Can Foreigners Buy a Property in India?

The Indian real estate market has become increasingly attractive to international investors. Many are curious about the process and regulations involved when they wish to buy a property in India. This blog will explore the eligibility criteria, types of properties available, the approval process, financing options, and taxation related to property ownership in India.

Eligibility for Foreigners to Own Real Estate in India

Foreign nationals can buy a property in India, but there are specific eligibility criteria. Generally, foreigners who are Persons of Indian Origin (PIO) or Non-Resident Indians (NRIs) have more straightforward access to property ownership. According to the Foreign Exchange Management Act (FEMA), foreign citizens can purchase residential properties, but they need to comply with certain regulations.

For example, a foreigner who has lived in India for an extended period and holds a valid visa can buy a property in India. However, they must ensure they do not purchase agricultural land unless they meet specific conditions set by the government.

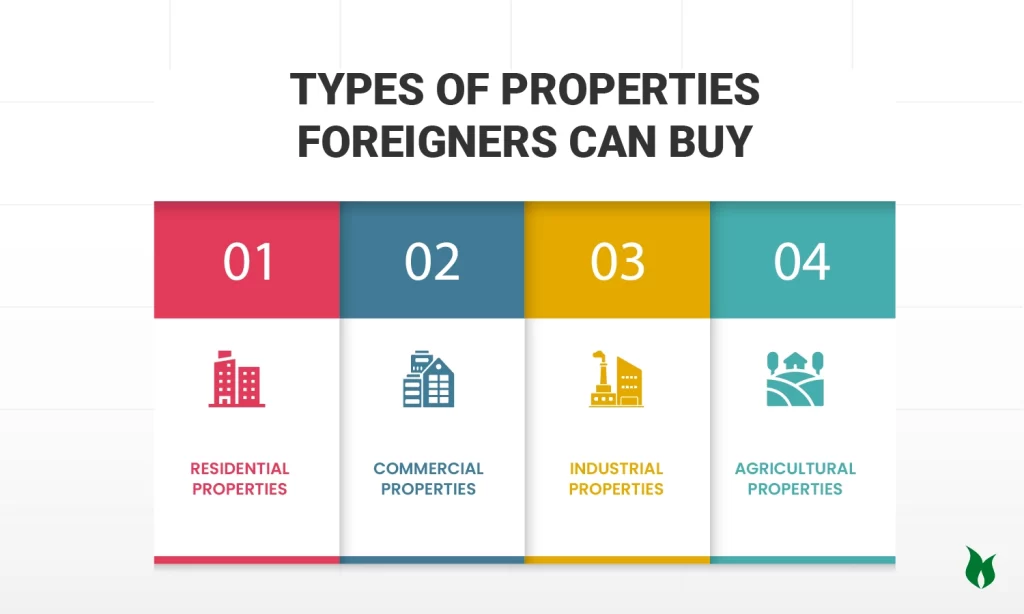

Types of Properties Foreigners Can Buy

Foreigners can buy a property in India in several categories:

- Residential Properties

This includes apartments, villas, and bungalows. The residential property market in cities like Chennai offers a variety of options, with prices ranging from ₹50 lakhs for a 2BHK apartment to several crores for luxury villas.

- Commercial Real Estate

Foreigners can invest in commercial properties such as office spaces and retail outlets. For instance, a commercial office space in a prime location in Chennai might cost around ₹1 crore or more.

- Agricultural Land Ownership

Foreigners are generally not allowed to purchase agricultural land unless they have specific permissions from the government.

If you are curious about learning more about Buying a Property, please take a moment to read this blog. – ‘’NRI Buying Property in India 2024 – 6 Things You Need to Know’’.

