A Legal Guide to Flat Purchase Process – Key Steps & Tips

Owning property in the vibrant city of Chennai can be a dream come true for many. From spacious luxury apartments in Chennai to cozy two-bedroom flats in Chennai, the city has an amazing selection of real estate options. But diving into the Chennai real estate market without understanding the flat purchase process can lead to considerable blunders. Your transfer to your new home will be smooth thanks to this article’s thorough explanation of the flat-buying process.

Complete Details on Flats Purchase Process

1. Identifying the Ideal Property

Whether you have opted for the top residential builders in Chennai like the best builders in Chennai or builders and developers in Chennai, the process starts with identifying the right property. Apart from factors like location and cost, it is essential to consider the reputation of the real estate builders in Chennai.

2. Verifying the Title and Ownership

This is a very important step in the flat purchase process. When picking a flat in India, the buyer needs to verify the property title, ensure there are no mortgages or previous unpaid dues, establish the validity of the property by checking the property documents, and make sure construction approvals are in order. layout plan title verification is an essential part of this step.

3. Legal Verification of Property Builder or Seller

Ensuring that the builders in Chennai you are dealing with have a clean record is necessary. It includes validating that the builder, the sellers, or the real estate in Chennai have no legal issues attached to them.

4. Obtaining a Home loan

Apart from understanding the legal process of buying, applying for home loans can be a critical part of your flat purchase process and planning. You need to ensure your PAN card and other documents are ready for the process.

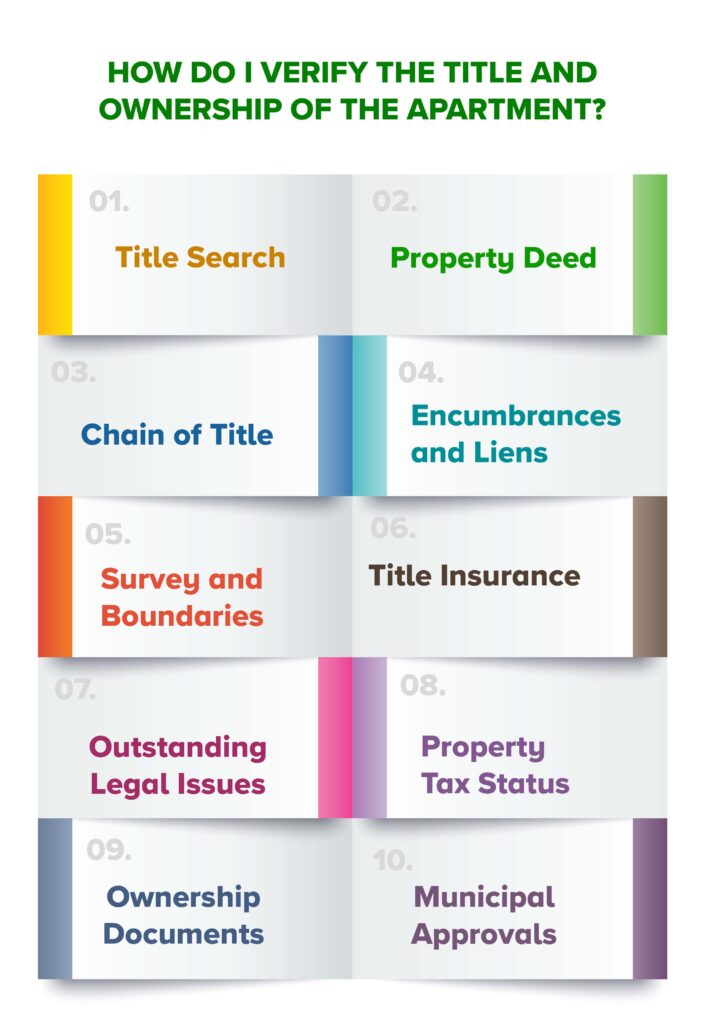

How Do I Verify the Title and Ownership of the Apartment?

Buying an apartment is a big decision, and ensuring legal ownership is important. Here are key steps to verify title and ownership in flat purchase process:

- Inspect title documents:

1. Review the title deed or sale deed: Check owner details, property description and any encumbrances. ( loans, mortgages).

