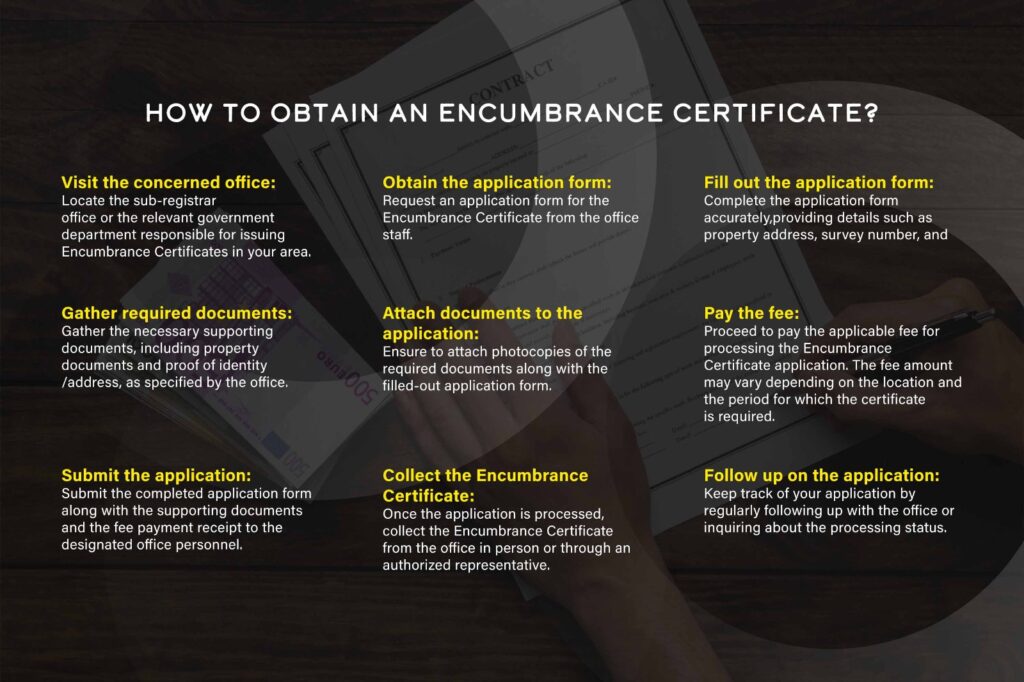

How to Obtain an Encumbrance Certificate?

Obtaining an Encumbrance Certificate in property buying involves the following steps:

- Determine the jurisdictional Sub-Registrar’s office.

- Complete the application form with accurate details.

- Attach the necessary documents.

- Submit the application along with the requisite fees.

- Receive the Encumbrance Certificate within the stipulated timeframe.

How to Apply for an Encumbrance Certificate Offline?

Applying for an Encumbrance Certificate offline requires a visit to the sub-registrar’s office:

- Obtain the application form.

- Fill in the required details accurately.

- Submit the completed form along with the supporting documents.

- Pay the prescribed fees.

- Collect the Encumbrance Certificate once processed.