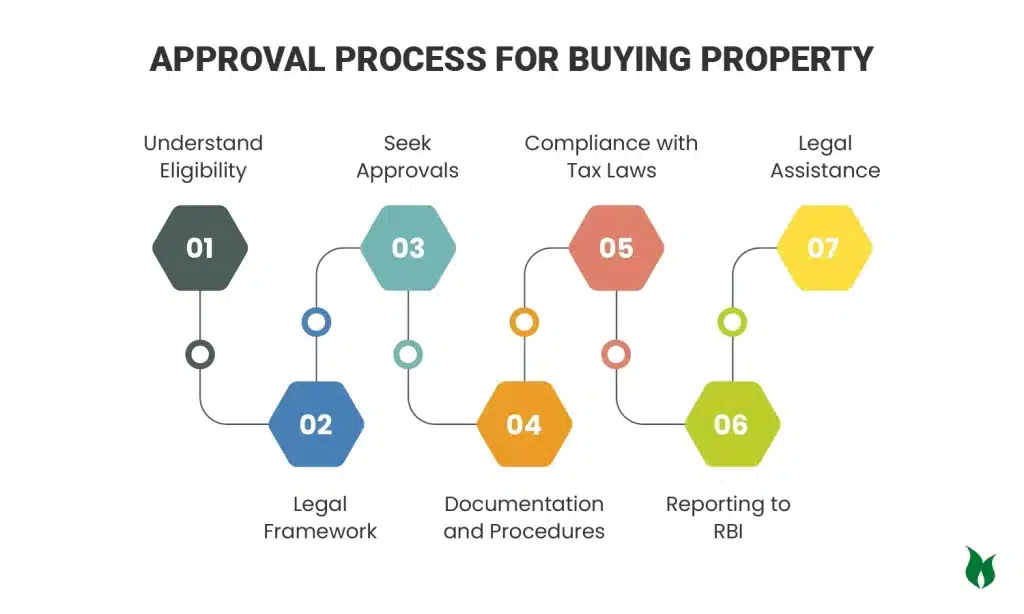

Approval Process for Buying Property

The property acquisition process for foreigners involves several steps:

- Obtain Necessary Approvals

Foreigners must seek approval from the Reserve Bank of India (RBI) before purchasing property. This is particularly important for residential properties.

- Documentation Requirements

Essential documents include a valid passport, visa, and proof of residence in India. All documents must be submitted to the concerned authorities for verification.

- Stamp Duty and Registration Fees

Upon finalizing the purchase, buyers must pay stamp duty and registration fees, which vary by state but generally range from 5% to 7% of the property’s value.

Also Read: Nri Investment in Real Estate – A Comprehensive Guide

Financing Options for Foreign Buyers

Foreigners looking to buy a property in India can explore various financing options:

- Home Loans for Foreigners

Some Indian banks offer home loans to NRIs and PIOs, subject to specific eligibility criteria. The loan amount can cover up to 80% of the property value, with interest rates starting from around 7% per annum.

- Foreign Direct Investment (FDI)

Foreign investors can also engage in FDI, which allows them to invest in real estate projects through joint ventures with Indian companies.

Income Tax on Properties in India

Understanding the taxation on property ownership is crucial for foreigners. Here are some key points:

- Rental Income Taxation

Rental income earned from properties in India is subject to income tax. Foreign investors must file tax returns in India, and the applicable tax rate can vary based on the income bracket.

- Capital Gains Tax

If a foreigner sells property in India, they must pay capital gains tax. The tax rate is 20% for long-term capital gains (properties held for more than two years) and varies for short-term gains.

Repatriation of Sale Proceeds

Foreign investors can repatriate funds from the sale if they want to Buy a Property in India, but certain conditions must be met. The amount that can be repatriated is limited to the original investment amount, and the process involves obtaining a tax clearance certificate from the Indian tax authorities

For those interested in entering the Indian real estate market and want to Buy a Property in India, working with reputable real estate builders is essential. Companies like Vijay Shanti Builders are known for their quality construction and customer service. They offer a range of prime residential real estate options, including luxury apartments and villas in Chennai, making it easier for foreigners to find suitable properties.

FAQS:

Yes, NRIs can buy property jointly with Indian residents, provided they comply with the regulations set by FEMA.

Yes, some Indian banks offer home loans to foreigners, especially NRIs and PIOs, subject to eligibility criteria.

Yes, foreigners can rent out their properties in India, but they must comply with local laws and taxation requirements.

Yes, foreigners can inherit property in India, but there are specific regulations that must be followed.

Yes, foreigners can sell property in India, but they must adhere to the taxation and repatriation rules.

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

6 Neighborhood Spotlight in Kadambadi Boosting Property Values

Kadambadi, located on Chennai’s scenic East Coast Road, is becoming a popular spot for

9 Things to Know for Land Buyers in Kadambadi

When considering things to know for land buyers in Kadambadi, there are several critical

Top 7 Factors Influencing Kadambadi Property Prices

If you are looking for a plot near ECR, you’re in luck! The East