2. Verify authenticity: Visit the sub-registrar’s office or use online portals( if available) to confirm document validity.

3. Check for chain title: Ensure ownership history is clear and unbroken through previous deeds.

- Conduct Public Records Search:

1. Visit the land registry office: Obtain a copy of the property registration certificate for official ownership details.

2. Check for liens or judgements: These can affect ownership rights and marketability.

3. Utilize online resources: Some states offer basic property information online, but details might be limited.

- Expert Help:

1. Consult a real estate lawyer: They can conduct a thorough title search and advise on potential issues.

2. Engage a property surveyor: They will verify the physical condition and compliance with regulations.

How Can I Verify the Legitimacy of the Property Builder or Seller?

You can verify the legitimacy of the builders in Chennai or any property seller by checking their past projects, reading reviews, and confirming their registration with government bodies. Here are some steps you can take to verify their legitimacy in flat purchase process:

1. Research the Company: Look for official websites, online presence, and reviews. Verify their registration and licensing details.

2. Check Legal Documents: Examine property documents for authenticity also Ensure the builder has clear ownership and development rights.

3. Visit Past Projects: Inspect completed projects to assess quality and adherence to promises.

4. Talk to Previous Buyers: Connect with past buyers for feedback and experiences.

5. Verify Financial Stability: Check the financial health of the builder or seller.

6. Consult Real Estate Authorities: Confirm the builder’s standing with local real estate regulatory bodies.

7. Legal Assistance: Engage legal experts to review contracts and agreements.

8. Transparent Communication: Legitimate builders will provide clear and honest information.

9. Beware of Red Flags: Be cautious if asked for upfront payments without legal documents.

10. Professional Associations: Membership in industry associations may indicate credibility.

What Are the Legal Implications of a Property Encumbrance Certificate?

The Property Encumbrance Certificate or PEC proves that a flat in India is free from legal liabilities. It is an essential piece of documentation for property purchase since it certifies that the property is free of liens and outstanding debts. This vital document, frequently needed in property transactions, is assuredly required to ensure that the property is free from encumbrances.

In India, there are two types of ECs – Form 15, providing 15 years’ transaction history, and Form 16, offering a comprehensive overview of all property transactions since its inception. This ensures transparency in the legal process of buying also highlighting the validity of the property. Obtain this vital document to verify the property’s validity and freedom from encumbrances during your flat purchase process