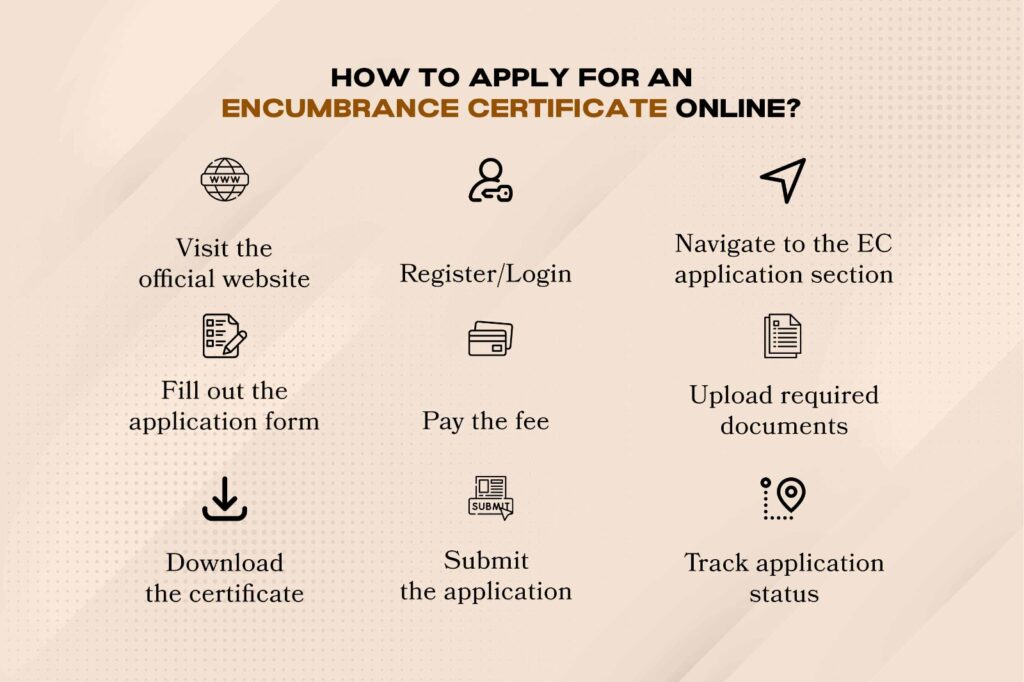

How to Apply for an Encumbrance Certificate Online?

In the digital age, applying for an Encumbrance Certificate online offers convenience:

- Visit the official website of the concerned authority.

- Register an account or log in if already registered.

- Fill in the online application form with accurate details.

- Upload the necessary documents.

- Make the payment online.

- Receive the Encumbrance Certificate digitally once processed.

How to Apply for an Encumbrance Certificate Online?

In the digital age, applying for an Encumbrance Certificate online offers convenience:

- Visit the official website of the concerned authority.

- Register an account or log in if already registered.

- Fill in the online application form with accurate details.

- Upload the necessary documents.

- Make the payment online.

- Receive the Encumbrance Certificate digitally once processed.

What Is a Nil Encumbrance Certificate?

A Nil Encumbrance Certificate is a legal document issued when no lender has placed a lien or any other financial charge on a particular property during a specified period.

It essentially confirms that the property is free from any encumbrances, giving the homeowner clear and undisputed title ownership. With a Nil Encumbrance Certificate in hand, the Property encumbrance certificate becomes eligible for obtaining a new loan from any financial institution in the country.

Different Between EC, CC, and OC?

Things to Keep in Mind When Applying for an Encumbrance Certificate

- Ensure all required documents are in order.

- Double-check the accuracy of information provided in the application.

- Verify the authenticity of the issuing authority.

- Keep track of application status for timely follow-up.

Vijay Shanthi Builders, renowned real estate builders in Chennai, offer exceptional 2 BHK apartments in Chennai. With a reputation for quality and reliability, they provide the perfect opportunity for individuals looking to buy flats in Chennai. Choose Vijay Shanthi Builders for a seamless and rewarding real estate experience.

FAQS:

An Encumbrance Certificate is required during property transactions, mutation processes, and for updating land tax records.

The purpose of an Encumbrance Certificate is to verify the property’s clear title and ensure it is free from any legal or financial liabilities.

Yes, most financial institutions require an Encumbrance Certificate as part of the documentation process for approving home loans.

Yes, Encumbrance Certificates can be obtained online through the respective government portals.

The Encumbrance certificate processing time varies depending on the application mode and the issuing authority’s efficiency. On average, the certificate is typically received within 15 to 30 days.

If encumbrances are present on a property, its marketability and legal ownership may be affected, potentially resulting in complications during transactions.

While it’s technically possible to sell a property without an Encumbrance Certificate, obtaining one is highly advisable to ensure a smooth and legal transaction process.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

Beware of the Red Flags for home buyers – Top 10 Insights

When embarking on the journey to purchase a home, armed with excitement and dreams,

How to Improve Your Credit Score Before Applying for a Home Loan?

How to Improve Your Credit Score Before Applying for a Home Loan? Are you looking

5+ Tips to Manage Home Loan Emis During a Financial Crisis

Handling home loan EMIs during financial difficulties can be overwhelming, but with careful planning