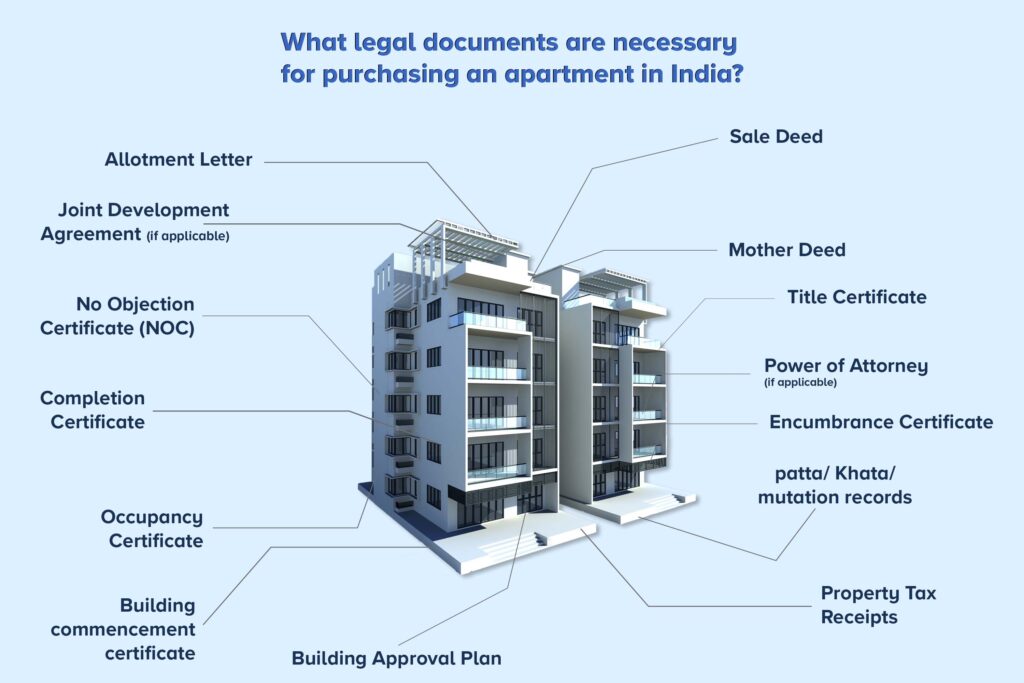

What Legal Documents Are Necessary for Purchasing an Apartment in India?

Buying an apartment is an exciting journey, but navigating the Legal aspects of property acquisition can feel a little overwhelming. Don’t worry! We got you.

The necessary documents and Purchasing property legality India are:

– Sale Agreement: This is the foundation, outlining the agreed upon price, payment terms, possession details, and other important aspects of the transaction.

– Title Deed: This document proves ownership of the property, including details like seller information, property description and any encumbrances.

– Encumbrance Certificate: This confirms if the property is free from any legal or financial burdens like loans, mortgages, or outstanding dues.

– Allotment Letter(if applicable): This applies to apartments in builder – constructed societies, issued by the developer confirming your ownership rights.

– Possession Letter (if applicable): This grants you physical possession of the apartment after completing all payments and formalities.

– Khata Certificate: It is issued by local municipal authority, this verifies the property’s inclusion in their records and helps determine property taxes due.

– Building Plan Approval: Ensures the apartment was constructed legally and adheres to building regulations.

– Occupancy Certificate (OC): Issued by the local authority , this confirms the building’s completion and compliance with safety and environmental standards.

– Share Certificate ( if applicable): In cooperative housing societies, this document establishes your ownership share in the society’s common areas and amenities.

– Society NOC ( No objection certificate): Issued by the housing society, this confirms there are no outstanding dues or objections to the sale.

– Bank Release Letter: If the property has an outstanding loan, a bank release letter confirms its full repayment, preventing future issues.

– Property Tax receipts: Request receipts from the seller to confirm ownership and verify there are no outstanding dues that could burden you later.

– Legal Search Report (Highly recommended): Conduct a thorough legal search to uncover hidden problems like disputes, encumbrances or forgery attempts.

If you are curious about learning more about Buying an Flat, please take a moment to read this blog. – ”Why Buying a Flat Is Good Investment in Chennai in 2024?”.

Why Is Property Registration Important, and What Is the Process?

Property registration in India is a legal formality that’s mandatory under the Indian Registration Act. It helps authenticate that a property has been transferred to the new owner legally. The steps for registration include Sale Deed: Draft a comprehensive sale deed detailing property specifics and transaction terms.

1. Pay Stamp Duty: Calculate and pay the applicable stamp duty based on the property’s value.

2. Pay Registration Fees: Submit the necessary registration fees to initiate the registration process.

3. Visit the Sub-Registrar’s Office: Present the sale deed, identity proofs, and other required documents at the local sub-registrar’s office.

4. Document Verification: Authorities verify and examine all submitted documents.

5. Signatures and Witnesses: Sign the sale deed in the presence of witnesses.

6. Get Sale Deed Registered: Complete the registration process, officially recording the property transfer.

What Legal Aspects Are Involved in Obtaining a Home Loan for Buying an Apartment?

When obtaining a home loan, make sure the bank recognizes the property builders, carefully read the loan agreement, ensure the property is approved by the bank, and check if the builder has tie-ups with any bank.

How Are Stamp Duty and Registration Charges Calculated, and What Is the Payment Process?

- Stamp Duty:

This is a tax levied by the state government on the sale of property. The rate varies depending on the state and the type of property. In general, it ranges from 5% to 7% of the market value of the property.

- Registration Charges:

This is a fee charged by the government for registering the sale deed and updating ownership records. It is usually a fixed percentage of the property value, typically around 1%.

Calculating Stamp duty and registration charges:

Example:

Let’s say you’re buying a house property in Tamil Nadu with a market value of 10L

– Stamp Duty: 10,00,000*7% = ₹70,000

– Registration Charges: 10,00,000*4% = ₹40,000

Total = 70,000 + 40,000 = ₹1,10,000

Payment Process:

The payment process for stamp duty and registration charges can vary depending on the state. However, it generally involves the following steps:

– Obtain Challan forms: These forms are available from the designated authorities or online portals.

– Fill in the challan forms: Enter the property details, calculated charges, and your payment information.

– Submit challan forms and make the payment: You can make the payment online through government portals or authorized banks, or offline at designated counters.

– Keep the challan receipts or payment confirmations: These will be required during property registration.

What Is the Procedure for Updating Property Records Post-purchase?

1. Mutation: This is the core flat purchase process of updating ownership records with your name. It is conducted at the local municipality corporation or panchayat office.

The documents that are required for this in the flat purchase process are:

– Sale deed

– Proof of payment of stamp duty and registration charges

– Property tax receipts

– Identity proofs of both seller and buyer

– Fees: Nominal fee ( varies by state)

– Timeline: Can take 30 – 45 days, depending on local authorities.

2. Property Tax Records:

– Update property tax records with your name to avoid future disputes.

– Visit the local municipal corporation/panchayat office.

– Submit similar documents as for mutation.

– Fees: May involve additional charges.

3. Encumbrance Certificate:

– Obtain an updated encumbrance certificate to confirm no outstanding dues or claims on the property.

– Apply at the sub registrar office where the sale deed was registered.

– Documents required: Application form, sale deed, identity proof.

– Fees: Nominal fee.

4. Other Updates:

Depending on the property type , consider updating records with:

– Electricity board

– Water supply authority

– Housing society ( if applicable)

What Is the Importance of No Objection Certificates (Nocs) in Apartment Purchase?

In apartment purchases, if you are buying a 1 bhk apartment or 2 bhk apartments in Chennai, No Objection Certificate (NOC) acts as essential legal clearance. They ensure the property is free of outstanding dues, legal disputes, and construction violations. Think of them as green lights from various authorities like society, electricity board, and local bodies, ensuring a smooth ownership transfer and avoiding future problems. Getting all necessary NOCs and Apartment purchase agreement India protects your investment and gives you peace of mind. Getting all needed NOCs and a clear Apartment Purchase Agreement in India with Vijay Shanthi Builders means not just a home but a secure and stress-free investment in the flat purchase process.

FAQs:

You must comprehend the Legalities of buying an apartment so that you can protect your investment and avoid any future legal problems.

The terms and conditions of the property transaction between the buyer and the seller are described in a selling agreement.

An Occupancy Certificate is proof that the building is constructed in line with approved plans and is ready for occupancy.

NOC clears your property of any legal debts and establishes the builder’s or previous owner’s legal clarity.

Yes, NRIs can buy apartments in India, but they need to comply with certain restrictions set by RBI.

The registration process of a house in India might take anywhere between two weeks to a month, from the day of application to receiving the final documents.

Embarking on the journey of buying a flat in the bustling city of Chennai can be exhilarating. Ensure you are well-versed with the legal guide to the flat purchase process to navigate through the Chennai real estate market effectively!

Chandan Jain

I'm Chandan Jain, Managing Director of Vijay Shanthi Builders. My journey into the realm of construction and urban development began with a profound passion for excellence and innovation. Join me as we explore the dynamic world of real estate, discovering top properties, understanding market trends, and making informed decisions together.

Related Posts

What Is The RERA Registration Process And How To Start?

What Is The RERA Registration Process And How To Start? A Foundation Built on TrustIn

7 Benefits Of Installing Glass Windows For Home

Introduction – A View That Speaks of You In a well-crafted home, even the simplest

5 Vastu Tips for a Peaceful Home Environment

Introduction Your home is more than just walls and furniture — it’s a space that